|

ý

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

||

|

For

the fiscal year ended December 31, 2009

|

||

|

OR

|

||

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

|

Florida

|

0-13358

|

59-2273542

|

||

|

(State

of Incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

||

|

217

North Monroe Street, Tallahassee, Florida

|

32301

|

|||

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|||

|

Class

|

Outstanding

at February 26, 2010

|

|

|

Common

Stock, $0.01 par value per share

|

17,056,303

shares

|

|

|

PAGE

|

||||

|

Item

1.

|

4

|

|||

|

Item

1A.

|

16

|

|||

|

Item

1B.

|

25

|

|||

|

Item

2.

|

25

|

|||

|

Item

3.

|

25

|

|||

|

Item

4.

|

25

|

|||

|

Item

5.

|

25

|

|||

|

Item

6.

|

27

|

|||

|

Item

7.

|

28

|

|||

|

Item

7A.

|

55

|

|||

|

Item

8.

|

56

|

|||

|

Item

9.

|

94

|

|||

|

Item

9A.

|

94

|

|||

|

Item

9B.

|

94

|

|||

|

Item

10.

|

96

|

|||

|

Item

11.

|

96

|

|||

|

Item

12.

|

96

|

|||

|

Item

13.

|

97

|

|||

|

Item

14.

|

97

|

|||

|

Item

15.

|

98

|

|||

|

100

|

||||

|

§

|

legislative

or regulatory changes;

|

|

§

|

the

strength of the United States economy in general and the strength of the

local economies in which we conduct

operations;

|

|

§

|

the

accuracy of our financial statement estimates and assumptions, including

the estimate for our loan loss

provision;

|

|

§

|

the

effects of the health and soundness of other financial institutions,

including the FDIC’s need to increase Deposit Insurance Fund

assessments;

|

|

§

|

our

ability to declare and pay

dividends;

|

|

§

|

changes

in the securities and real estate

markets;

|

|

§

|

changes

in monetary and fiscal policies of the U.S.

Government;

|

|

§

|

inflation,

interest rate, market and monetary

fluctuations;

|

|

§

|

the

frequency and magnitude of foreclosure of our

loans;

|

|

§

|

the

effects of our lack of a diversified loan portfolio, including the risks

of geographic and industry

concentrations;

|

|

§

|

our

need and our ability to incur additional debt or equity

financing;

|

|

§

|

our

ability to integrate the business and operations of companies and banks

that we have acquired, and those we may acquire in the

future;

|

|

§

|

our

ability to comply with the extensive laws and regulations to which we are

subject;

|

|

§

|

the

willingness of clients to accept third-party products and services rather

than our products and services and vice

versa;

|

|

§

|

increased

competition and its effect on

pricing;

|

|

§

|

technological

changes;

|

|

§

|

the

effects of security breaches and computer viruses that may affect our

computer systems;

|

|

§

|

changes

in consumer spending and saving

habits;

|

|

§

|

growth

and profitability of our noninterest

income;

|

|

§

|

changes

in accounting principles, policies, practices or

guidelines;

|

|

§

|

the

limited trading activity of our common

stock;

|

|

§

|

the

concentration of ownership of our common

stock;

|

|

§

|

anti-takeover

provisions under federal and state law as well as our Articles of

Incorporation and our Bylaws;

|

|

§

|

other

risks described from time to time in our filings with the Securities and

Exchange Commission; and

|

|

§

|

our

ability to manage the risks involved in the

foregoing.

|

|

§

|

Business Banking – The

Bank provides banking services to corporations and other business clients.

Credit products are available for a wide variety of general business

purposes, including financing for commercial business properties,

equipment, inventories and accounts receivable, as well as commercial

leasing and letters of credit. We also provide treasury

management services, and, through a marketing alliance with Elavon, Inc.,

merchant credit card transaction processing

services.

|

|

§

|

Commercial Real Estate

Lending – The Bank provides a wide range of products to meet the

financing needs of commercial developers and investors, residential

builders and developers, and community development. Credit

products are available to facilitate the purchase of land and/or build

structures for business use and for investors who are developing

residential or commercial property.

|

|

§

|

Residential Real Estate

Lending – The Bank provides products to help meet the home

financing needs of consumers, including conventional permanent and

construction/permanent (fixed or adjustable rate) financing arrangements,

and FHA/VA loan products. The bank offers both fixed-rate and

adjustable rate residential mortgage (ARM) loans. As of

December 31, 2009, approximately 13.2% of the Bank’s loan portfolio

consisted of residential ARM loans. A portion of our loans

originated are sold into the secondary market. The Bank offers

these products through its existing network of banking

offices. We do not originate subprime residential real estate

loans.

