|

|

(1)Title

of each class of securities to which transaction

applies:

|

|

|

(2)Aggregate

number of securities to which transaction

applies:

|

|

|

(3)Per

unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was

determined):

|

|

|

(4)Proposed

maximum aggregate value of

transaction:

|

|

|

(5)Total fee

paid:

|

|

o

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing and registration

statement number, or the Form or Schedule and the date of its

filing.

|

|

CONTENTS

|

|

|

LETTER

TO SHAREOWNERS

|

|

|

NOTICE

OF ANNUAL MEETING OF SHAREOWNERS

|

|

|

PROXY

STATEMENT

|

|

|

General

Information

|

1

|

|

Corporate

Governance

|

3

|

|

Board

and Committee Membership

|

5

|

|

Director

Compensation

|

7

|

|

Proposal

No. 1 – Nominees for Election as Directors

|

9

|

|

Continuing

Directors and Executive Officers

|

10

|

|

Share

Ownership

|

12

|

|

Executive

Officers and Transactions with Related Persons

|

14

|

|

Executive

Compensation

|

16

|

|

Audit

Committee Report

|

30

|

|

Proposal

No. 2 –Ratification of Auditors

|

31

|

|

Audit

Fees and Related Matters

|

32

|

|

Other

Matters

|

33

|

|

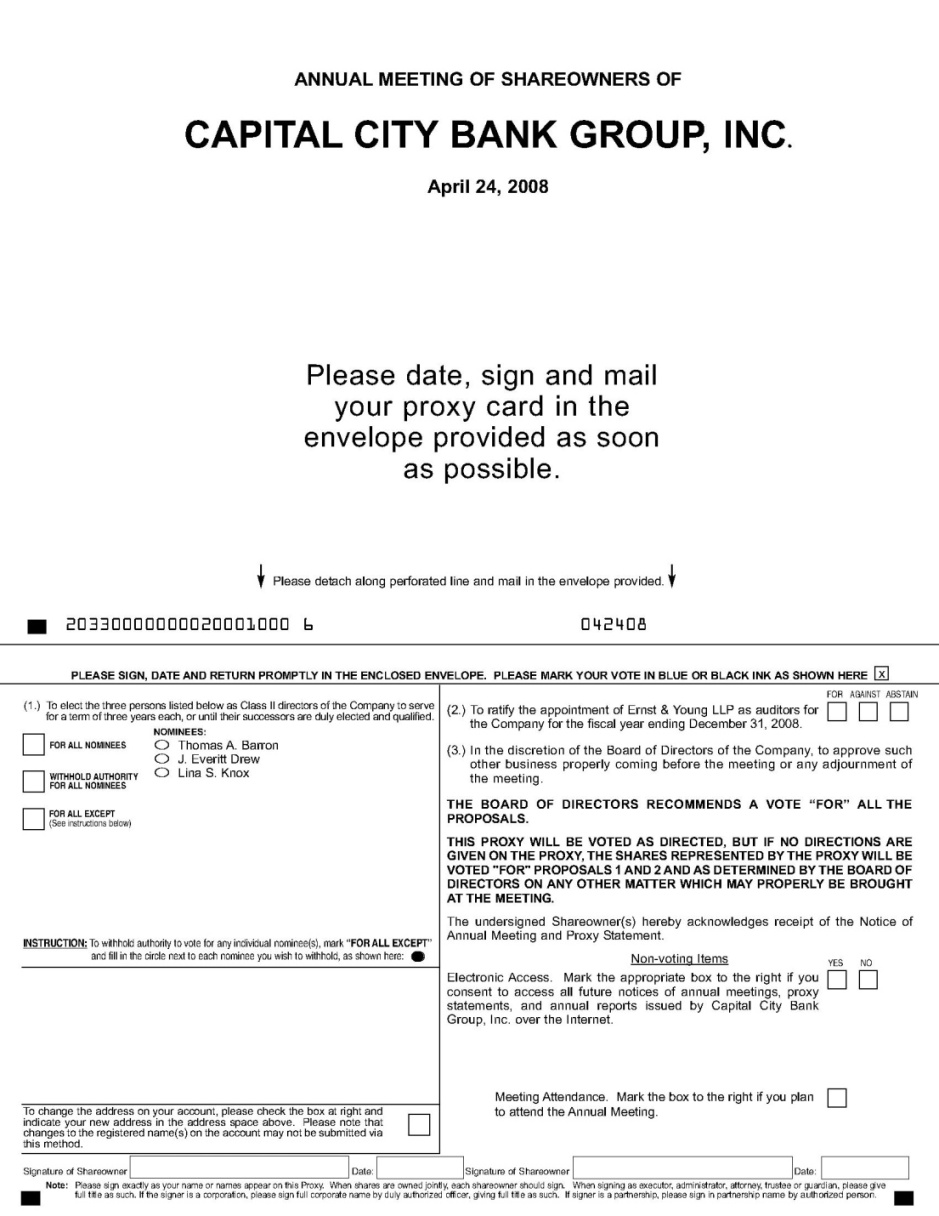

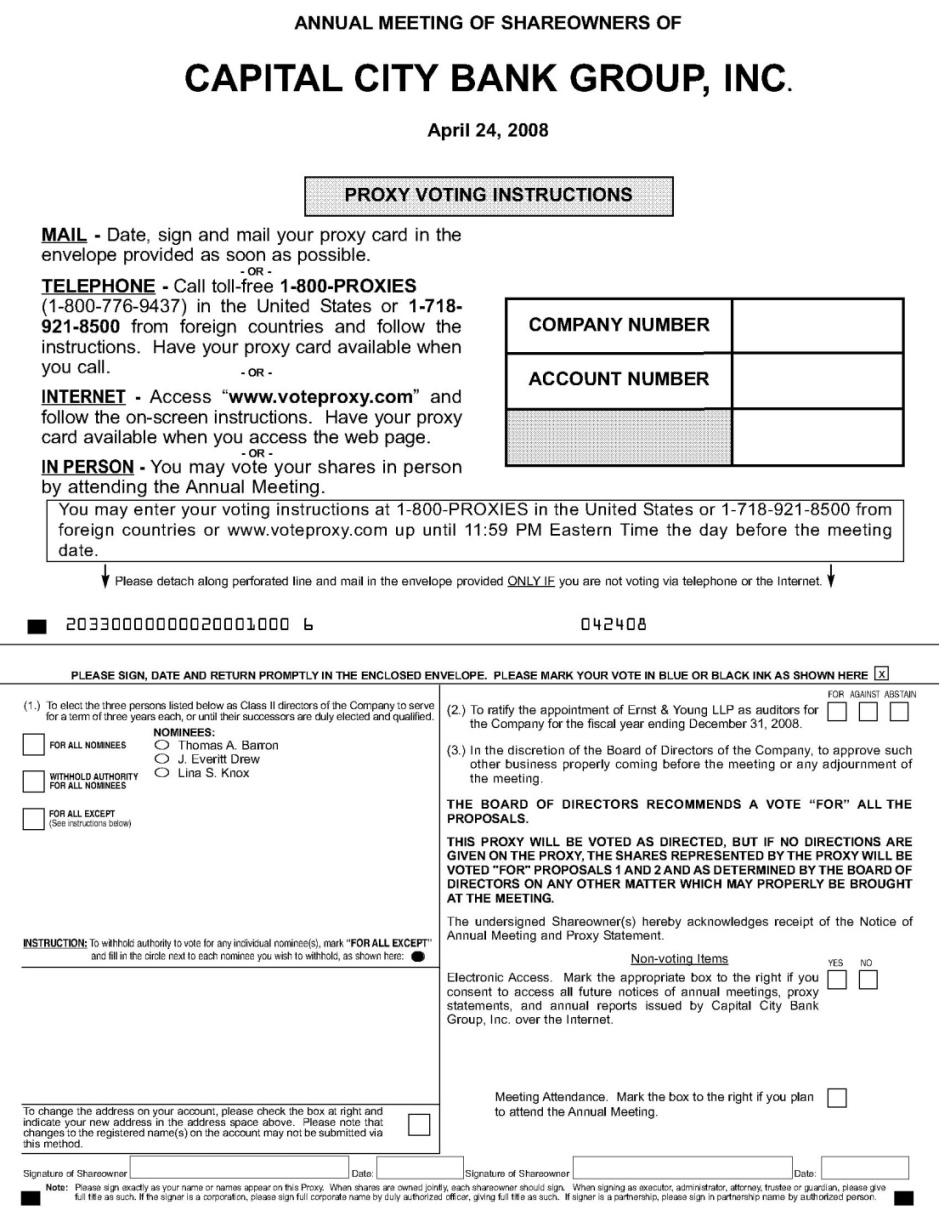

BUSINESS (1)

Elect

three Class II directors to the Board of Directors;

(2) Ratify