|

|

§

|

Retail Credit – The

Bank provides a full range of loan products to meet the needs of

consumers, including personal loans, automobile loans, boat/RV loans, home

equity loans, and credit card

programs.

|

|

§

|

Institutional Banking –

The Bank provides banking services to meet the needs of state and local

governments, public schools and colleges, charities, membership and

not-for-profit associations including customized checking and savings

accounts, cash management systems, tax-exempt loans, lines of credit, and

term loans.

|

|

§

|

Retail Banking – The

Bank provides a full range of consumer banking services, including

checking accounts, savings programs, automated teller machines (ATMs),

debit/credit cards, night deposit services, safe deposit facilities,

PC/Internet banking, and mobile banking. Clients can use

Capital City Bank Direct which offers both a “live” call center between

the hours of 8 a.m. to 6 p.m. five days a week, and an automated phone

system offering 24-hour access to their deposit and loan account

information, and transfer funds between linked accounts. The

Bank is a member of the “Star” ATM Network that permits banking clients to

access cash at ATMs or point of sale

merchants.

|

|

Market

Share as of June 30,(1)

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Florida

|

||||||||||||

|

Alachua County

|

3.9

|

%

|

4.6

|

%

|

4.7

|

%

|

||||||

|

Bradford County

|

51.3

|

%

|

50.1

|

%

|

47.6

|

%

|

||||||

|

Citrus County

|

2.7

|

%

|

3.1

|

%

|

3.0

|

%

|

||||||

|

Clay County

|

1.7

|

%

|

1.9

|

%

|

2.0

|

%

|

||||||

|

Dixie County

|

23.4

|

%

|

23.4

|

%

|

22.9

|

%

|

||||||

|

Gadsden County

|

55.1

|

%

|

55.7

|

%

|

61.0

|

%

|

||||||

|

Gilchrist County

|

39.5

|

%

|

37.8

|

%

|

33.6

|

%

|

||||||

|

Gulf County

|

7.7

|

%

|

9.1

|

%

|

11.7

|

%

|

||||||

|

Hernando County

|

1.6

|

%

|

1.2

|

%

|

1.2

|

%

|

||||||

|

Jefferson County

|

18.3

|

%

|

21.9

|

%

|

22.8

|

%

|

||||||

|

Leon County

|

15.9

|

%

|

17.6

|

%

|

16.2

|

%

|

||||||

|

Levy County

|

27.9

|

%

|

31.7

|

%

|

33.0

|

%

|

||||||

|

Madison County

|

10.1

|

%

|

12.1

|

%

|

13.1

|

%

|

||||||

|

Pasco County

|

0.2

|

%

|

0.2

|

%

|

0.2

|

%

|

||||||

|

Putnam County

|

14.0

|

%

|

19.7

|

%

|

11.1

|

%

|

||||||

|

St.

Johns County

|

0.8

|

%

|

1.1

|

%

|

1.2

|

%

|

||||||

|

Suwannee County

|

6.6

|

%

|

7.2

|

%

|

7.7

|

%

|

||||||

|

Taylor County

|

30.7

|

%

|

31.1

|

%

|

30.1

|

%

|

||||||

|

Wakulla County

|

3.8

|

%

|

5.5

|

%

|

2.6

|

%

|

||||||

|

Washington County

|

14.2

|

%

|

17.0

|

%

|

13.8

|

%

|

||||||

|

Georgia

|

||||||||||||

|

Bibb County

|

2.6

|

%

|

2.1

|

%

|

2.5

|

%

|

||||||

|

Burke County

|

7.7

|

%

|

7.4

|

%

|

7.8

|

%

|

||||||

|

Grady

County

|

16.2

|

%

|

16.7

|

%

|

18.7

|

%

|

||||||

|

Laurens County

|

12.7

|

%

|

16.2

|

%

|

19.2

|

%

|

||||||

|

Troup County

|

5.9

|

%

|

5.6

|

%

|

6.2

|

%

|

||||||

|

Alabama

|

||||||||||||

|

Chambers County

|

6.6

|

%

|

7.3

|

%

|

6.5

|

%

|

||||||

|

(1)

|

Obtained

from the June 30, 2009 FDIC/OTS Summary of Deposits

Report.