the appointment of Ernst & Young LLP as our independent registered

public

accounting firm for the

current fiscal year; and

(3) Transact

other business properly coming before the meeting or any postponement

or

adjournment

of the

meeting.

DOCUMENTS The

Proxy Statement, proxy card, and Capital City Bank Group Annual Report are

included in this mailing.

RECORD DATE Shareowners

owning Capital City Bank Group shares at the close of business on February

29, 2008, are entitled to notice of, attend, and vote at the

meeting. A list of these shareowners will be available at the

Annual Meeting and for 10 days before the Annual Meeting between the hours

of 9:00 a.m. and 5:00 p.m., at our principal executive offices at 217

North Monroe Street, Tallahassee, Florida 32301.

|

TIME 10:00

a.m., Eastern Time, April 24, 2008

PLACE University

Center Club

Building

B, Floor 3

University

Center

Florida

State University

Tallahassee,

Florida

VOTING Even

if you plan to attend the meeting in Tallahassee, Florida, please provide

us your voting instructions in one of the following ways as soon as

possible:

(1) Internet

- use the Internet address on the proxy card;

(2) Telephone

- use the toll-free number on the proxy card; and

(3) Mail

- mark, sign, and date the proxy card and return in the enclosed

postage-paid envelope.

|

||

|

By

Order of the Board of Directors

J.

Kimbrough Davis

Executive

Vice President, Chief Financial Officer,

and

Corporate Secretary

Tallahassee,

Florida

March

28, 2008

|

|||

|

§

|

Shareowner of

Record. If your shares are registered directly in your

name with our transfer agent, American Stock Transfer & Trust Company,

you are considered, with respect to those shares, the “shareowner of

record.” As the shareowner of record, you have the right to

grant your voting proxy directly to us or to a third party, or to vote in

person at the Annual Meeting.

|

|

§

|

Beneficial

Owner. If your shares

are held in a brokerage account, by a trustee or, by another nominee, you

are considered the “beneficial owner” of those shares. As the

beneficial owner of those shares, you have the right to direct your

broker, trustee, or nominee how to vote and you also are invited to attend

the Annual Meeting. However, because a beneficial owner is not

the shareowner of record, you may not vote these shares in person at the

Annual Meeting unless you obtain a “legal proxy” from the broker, trustee

or nominee that holds your shares, giving you the right to vote the shares

at the Annual Meeting.

|

|

Name

|

Audit

|

Compensation

|

Corporate

Governance

|

Nominating

|

|

DuBose

Ausley

|

X

|

X

|

||

|

Thomas

A. Barron

|

||||

|

Frederick

Carroll, III*

|

Chair

|

|||

|

Cader

B. Cox, III

|

Chair

|

X

|

||

|

J. Everitt

Drew*

|

X

|

X

|

||

|

John

K. Humphress*

|

X

|

Chair

|

||

|

L.

McGrath Keen, Jr.

|

||||

|

Lina

S. Knox

|

X

|

X

|

||

|

Ruth

A. Knox

|

X

|

Chair

|

||

|

Henry

Lewis III

|

X

|

X

|

||

|

William

G. Smith, Jr.**

|

|

Name

|

Fees

Earned or Paid in Cash

($)

|

Stock

Awards

($)(1)

|

All

Other Compensation(2)

($)

|

Total

($)

|

|

|

DuBose

Ausley

|

$ 23,000 | $ 10,683 | $ 0 | $ 33,683 | |

|

Frederick

Carroll, III

|

31,500 | 11,122 | 0 | 42,622 | |

|

Cader

B. Cox, III

|

33,000 | 11,122 | 2,500 | 46,622 | |

|

J.

Everitt Drew

|

31,000 | 10,683 | 0 | 41,683 | |

|

John

K. Humphress

|

30,250 | 10,683 | 0 | 40,933 | |

|

L.

McGrath Keen, Jr.

|

0 | 0 | 0 | 0 | (3) |

|

Lina

S. Knox

|

22,250 | 10,683 | 0 | 32,933 | |

|

Ruth

A. Knox

|

30,250 | 11,122 | 1,000 | 42,372 | |

|

Henry

Lewis III

|

26,250 | 11,122 | 0 | 37,372 |

|

1.

|

We

pay each non-employee director an annual stock grant of 400 shares of our

common stock, issued under our Director Stock Purchase

Plan. Under the terms of the Director Stock Purchase Plan, each

non-employee director has the opportunity to participate in the Director

Stock Purchase Plan under two separate options. The first

option, Option A, permits non-employee directors to make an election

(“Option A Participants”) each January indicating the dollar amount of his

or her annual retainer and fees received from serving as a director in the

preceding year which he or she would like to be applied to the purchase of

shares of our common stock. The second option, Option B,

permits non-employee directors to make an election (“Option B

Participants”) each December indicating the percentage of his or her

annual retainer and fees to be received from serving as a director in the

upcoming year which he or she would like to be applied to the purchase of

shares of Common Stock. Option A Participants receive their

annual stock grant each January for the preceding year’s service as

director. Option B Participants will receive their annual stock

grant in four equal quarterly installments during the year to which the

non-employee director’s service relates. Messrs. Drew,

Humphress, and Ausley and Ms. Lina Knox are Option A Participants, and

therefore did not receive their stock grants in 2007. Instead,

these directors received their stock grants in January

2008. The amounts recognized in the fiscal year for financial

statement reporting purposes in accordance with Statement of Financial

Accounting Standards 123, as revised (SFAS 123(R)) are the same as the

amount reported in this column.

|

|

2.

|

The

amounts in this column represent director fees paid to the director for

serving as directors for certain subsidiaries of

ours.

|

|

3.

|

Mr.

Keen has been employed by Capital City Bank since the acquisition of

Farmers and Merchants Bank in October 2004. As our associate,

Mr. Keen receives a base salary, and may receive other benefits that our

associates receive, such as pension benefits. He received no

compensation for his board service in

2007.

|

|

|

THOMAS

A. BARRON

Mr.

Barron, 55, has been a director since 1982. He is our Treasurer

and was appointed President of Capital City Bank in

1995.

|

|

|

|

J.

EVERITT DREW

Mr.

Drew, 52, has been a director since 2003. From 2000 through

January 2007, he was President of St. Joe Land Company where his duties

included overseeing the sale and development efforts of several thousand

acres of St. Joe property in northwest Florida and southwest Georgia.

Since January 2007, Mr. Drew has been President of SouthGroup Equities,

Inc., a private real estate investment and development

company.

|

|

|

|

LINA

S. KNOX

Ms.

Knox, 63, has been a director since 1998. She is a dedicated

community volunteer. Ms. Knox is the first cousin of Mr.

Smith.

|

|

|

The

Board of Directors unanimously recommends a vote “FOR” the

nominees.

|

||

|

|

DuBOSE

AUSLEY

Mr.

Ausley, 70, has been a director since 1982, and was our Chairman from 1982

until 2003. He is employed by the law firm of Ausley &

McMullen and was Chairman of this firm and its predecessor for more than

20 years until 2002. Since 1992, he has served as a director of

TECO Energy, Inc. In addition, Mr. Ausley has served as a

director of Huron Consulting Group, Inc. since 2004 and a director of Blue

Cross and Blue Shield of Florida, Inc. since 1982.

|

|

|

|

FREDERICK

CARROLL, III

Mr.