|

|

County

|

Number

of

Commercial

Banks

|

Number

of Commercial Bank Offices

|

||||||

|

Florida

|

||||||||

|

Alachua

|

15

|

66

|

||||||

|

Bradford

|

3

|

3

|

||||||

|

Citrus

|

14

|

49

|

||||||

|

Clay

|

15

|

31

|

||||||

|

Dixie

|

4

|

4

|

||||||

|

Gadsden

|

4

|

6

|

||||||

|

Gilchrist

|

3

|

6

|

||||||

|

Gulf

|

6

|

9

|

||||||

|

Hernando

|

13

|

43

|

||||||

|

Jefferson

|

2

|

2

|

||||||

|

Leon

|

20

|

96

|

||||||

|

Levy

|

3

|

13

|

||||||

|

Madison

|

6

|

6

|

||||||

|

Pasco

|

26

|

120

|

||||||

|

Putnam

|

6

|

16

|

||||||

|

St. Johns

|

23

|

66

|

||||||

|

Suwannee

|

5

|

8

|

||||||

|

Taylor

|

3

|

4

|

||||||

|

Wakulla

|

4

|

7

|

||||||

|

Washington

|

6

|

5

|

||||||

|

Georgia

|

||||||||

|

Bibb

|

12

|

57

|

||||||

|

Burke

|

5

|

10

|

||||||

|

Grady

|

5

|

8

|

||||||

|

Laurens

|

10

|

20

|

||||||

|

Troup

|

11

|

27

|

||||||

|

Alabama

|

||||||||

|

Chambers

|

5

|

10

|

||||||

|

§

|

internal

policies, procedures and controls designed to implement and maintain the

savings association’s compliance with all of the requirements of the USA

PATRIOT Act, the BSA and related laws and

regulations;

|

|

§

|

systems

and procedures for monitoring and reporting of suspicious transactions and

activities;

|

|

§

|

a

designated compliance officer;

|

|

§

|

employee

training;

|

|

§

|

an

independent audit function to test the anti-money laundering

program;

|

|

§

|

procedures

to verify the identity of each customer upon the opening of accounts;

and

|

|

§

|

heightened

due diligence policies, procedures and controls applicable to certain

foreign accounts and relationships.

|

|

§

|

the

risk characteristics of various classifications of

loans;

|

|

§

|

previous

loan loss experience;

|

|

§

|

specific

loans that have loss potential;

|

|

§

|

delinquency

trends;

|

|

§

|

estimated

fair market value of the

collateral;

|

|

§

|

current

economic conditions; and

|

|

§

|

geographic

and industry loan concentrations.

|

|

§

|

Commercial Real Estate

Loans. Repayment is dependent on income being generated in amounts

sufficient to cover operating expenses and debt service. These

loans also involve greater risk because they are generally not fully

amortizing over a loan period, but rather have a balloon payment due at

maturity. A borrower’s ability to make a balloon payment

typically will depend on being able to either refinance the loan or timely

sell the underlying property.

|

|

§

|

Commercial Loans.

Repayment is generally dependent upon the successful operation of the

borrower’s business. In addition, the collateral securing the

loans may depreciate over time, be difficult to appraise, be illiquid, or

fluctuate in value based on the success of the

business.

|

|

§

|

Construction Loans. The

risk of loss is largely dependent on our initial estimate of whether the

property’s value at completion equals or exceeds the cost of property

construction and the availability of take-out financing. During

the construction phase, a number of factors can result in delays or cost

overruns. If our estimate is inaccurate or if actual

construction costs exceed estimates, the value of the property securing

our loan may be insufficient to ensure full repayment when completed

through a permanent loan, sale of the property, or by seizure of

collateral.

|

|

§

|

Vacant Land Loans.

Because vacant or unimproved land is generally held by the borrower

for investment purposes or future use, payments on loans secured by vacant

or unimproved land will typically rank lower in priority to the borrower

than a loan the borrower may have on their primary residence or

business. These loans are susceptible to adverse conditions in

the real estate market and local

economy.

|

|

§

|

Consumer Loans.

Consumer loans (such as personal lines of credit) are collateralized, if

at all, with assets that may not provide an adequate source of payment of

the loan due to depreciation, damage, or

loss.

|

|

§

|

general

or local economic conditions;

|

|

§

|

environmental

cleanup liability;

|

|

§

|

neighborhood

values;

|

|

§

|

interest

rates;

|

|

§

|

real

estate tax rates;

|

|

§

|

operating

expenses of the mortgaged

properties;

|

|

§

|

supply

of and demand for rental units or

properties;

|

|

§

|

ability

to obtain and maintain adequate occupancy of the

properties;

|

|

§

|

zoning

laws;

|

|

§

|

governmental

rules, regulations and fiscal policies;

and

|

|

§

|

acts

of God.

|

|

§

|

Supermajority

voting requirements to remove a director from

office;

|

|

§

|

Provisions

regarding the timing and content of shareowner proposals and

nominations;

|

|

§

|

Supermajority

voting requirements to amend Articles of Incorporation unless approval is

received by a majority of “disinterested

directors”;

|

|

§

|

Absence

of cumulative voting; and

|

|

§

|

Inability

for shareowners to take action by written

consent.

|

|

Item

1B.

|

|

Item 3.

|

|

Item

4.

|

|

2009

|

2008

|

|||||||||||||||||||||||||||||||

|

Fourth

Quarter

|

Third

Quarter

|

Second

Quarter

|

First

Quarter

|

Fourth

Quarter

|

Third

Quarter

|

Second

Quarter

|

First

Quarter

|

|||||||||||||||||||||||||

|

Common

stock price:

|

||||||||||||||||||||||||||||||||

|

High

|

$

|

14.34

|

$

|

17.10

|

$

|

17.35

|

$

|

27.31

|

$

|

33.32

|

$

|

34.50

|

$

|

30.19

|

$

|

29.99

|

||||||||||||||||

|

Low

|

11.00

|

13.92

|

11.01

|

9.50

|

21.06

|

19.20

|

21.76

|

24.76

|

||||||||||||||||||||||||

|

Close

|

13.84

|

14.20

|

16.85

|

11.46

|

27.24

|

31.35

|

21.76

|

29.00

|

||||||||||||||||||||||||

|

Cash

dividends declared per share

|

.1900

|

.1900

|

.1900

|

.1900

|

.1900

|

.1850

|

.1850

|

.1850

|

||||||||||||||||||||||||

|

Period

Ending

|

||||||||||||||||||||||||

|

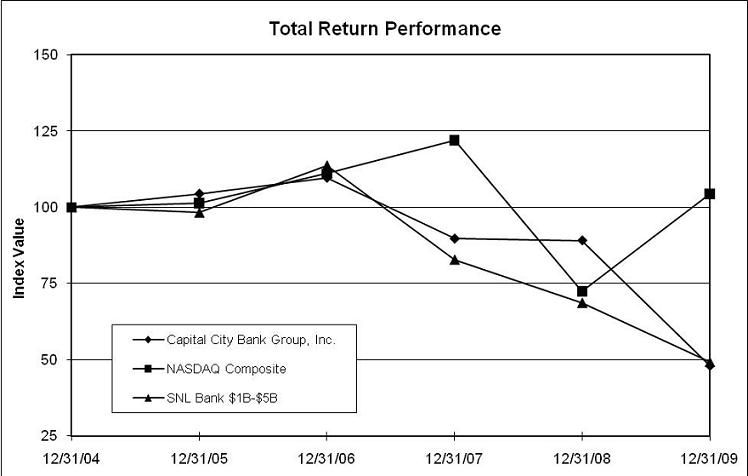

Index

|

12/31/04

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

||||||||||||||||||

|

Capital

City Bank Group, Inc.

|

$

|

100.00

|

$

|

104.36

|

$

|

109.58

|

$

|

89.68

|

$

|

89.10

|

$

|

48.04

|

||||||||||||

|

NASDAQ

Composite

|

100.00

|

101.37

|

111.03

|

121.92

|

72.49

|

104.31

|

||||||||||||||||||

|

SNL

$1B-$5B Bank Index

|

100.00

|

98.29

|

113.74

|

82.85

|

64.72

|

49.26

|

||||||||||||||||||

|

Item

6.

|

|

|

For

the Years Ended December 31,

|

||||||||||||||||||||

|

(Dollars in Thousands, Except

Per Share Data)(1)

(3)

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Interest

Income

|

$

|

122,776

|

$

|

142,866

|

$

|

165,323

|

$

|

165,893

|

$

|

140,053

|

||||||||||

|

Net

Interest Income

|

105,934

|

108,866

|

112,241

|

119,136

|

109,990

|

|||||||||||||||

|

Provision

for Loan Losses

|

40,017

|

32,496

|

6,163

|

1,959

|

2,507

|

|||||||||||||||

|

Net

(Loss) Income

|

(3,471

|

)

|

15,225

|

29,683

|

33,265

|

30,281

|

||||||||||||||

|

Per

Common Share:

|

||||||||||||||||||||

|

Basic

Net (Loss) Income

|

$

|

(0.20

|

)

|

$

|

0.89

|

$

|

1.66

|

$

|

1.79

|

$

|

1.66

|

|||||||||

|

Diluted

Net (Loss) Income

|

(0.20

|

)