Carroll, 57, has been a director since 2003. Since 1990, he has

been the Managing Partner of Carroll and Company, CPAs, an accounting firm

specializing in tax and audit based in Tallahassee,

Florida.

|

|

|

|

JOHN

K. HUMPHRESS

Mr.

Humphress, 59, has been a director since 1994. Since 1973, he

has been a shareholder of a public accounting firm, Wadsworth, Humphress,

Hollar, & Konrad, P.A. (and its predecessors).

|

|

|

|

HENRY

LEWIS III

Dr.

Lewis, 58, has been a director since 2003. He is a Professor

and Director of the College of Pharmacy and Pharmaceutical Studies at

Florida A&M University. Prior to Dr. Lewis’s appointment to

his position as director in 2004, Dr. Lewis served as Dean of the College

of Pharmacy and Pharmaceutical Studies at Florida A&M University since

1994.

|

|

|

CONTINUING

CLASS I DIRECTORS (Term expiring in 2010)

|

||

|

|

CADER

B. COX, III

Mr.

Cox, 58, has been a director since 1994. From 1976 to May 2006,

he has served as President, and since May 2006, he has served as CEO of

Riverview Plantation, Inc., a resort and agricultural

company.

|

|

|

|

L.

McGRATH KEEN, JR.

Mr.

Keen, 54, has been a director since 2004. He served as President

(2000-2004) and director (1980-2004) of Farmers and Merchants Bank, prior

to its merger with us. He was a principal shareowner of Farmers and

Merchants Bank at the time of the merger. Since 2004, Mr. Keen

has served as an associate of Capital City Bank.

|

|

|

|

RUTH

A. KNOX

Ms.

Knox, 54, has been a director since 2003. Since 2003, she has

served as President of Wesleyan College, Macon, Georgia. Prior

to this appointment, she practiced law in Atlanta and Macon, Georgia for

25 years.

|

|

|

|

WILLIAM G. SMITH,

JR.

Mr.

Smith, 54, is our Chairman of the Board and has been a director since

1982. In 1995, he was appointed our President and Chief

Executive Officer and Chairman of Capital City Bank. In 2003,

Mr. Smith was elected our Chairman of the Board of

Directors. Mr. Smith has served as a director of Southern

Company since February 2006. Mr. Smith is the first cousin of

Lina S. Knox.

|

|

|

NON-DIRECTOR

EXECUTIVE OFFICER

|

||

|

|

J.

KIMBROUGH DAVIS

Mr.

Davis, 54, was appointed our Executive Vice President and Chief Financial

Officer in 1997. He served as Senior Vice President and Chief

Financial Officer from 1991 to 1997. In 1998, he was appointed

Executive Vice President and Chief Financial Officer of Capital City

Bank.

|

|

|

Name

|

Shares Beneficially

Owned

(1)

|

Percentage

of Outstanding Shares Owned(2)

|

||

|

DuBose

Ausley

|

640,593

|

(3)

|

3.73%

|

|

|

Thomas

A. Barron

|

296,785

|

(4)

|

1.73%

|

|

|

Frederick

Carroll, III

|

6,989

|

*

|

||

|

Cader

B. Cox, III

|

402,384

|

(5)

|

2.34%

|

|

|

J.

Kimbrough Davis

|

71,400

|

(6)

|

*

|

|

|

J.

Everitt Drew

|

7,649

|

(7)

|

*

|

|

|

John

K. Humphress

|

511,455

|

(8)

|

2.98%

|

|

|

L.

McGrath Keen, Jr.

|

375,927

|

(9)

|

2.19%

|

|

|

Lina

S. Knox (10)

|

68,563

|

(11)

|

*

|

|

|

Ruth

A. Knox

|

6,092

|

*

|

||

|

Henry

Lewis III

|

4,626

|

*

|

||

|

Private

Capital Management, L.P.

8889

Pelican Bay Blvd., Naples, Florida 34108

|

1,543,721

|

(12)

|

8.99%

|

|

|

Robert

H. Smith (10)

Post

Office Box 30935, Sea Island, Georgia 31561

|

3,102,641

|

(13)

|

18.06%

|

|

|

William

G. Smith, Jr. (10)

Post

Office Box 11248, Tallahassee, Florida 32302

|

3,385,990

|

(14)

|

19.71%

|

|

|

All

Directors and Executive Officers as a Group

(12

Persons)

|

5,402,438

|

31.45%

|

||

|

|

(Please

refer to the footnotes on the following

page.)

|

|

1.

|

For

purposes of this table, a person is deemed to be the beneficial owner of

any shares of common stock if he or she has or shares voting or investment

power with respect to the shares or has a right to acquire beneficial

ownership at any time within 60 days from the record

date. “Voting power” is the power to vote or direct the voting

of shares and “investment power” is the power to dispose or direct the

disposition of shares.

|

|

2.

|

An

asterisk in this column means that the respective director or executive

officer is the beneficial owner of less than 1% of our common

stock.

|

|

3.

|

Includes

(i) 285,431 shares held in trust under which Mr. Ausley serves as

trustee and has sole voting and investment power; (ii) 12,500 shares owned

by Mr. Ausley’s wife, of which he disclaims beneficial ownership; and

(iii) 350 shares owned by Mr. Ausley and his

wife.

|

|

4.

|

Includes

(i) 56,825 shares held in trusts under which Mr. Barron serves as

trustee; (ii) 716 shares for which Mr. Barron has power of

attorney and may be deemed to be a beneficial owner; and (iii) 28,906

shares owned by Mr. Barron's wife, of which he disclaims beneficial

ownership. Of the shares of our common stock beneficially owned

by Mr. Barron, 133,799 shares are pledged as

security.

|

|

5.

|

Includes

(i) 376,015 shares held in a trust under which Mr. Cox shares voting and

investment power as a co-trustee; and (ii) 2,500 shares owned by Mr. Cox’s

wife, all of which he disclaims beneficial ownership. Of the shares

beneficially owned by Mr. Cox, 376,015 shares are also beneficially owned

by Mr. Humphress.

|

|

6.

|

Includes

(i) 1,162 shares in accounts for his children for which Mr. Davis is

custodian; (ii) 20,559 shares owned jointly by Mr. Davis and his

wife; and (iii) 5,708 shares owned by Mr. Davis’s wife, directly and

through an Individual Retirement Account of which he disclaims beneficial

ownership.

|

|

7.

|

Includes

624 shares in accounts for his children for which Mr. Drew is

custodian.

|

|

8.

|

Includes

(i) 90,890 shares held by a limited partnership of which Mr. Humphress is

a general partner and shares voting and investment power; and (ii) 376,015

shares held in a trust under which Mr. Humphress shares voting and

investment power as a co-trustee, of which he disclaims beneficial

ownership. Of the shares beneficially owned by Mr. Humphress,

376,015 shares are also beneficially owned by Mr.

Cox.

|

|

9.

|

Includes

118,490 shares held in trust of which Mr. Keen serves as sole

trustee.

|

|

10.

|

Robert

H. Smith and William G. Smith, Jr. are brothers, and Lina S. Knox is their

first cousin.

|

|

11.

|

Includes

3,750 shares owned jointly by Ms. Knox and her

husband.

|

|

12.

|

As

reported in a Schedule 13G amendment dated February 14,

2008. Private Capital Management, L.P., a registered investment

adviser, reported that it is deemed to be the beneficial owner of the

shares held by Private Capital Management’s clients and managed by Private

Capital Management. Private Capital Management reported shared

voting and investment power over 1,543,721 shares, and disclaimed

beneficial ownership of all shares.

|

|

13.

|

Includes

(i) 100,294 shares in accounts for his children for which Mr. Smith is

custodian; (ii) 569,524 shares held in certain trusts under which Mr.

Smith shares voting and investment power as a co-trustee; and (iii)

617,423 shares held by a partnership under which Mr. Smith shares voting

and investment power. Of the shares beneficially owned by

Robert H. Smith, 1,186,947 shares are also beneficially owned by

William G. Smith, Jr.

|

|

14.

|

Includes

(i) 569,524 shares held in certain trusts under which Mr. Smith

shares voting and investment power as a co-trustee; (ii) 617,423

shares held by a partnership under which Mr. Smith shares voting and

investment power; (iii) 44,644 shares owned by Mr. Smith’s wife, of which

he disclaims beneficial ownership; and (iv) 47,968 shares that may be

acquired pursuant to non-voting stock options that are or will become

exercisable within 60 days. Of the shares beneficially owned by

William G. Smith, Jr., 1,186,947 shares are also beneficially owned

by Robert H. Smith. Of the shares of our common stock

beneficially owned by Mr. Smith, 333,024 shares are pledged as

security, including 223,024 shares of the 617,423 shares held by a

partnership under which Mr. Smith shares voting and

investment.

|

|

§

|

Develop performance

measures: identify appropriate performance measures and recommend

performance targets that are used to determine annual and long-term awards

for the Chief Executive Officer and senior managers of the

company.

|

|

§

|

Compile benchmark data:

management participates in compensation surveys through reputable

third-party firms which are used to gather data on base salary, annual

cash and long-term performance awards. In 2007, we used Watson-Wyatt’s

survey report on Financial Institution’s Compensation General Executive

Positions. The Chief People Officer also provides historical

compensation data for each position reviewed by the Compensation

Committee.

|

|

§

|

Develop compensation

guidelines: using the benchmark survey data and publicly disclosed

compensation information as the foundation, management develops

compensation guidelines for each executive position. These guidelines are

provided to the CEO as the basis for his recommendations regarding

individual compensation actions. In addition, executives are

briefed on the guidelines established for their

positions.

|

|

§

|

Align

compensation with shareowner value;

|

|

§

|

Provide

a direct and transparent link between the performance of the Company and

pay for the CEO and top management;

|

|

§

|

Make

wise use of the Company’s equity resources to ensure compatibility between

management and shareowner

interests;

|

|

§

|

Align

the interests through performance-based incentive plans of the Company’s

senior executive officers with that of shareowners;

and

|

|

§

|

Award

total compensation that is both reasonable and effective in attracting,

motivating and retaining key

associates.

|

|

§

|

Pay

base salaries to our senior executives at a level that is greater than the

60th

percentile of our selected peer group of

banks;

|

|

§

|

Provide

total direct compensation (salary and incentive compensation) to our

senior executives at a level greater than the 75th

percentile of our selected peer group of

banks;

|

|

§

|

Provide

total incentive compensation (the sum of cash incentives and equity

incentives) at a level greater than 30 percent of total direct

compensation; and

|

|

§

|

Continue,

over time, the alignment of senior management’s interest with that of

shareowners (the percentage of equity compensation should increase

relative to total incentive

compensation).