|

0.89

|

1.66

|

1.79

|

1.66

|

||||||||||||||

|

Cash

Dividends Declared

|

.760

|

.745

|

.710

|

.663

|

.619

|

|||||||||||||||

|

Book

Value

|

15.72

|

16.27

|

17.03

|

17.01

|

16.39

|

|||||||||||||||

|

Key

Performance Ratios:

|

||||||||||||||||||||

|

Return

on Average Assets

|

(0.14

|

)%

|

0.59

|

%

|

1.18

|

%

|

1.29

|

%

|

1.22

|

%

|

||||||||||

|

Return

on Average Equity

|

(1.26

|

)

|

5.06

|

9.68

|

10.48

|

10.56

|

||||||||||||||

|

Net

Interest Margin (FTE)

|

4.96

|

4.96

|

5.25

|

5.35

|

5.09

|

|||||||||||||||

|

Dividend

Pay-Out Ratio

|

NM

|

83.71

|

42.77

|

37.01

|

37.35

|

|||||||||||||||

|

Equity

to Assets Ratio

|

9.89

|

11.20

|

11.19

|

12.15

|

11.65

|

|||||||||||||||

|

Asset

Quality:

|

||||||||||||||||||||

|

Allowance

for Loan Losses

|

$

|

43,999

|

$

|

37,004

|

$

|

18,066

|

$

|

17,217

|

$

|

17,410

|

||||||||||

|

Allowance

for Loan Losses to Loans

|

2.30

|

%

|

1.89

|

%

|

0.95

|

%

|

0.86

|

%

|

0.84

|

%

|

||||||||||

|

Nonperforming

Assets

|

144,052

|

107,842

|

28,163

|

8,731

|

5,550

|

|||||||||||||||

|

Nonperforming

Assets to Loans + ORE

|

7.38

|

5.48

|

1.47

|

0.44

|

0.27

|

|||||||||||||||

|

Allowance

to Nonperforming Loans

|

40.77

|

37.52

|

71.92

|

214.09

|

331.11

|

|||||||||||||||

|

Net

Charge-Offs to Average Loans

|

1.66

|

0.71

|

0.27

|

0.11

|

0.13

|

|||||||||||||||

|

Averages

for the Year:

|

||||||||||||||||||||

|

Loans,

Net

|

$

|

1,961,990

|

$

|

1,918,417

|

$

|

1,934,850

|

$

|

2,029,397

|

$

|

1,968,289

|

||||||||||

|

Earning

Assets

|

2,184,232

|

2,240,649

|

2,183,528

|

2,258,277

|

2,187,672

|

|||||||||||||||

|

Total

Assets

|

2,516,815

|

2,567,905

|

2,507,217

|

2,581,078

|

2,486,733

|

|||||||||||||||

|

Deposits

|

1,992,429

|

2,066,065

|

1,990,446

|

2,034,931

|

1,954,888

|

|||||||||||||||

|

Subordinated

Notes

|

62,887

|

62,887

|

62,887

|

62,887

|

50,717

|

|||||||||||||||

|

Long-Term

Borrowings

|

51,973

|

39,735

|

37,936

|

57,260

|

70,216

|

|||||||||||||||

|

Shareowners'

Equity

|

275,545

|

300,890

|

306,617

|

317,336

|

286,712

|

|||||||||||||||

|

Year-End

Balances:

|

||||||||||||||||||||

|

Loans,

Net

|

$

|

1,915,940

|

$

|

1,957,797

|

$

|

1,915,850

|

$

|

1,999,721

|

$

|

2,067,494

|

||||||||||

|

Earning

Assets

|

2,369,029

|

2,156,172

|

2,272,829

|

2,270,410

|

2,299,677

|

|||||||||||||||

|

Total

Assets

|

2,708,324

|

2,488,699

|

2,616,327

|

2,597,910

|

2,625,462

|

|||||||||||||||

|

Deposits

|

2,258,234

|

1,992,174

|

2,142,344

|

2,081,654

|

2,079,346

|

|||||||||||||||

|

Subordinated

Notes

|

62,887

|

62,887

|

62,887

|

62,887

|

62,887

|

|||||||||||||||

|

Long-Term

Borrowings

|

49,380

|

51,470

|

26,731

|

43,083

|

69,630

|

|||||||||||||||

|

Shareowners'