|

|

§

|

Performance: We believe that

the best way to accomplish alignment of compensation plans with the

participants’ interests is to link pay directly to individual and company

performance.

|

|

§

|

Competitiveness: Compensation

and benefits programs are designed to be competitive with those provided

by companies with whom we compete for talent. Benefits programs

are designed to be competitive with other companies’ programs and are not

based on performance.

|

|

§

|

Cost: Compensation

and benefit programs are designed to be cost-effective and affordable,

ensuring that the interests of our shareowners are

considered.

|

|

§

|

Comparator

Group: The relevant comparator group for compensation

and benefits programs consists of commercial banks and thrifts, with a

geographic footprint or asset base similar to

ours.

|

|

§

|

Base

salary

|

|

§

|

Short-term

incentives

|

|

§

|

Long-term

incentives

|

|

§

|

Benefits

and perquisites

|

|

§

|

Post-termination

compensation and benefits

|

|

FINANCIAL

INSTITUTIONS

|

||

|

Ameris

Bancorp

|

Bank

of the Ozarks

|

Bank

of Florida Corp.

|

|

Cadence

Financial Corp.

|

Cardinal

Financial Corp.

|

CenterState

Banks of Florida, Inc.

|

|

City

Holding Company

|

Coast

Financial Holdings

|

Fidelity

Southern Corp.

|

|

First

Bancorp

|

First

Community Bancshares, Inc.

|

Florida

Community Banks, Inc.

|

|

FNB

United Corp.

|

GB&T

Bancshares

|

Great

Florida Bank

|

|

Green

Bankshares, Inc.

|

Home

Bancshares, Inc.

|

Pinnacle

Financial Partners, Inc.

|

|

Renasant

Corporation

|

SCBT

Financial Corp.

|

Seacoast

Banking Corp.

|

|

Security

Bank Corp.

|

Simmons

First National Corp.

|

StellerOne

Corp.

|

|

TIB

Financial Corp.

|

TowneBank

|

Union

Bankshares Corp.

|

|

Virginia

Commerce Bancorp

|

||

|

Name

|

Annual

75% Payout

|

Annual

100% Payout

|

Maximum

Payout

|

|

William

G. Smith, Jr.

|

2,657

|

3,543

|

17,715

|

|

Thomas

A. Barron

|

2,254

|

3,005

|

15,025

|

|

J.

Kimbrough Davis

|

1,757

|

2,316

|

11,580

|

|

§

|

Retirement Plan: The Retirement

Plan is a tax-qualified, noncontributory defined benefit plan intended to

provide for an associate’s financial security in retirement. All full-time

and part-time associates with 1,000 hours of service annually are eligible

for the Retirement Plan.

|

|

§

|

401(k) Plan: The 401(k)

plan provides associates the opportunity to save for retirement on a

tax-favored basis. We studied the overall competitiveness of

our retirement benefits package and its long-term costs. To

better align the retirement benefits package with associates’ preferences

and recruitment needs, a decision was made to change the benefit design of

the Retirement Plan and the 401(k) Plan. For associates hired

after January 1, 2002, the pension benefit under the Retirement Plan was

reduced and in the 401(k) Plan, a 50% matching contribution was introduced

into the 401(k) Plan. This change was intended to be

cost-neutral. Executives may elect to participate in the 401(k)

Plan on the same basis as our other similarly situated

associates. No named executive officers are currently eligible

for the company-sponsored match.

|

|

§

|

Supplemental Executive

Retirement Plan (SERP): Each of our named executive

officers participates in our SERP, a nonqualified plan which provides

benefits in excess of the Retirement Plan. The SERP is designed to restore

a portion of the benefits Messrs. Smith, Barron, and Davis would otherwise

receive under our Retirement Plan, if these benefits were not limited by

U.S. tax laws. This more closely aligns the benefits of Messrs.

Smith, Barron, and Davis with those of other Retirement Plan

participants. We have no obligation to fund the SERP but accrue

for our anticipated obligations under the SERP on an annual

basis.

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

(j)

|

|

Name

and Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)(1)

|

Option

Awards

($)(2)

|

Non-Equity

Incentive Plan Compensation

($)(3)

|

Change

in Pension Value and Nonqualified Deferred Compensation

Earnings

($)(4)

|

All

Other Compensation

($)(5)

|

Total

($)

|

|

William

G. Smith, Jr.,

Chairman,

President, and Chief Executive Officer

|

2007

|

$ 275,000

|

$ 0

|

$

0

|

$ 125,004

|

$ 114,525

|

$ 326,151

|

$ 552

|

$ 841,232

|

|

2006

|

230,000

|

0

|

91,109

|

205,176

|

204,233

|

174,214

|

29,467

|

934,199

|

|

|

2005

|

210,000

|

0

|

40,803

|

192,884

|

230,423

|

239,894

|

12,798

|

926,802

|

|

|

Thomas

A. Barron,

President,

Capital City Bank

|

2007

|

236,000

|

0

|

0

|

--

|

96,710

|

208,106

|

1,032

|

541,848

|

|

2006

|

220,000

|

0

|

77,290

|

--

|

172,463

|

92,660

|

25,057

|

587,470

|

|

|

2005

|

200,000

|

0

|

38,474

|

--

|

215,061

|

246,618

|

12,076

|

712,229

|

|

|

J.