Equity

|

267,899

|

278,830

|

292,675

|

315,770

|

305,776

|

|||||||||||||||

|

Other

Data:

|

||||||||||||||||||||

|

Basic

Average Shares Outstanding

|

17,043,964

|

17,141,454

|

17,909,396

|

18,584,519

|

18,263,855

|

|||||||||||||||

|

Diluted

Average Shares Outstanding

|

17,044,711

|

17,146,914

|

17,911,587

|

18,609,839

|

18,281,243

|

|||||||||||||||

|

Shareowners

of Record(2)

|

1,778

|

1,756

|

1,750

|

1,805

|

1,716

|

|||||||||||||||

|

Banking

Locations(2)

|

70

|

68

|

70

|

69

|

69

|

|||||||||||||||

|

Full-Time

Equivalent Associates(2)

|

1,006

|

1,042

|

1,097

|

1,056

|

1,013

|

|||||||||||||||

|

(1)

|

All share and per share data have

been adjusted to reflect the 5-for-4 stock split effective July 1,

2005.

|

|

(2)

|

As of record date. The

record date is on or about March 1st of the following

year.

|

|

(3)

|

The

consolidated financial statements reflect the acquisition of First Alachua

Banking Corporation on May 20,

2005.

|

|

NM

|

=

Not meaningful

|

|

For the Years Ended December

31,

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Efficiency

ratio

|

79.77

|

%

|

68.09

|

%

|

70.13

|

%

|

||||||

|

Effect

of intangible amortization and merger expenses

|

(2.44

|

)%

|

(3.19

|

)%

|

(3.36

|

)%

|

||||||

|

Operating

efficiency ratio

|

77.33

|

%

|

64.91

|

%

|

66.77

|

%

|

||||||

|

For the Years Ended December

31,

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Net

noninterest expense as a percent of average assets

|

2.97

|

%

|

2.12

|

%

|

2.50

|

%

|

||||||

|

Effect

of intangible amortization and merger expenses

|

(0.16

|

)%

|

(0.22

|

)%

|

(0.23

|

)%

|

||||||

|

Operating

net noninterest expense as a percent of average assets

|

2.81

|

%

|

1.90

|

%

|

2.27

|

%

|

||||||

|

·

|

For

the full year 2009, we realized a net loss of $3.5 million, $0.20 per

diluted share, compared to net income of $15.2 million, or $0.89 per

diluted share for 2008. For the year, weak economic and real

estate market conditions required an increase in our loan loss

provision. Higher pension expense, FDIC insurance fees, and an

increase in costs related to the management and resolution of problem

assets also negatively impacted earnings for 2009. For 2008,

our earnings included a $6.25 million gain ($0.22 per diluted share) from

the sale of a portion of the bank’s merchant services portfolio, a $2.4

million gain from the redemption of Visa shares and the reversal of $1.1

million in Visa related litigation

reserves.

|

|

·

|

For

2009, tax equivalent net interest income declined $3.1 million, or 2.8%,

to $108.2 million due primarily to a higher level of foregone interest and

lower loan fees, both associated with an increased level of nonperforming

loans. During the course of 2009, unfavorable asset re-pricing

also placed pressure on our net interest margin, which was flat year over

year at 4.96%.

|

|

·

|

Loan

loss provision was $40.0 million for 2009 compared to $32.5 million for

2008 with the increase attributable to a higher level of required

reserves. Growth in the level of nonaccrual loans coupled with

weaker economic conditions and declining property values (primarily vacant

residential land) were the primary factors contributing to the higher

required reserves. Net loan charge-offs for 2009 were 166 basis

points of average loans compared to 71 basis points in 2008. At

year-end 2009, the allowance for loan losses was 2.30% of outstanding

loans (net of overdrafts) and provided coverage of 41% of nonperforming

loans, compared to 1.89% and 38%, respectively, at the end of

2008.

|

|

·

|

For

2009, noninterest income decreased $9.6 million, or 14.4%, due to one-time

transactions in 2008, including a $6.25 million pre-tax gain from the

Bank’s merchant services portfolio sale and a $2.4 million pre-tax gain

from the redemption of Visa shares. Additionally, lower

merchant fees of $3.2 million related to the disposition of a portion of

our merchant services portfolio also contributed to the unfavorable

variance. Improvement in deposit fees ($400,000) and mortgage

banking fees ($1.1 million) as well as a higher level of card fees

($794,000), partially offset the aforementioned unfavorable

variances.