Kimbrough Davis,

Executive

Vice President and Chief Financial Officer

|

2007

|

230,000

|

0

|

0

|

--

|

38,175

|

193,720

|

552

|

462,447

|

|

2006

|

200,000

|

0

|

59,562

|

--

|

77,155

|

122,355

|

19,399

|

478,471

|

|

|

2005

|

185,000

|

0

|

25,322

|

--

|

87,048

|

156,770

|

7,999

|

462,139

|

|

1.

|

The

amounts in column (e) reflect the dollar amount recognized for financial

statement reporting purposes for the respective fiscal year, in accordance

with SFAS 123R of awards under our Stock-Based Incentive

Plan. Thus, they may include amounts from awards granted prior

to the year in which the compensation is reported in this

table.

|

|

2.

|

The

amounts in column (f) reflect the dollar amount recognized for financial

statement reporting purposes for the respective fiscal year, in accordance

with SFAS 123R of awards pursuant to our Stock Option Program, and thus

may include amounts from awards granted prior to the year in which the

compensation is reported in this table. Awards are discussed in

further detail on page 20 under the heading “Stock

Options.” Assumptions used in the calculation of these amounts

are included in footnote 11 to our audited consolidated financial

statements for the fiscal year ended December 31, 2007 included in our

Annual Report on Form 10-K filed with the Securities and Exchange

Commission on March 17, 2008.

|

|

3.

|

The

amounts in column (g) reflect the cash awards to the named individuals

under the Cash Bonus Plan, which is discussed in further detail on page 20

under the heading “Short-term Incentives.” Awards were paid out

at 50.9%, 90.77% and 102.41% of the target awards for 2007, 2006 and 2005,

respectively.

|

|

4.

|

The

amounts in column (h) reflect the actuarial increase in the present value

of the named executive officer’s benefits under all pension plans

established by us determined using the assumptions consistent with those

used in our financial statements, which are discussed in further detail on

page 28 under the heading “Pension

Benefits.”

|

|

5.

|

The

amount shown in column (i) reflects for each named executive officer: tax

supplement bonus paid and life insurance premium. In 2007, no

tax supplement bonuses were paid.

|

|

(a)

Name

|

Award

Type

|

(b)

Grant

Date

|

Estimated

Possible Payouts Under Non-Equity Incentive Plan Awards

|

Estimated

Future Payouts Under Equity Incentive Plan Awards

|

(l)

Grant

Date Fair Value of Options and Stock Awards

|

||||

|

(c)

Threshold

($)

|

(d)

Target

($)

|

(e)

Maximum

($)

|

(f)

Threshold

(#)

|

(g)

Target

(#)

|

(h)

Maximum

(#)

|

||||

|

William

G. Smith, Jr.

|

Cash1

|

N/A

|

$ 0

|

$ 225,000

|

$ 450,000

|

--

|

--

|

--

|

N/A

|

|

PSU2

|

1/18/07

|

--

|

--

|

--

|

$ 0

|

$

250,000

|

$

500,000

|

$ 0

|

|

|

Thomas

A. Barron

|

Cash1

|

N/A

|

0

|

190,000

|

380,000

|

--

|

--

|

--

|

N/A

|

|

J.

Kimbrough Davis

|

Cash1

|

N/A

|

0

|

75,000

|

150,000

|

--

|

--

|

--

|

N/A

|

|

1.

|

The

amounts shown in column (c) reflect the minimum payment level under our

Cash Bonus Plan. The amount shown in column (e) is 200%

of the target amount. The Compensation Committee determines

these amounts annually.

|

|

2.

|

As

discussed in the Compensation Discussion and Analysis, performance share

units are awarded pursuant to our 2005 Associate Incentive

Plan. In 2007, we entered into an agreement with Mr. Smith to

award him performance share units with an economic value equivalent

ranging from $0 to $500,000, including a 31% tax supplement

bonus. The award would be paid if our compound annual growth

rate in diluted earnings per share EPS met certain levels as discussed in

detail on page 21. Since our EPS compound growth rate was less

than 7.5% in 2007, Mr. Smith did not receive an award. Thus, no

amount is shown in column (l)

|

|

Option

Awards

|

|||||

|

Number

of Securities Underlying Unexercised Options

(#)

|

Equity

Incentive Plan Awards: Number of Securities Underlying Unexercised

Unearned Options

(#)

|

Option

Exercise Price

($)