|

|

·

|

Noninterest

expense increased $10.6 million, or 8.8%, in 2009 due to higher legal fees

($1.7 million), other real estate owned (“OREO”) expenses ($5.7 million),

pension expense ($2.8 million), and FDIC insurance fees ($3.9

million). Legal fees and OREO expenses were higher due to the

cost of managing and resolving problem assets. The unfavorable

variance in pension expense reflects a decline in pension asset value in

2008. FDIC insurance fees increased as a result of the second

quarter special assessment as well as the general increase in premium

rates as mandated by the FDIC. The unfavorable variance was

also impacted by the reversal of a portion ($1.1 million) of our Visa

litigation accrual in 2008, which had the effect of reducing noninterest

expense. Lower intangible amortization expense ($1.6 million)

as well as various initiatives to better manage controllable expenses

partially offset the aforementioned unfavorable

variances.

|

|

·

|

Average

earning assets were $2.244 billion for the fourth quarter of 2009, an

increase of $86.7 million, or 4.0%, from the fourth quarter of 2008 due to

improvement in the overnight funds position primarily driven by deposit

growth of $144.1 million, or 7.4%.

|

|

·

|

As

of December 31, 2009, we are well-capitalized with a risk based capital

ratio of 14.11% and a tangible common equity ratio of 6.84% compared to

14.69% and 7.76%, respectively, at year-end

2008.

|

|

For

the Years Ended December 31,

|

||||||||||||

|

(Dollars

in Thousands, Except Per Share Data)

|

2009

|

2008

|

2007

|

|||||||||

|

Interest

Income

|

$

|

122,776

|

$

|

142,866

|

$

|

165,323

|

||||||

|

Taxable

Equivalent Adjustments

|

2,296

|

2,482

|

2,420

|

|||||||||

|

Total

Interest Income (FTE)

|

125,072

|

145,348

|

167,743

|

|||||||||

|

Interest

Expense

|

16,842

|

34,000

|

53,082

|

|||||||||

|

Net

Interest Income (FTE)

|

108,230

|

111,348

|

114,661

|

|||||||||

|

Provision

for Loan Losses

|

40,017

|

32,496

|

6,163

|

|||||||||

|

Taxable

Equivalent Adjustments

|

2,296

|

2,482

|

2,420

|

|||||||||

|

Net

Interest Income After Provision for Loan Losses

|

65,917

|

76,370

|

106,078

|

|||||||||

|

Noninterest

Income

|

57,391

|

67,040

|

59,300

|

|||||||||

|

Noninterest

Expense

|

132,115

|

121,472

|

121,992

|

|||||||||

|

(Loss)

Income Before Income Taxes

|

(8,807

|

)

|

21,938

|

43,386

|

||||||||

|

Income

Tax (Benefit) Expense

|

(5,336

|

)

|

6,713

|

13,703

|

||||||||

|

Net

(Loss) Income

|

$

|

(3,471

|

)

|

$

|

15,225

|

$

|

29,683

|

|||||

|

Basic

Net (Loss) Income Per Share

|

$

|

(0.20

|

)

|

$

|

0.89

|

$

|

1.66

|

|||||

|

Diluted

Net (Loss) Income Per Share

|

$

|

(0.20

|

)

|

$

|

0.89

|

$

|

1.66

|

|||||

|

2009

|

2008

|

2007

|

||||||||||||||||||||||||||

|

(Taxable

Equivalent Basis - Dollars in Thousands)

|

Balance

|

Interest

|

Rate

|

Balance

|

Interest

|

Rate

|

Balance

|

Interest

|

Rate

|

|||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||||||||||

|

Loans,

Net of Unearned Interest(1)(2)

|

$

|

1,961,990

|

$

|

118,186

|

6.02

|

%

|

$

|

1,918,417

|

$

|

133,457

|

6.96

|

%

|

$

|

1,934,850

|

$

|

155,434

|

8.03

|

%

|

||||||||||

|

Taxable

Investment Securities

|

83,648

|

2,698

|

3.22

|

93,149

|

3,889

|

5.04

|

103,840

|

4,949

|

4.76

|

|||||||||||||||||||

|

Tax-Exempt

Investment Securities(2)

|

105,683

|

4,106

|

3.88

|

97,010

|

4,893

|

4.16

|

84,849

|

4,447

|

5.24

|

|||||||||||||||||||

|

Funds

Sold

|

32,911

|

82

|

0.25

|

132,073

|

3,109

|

2.32

|

59,989

|

2,913

|

4.79

|

|||||||||||||||||||

|

Total

Earning Assets

|

2,184,232

|

125,072

|

5.73

|

%

|

2,240,649

|

145,348

|

6.48

|

%

|

2,183,528

|

167,743

|

7.68

|

%

|

||||||||||||||||

|

Cash

& Due From Banks

|

76,107

|

82,410

|

86,692

|

|||||||||||||||||||||||||

|

Allowance

for Loan Losses

|

(42,331

|

)