|

Option

Expiration Date

|

||

|

Name

|

Exercisable

|

Unexercisable

|

|||

|

William

G. Smith, Jr.

|

23,138

|

0

|

--

|

32.96

|

3/12/2014

|

|

24,831

|

12,415

|

--

|

32.69

|

3/14/2015

|

|

|

Compensation

Components

|

Change

in Control1

|

Voluntary

Termination1

|

Early

Retirement1

|

Death1

|

Disability 2

|

Involuntary

Termination1

|

||||||||||||

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

||||||||||||

|

Retirement

Plan

|

$ | 863,084 | $ | 863,084 |

Not

eligible

|

$ | 863,084 | $ | 15,000 | $ | 863,084 | |||||||

|

SERP

|

1,152,006 | 1,146,031 |

Not

eligible

|

1,146,031 | 10,446 | 1,146,031 | ||||||||||||

|

Accelerated

Vesting of Stock options

|

0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

|

Compensation

Components

|

Change

in Control1

|

Voluntary

Termination1

|

Early

Retirement1

|

Death1

|

Disability2

|

Involuntary

Termination1

|

|||||||||||

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

|||||||||||

|

Retirement

Plan

|

$ | 1,341,600 |

Not

eligible

|

$ | 1,341,600 | $ | 1,341,600 | $ | 15,000 | $ | 1,341,600 | ||||||

|

SERP

|

1,314,179 |

Not

eligible

|

1,314,179 | 1,314,179 | 6,708 | 1,314,179 | |||||||||||

|

Compensation

Components

|

Change

in Control1

|

Voluntary

Termination1

|

Early

Retirement1

|

Death1

|

Disability 2

|

Involuntary

Termination1

|

|||||||||||

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

|||||||||||

|

Retirement

Plan

|

$ | 787,976 | $ | 787,976 |

Not

eligible

|

$ | 787,976 | $ | 14,688 | $ | 787,976 | ||||||

|

SERP

|

408,831 | 316,758 |

Not

eligible

|

316,758 | 1,648 | 316,758 | |||||||||||

|

§

|

1.90%

of final average monthly compensation multiplied by years of service after

1988 (limited to 30 years), plus

|

|

§

|

0.40%

of final average monthly compensation in excess of $2,000 multiplied by

years of service after 1988 (generally limited to 30 years),

plus

|

|

§

|

the

monthly benefit accrued as of December 31, 1988 updated for salary

increases since 1988

|

|

§

|

Reduced

Retirement: If participants are at least age 55 and have

at least 15 years of service, then they may commence benefits early on a

reduced basis. The monthly benefit will be calculated using the

benefit formula described above, reduced 6.67% times the number of years

(up to five) that the Benefit Commencement Date precedes the Normal

Retirement Date, and 3.33% times any additional years (up to

five).

|

|

§

|

Unreduced

Retirement: If they are at least age 61 and have at

least 30 years of service, then they may commence benefits early on an

unreduced basis. The monthly benefit will be calculated using

the benefit formula described above, reduced 6.67% times the number of

years (up to five) that the Benefit Commencement Date precedes the later

of age 61 or 30 years of service, and 3.33% times any additional years (up

to five).

|

|

Name

|

Plan

Name

|

Number

of Years of Credited Service

(#)

|

Present

Value of Accumulated Benefit

($)

|

Payments

During Last Fiscal Year

($)

|

|

William

G. Smith, Jr.

|

Retirement

Plan

|

29

|

$ 963,431

|

$ 0

|

|

Supplemental

Executive Retirement Plan

|

29

|

1,294,313

|

0

|

|

|

Thomas

A. Barron

|

Retirement

Plan

|

33

|

1,119,294

|

0

|

|

Supplemental

Executive Retirement Plan

|

33

|

1,109,304

|

0

|

|

|

J.

Kimbrough Davis

|

Retirement

Plan

|

26

|

879,590

|

0

|

|

Supplemental

Executive Retirement Plan

|

26

|

357,743

|

0

|

|

Assumption

|

Basis

for assumption

|

12/31/2004

|

12/31/2005

|

12/31/2006

|

12/31/2007

|

|

Discount

rate

|

Under

SEC rules, discount rate used to measure pension liabilities under SFAS

No. 87, Employers’ Accounting for

Pensions

|

6.00%

|

5.75%

|

6.00%

|

6.25%

|

|

Rate

of future salary increases

|

Under

SEC rules, no salary projection

|

0.00%

|

0.00%

|

0.00%

|

0.00%

|

|

Form

of payment

|

Retirement

Plan: form elected by officer

|

80%

elect a lump sum and 20% elect an annuity

|

80%

elect a lump sum and 20% elect an annuity

|

80%

elect a lump sum and 20% elect an annuity

|

80%

elect a lump sum and 20% elect an annuity

|

|

SERP:

form elected by officer

|

Lump

sum

|

Lump

sum

|

Lump

sum

|

Lump

sum

|

|

|

Lump

sum interest rate

|

Interest

rate defined by the plan for the upcoming plan year

|

6.00%

|

6.00%

|

6.00%

|

6.00%

|

|

Date

of retirement

|

As

per SEC guidance, use first age eligible for unreduced

retirement

|

61

|

61

|

61

|

61

|

|

Post-retirement

mortality

|

Retirement

Plan: same assumption used to measure pension liabilities under SFAS No.

87, Employers’ Accounting for

Pensions

|

For

lump sums, the long-term IRC § 417(e) basis

For

annuity payments, RP2000 Mortality Table for males

|

For

lump sums, the long-term IRC § 417(e) basis

For

annuity payments, RP2000 Mortality Table for males

|

For

lump sums, the long-term IRC § 417(e) basis

For

annuity payments, RP2000 Mortality Table for males

|

For

lump sums, the long-term IRC §

417(e)

basis

For

annuity payments, RP2000 Mortality Table for

males

|

|

The

Board of Directors unanimously recommends a vote “FOR”

ratification

of the appointment of Ernst &

Young.

|

|

2007

|

2006

|

||

|

Audit

Fees

|

$ 582,269

|

$ 703,490

|

|

|

Audit-Related

Fees

|

-

|

11,850

|

|

|

Tax

Fees

|

74,000

|

43,000

|

|

|

All

Other Fees

|

-

|

-

|

|

|

Total

|

$ 656,269

|

$ 758,340

|

|