|

(23,015

|

)

|

(17,535

|

)

|

||||||||||||||||||||||

|

Other

Assets

|

298,807

|

267,861

|

254,532

|

|||||||||||||||||||||||||

|

TOTAL

ASSETS

|

$

|

2,516,815

|

$

|

2,567,905

|

$

|

2,507,217

|

||||||||||||||||||||||

|

LIABILITIES

|

||||||||||||||||||||||||||||

|

NOW

Accounts

|

$

|

711,753

|

$

|

1,039

|

0.15

|

%

|

$

|

743,327

|

$

|

7,454

|

1.00

|

%

|

$

|

$557,060

|

$

|

10,748

|

1.93

|

%

|

||||||||||

|

Money

Market Accounts

|

320,531

|

1,288

|

0.40

|

374,278

|

5,242

|

1.40

|

397,193

|

13,667

|

3.44

|

|||||||||||||||||||

|

Savings

Accounts

|

121,582

|

60

|

0.05

|

116,413

|

121

|

0.10

|

119,700

|

279

|

0.23

|

|||||||||||||||||||

|

Other

Time Deposits

|

420,198

|

8,198

|

1.95

|

424,748

|

14,489

|

3.41

|

474,728

|

19,993

|

4.21

|

|||||||||||||||||||

|

Total

Interest Bearing Deposits

|

1,574,064

|

10,585

|

0.67

|

%

|

1,658,766

|

27,306

|

1.65

|

%

|

1,548,681

|

44,687

|

2.89

|

%

|

||||||||||||||||

|

Short-Term

Borrowings

|

79,321

|

291

|

0.36

|

61,181

|

1,157

|

1.88

|

66,397

|

2,871

|

4.31

|

|||||||||||||||||||

|

Subordinated

Notes Payable

|

62,887

|

3,730

|

5.85

|

62,887

|

3,735

|

5.84

|

62,887

|

3,730

|

5.93

|

|||||||||||||||||||

|

Other

Long-Term Borrowings

|

51,973

|

2,236

|

4.30

|

39,735

|

1,802

|

4.54

|

37,936

|

1,794

|

4.73

|

|||||||||||||||||||

|

Total

Interest Bearing Liabilities

|

1,768,245

|

16,842

|

0.95

|

%

|

1,822,569

|

34,000

|

1.87

|

%

|

1,715,901

|

53,082

|

3.09

|

%

|

||||||||||||||||

|

Noninterest

Bearing Deposits

|

418,365

|

407,299

|

441,765

|

|||||||||||||||||||||||||

|

Other

Liabilities

|

54,660

|

37,147

|

42,934

|

|||||||||||||||||||||||||

|

TOTAL

LIABILITIES

|

2,241,270

|

2,267,015

|

2,200,600

|

|||||||||||||||||||||||||

|

SHAREOWNERS'

EQUITY

|

||||||||||||||||||||||||||||

|

TOTAL

SHAREOWNERS' EQUITY

|

275,545

|

300,890

|

306,617

|

|||||||||||||||||||||||||

|

TOTAL

LIABILITIES & EQUITY

|

$

|

2,516,815

|

$

|

2,567,905

|

$

|

2,507,217

|

||||||||||||||||||||||

|

Interest

Rate Spread

|

4.78

|

%

|

4.61

|

%

|

4.59

|

%

|

||||||||||||||||||||||

|

Net

Interest Income

|

$

|

108,230

|

$

|

111,348

|

$

|

114,661

|

||||||||||||||||||||||

|

Net

Interest Margin(3)

|

4.96

|

%

|

4.96

|

%

|

5.25

|

%

|

||||||||||||||||||||||

|

(1)

|

Average balances include

nonaccrual loans. Interest income includes loan fees of $1.6

million, $2.3 million, and $3.0 million in 2009, 2008, and 2007,

respectively.

|

|

(2)

|

Interest income includes the

effects of taxable equivalent adjustments using a 35% tax

rate.

|

|

(3)

|

Taxable equivalent net interest

income divided by average earning

assets.

|

|

2009

Changes From 2008

|

2008

Changes From 2007

|

||||||||||||||||||||||||

|

Due to Average

|

Due to Average

|

||||||||||||||||||||||||

|

(Taxable

Equivalent Basis - Dollars in Thousands)

|

Total

|

Calendar(3)

|

Volume

|

Rate

|

Total

|

Calendar(3)

|

Volume

|

Rate

|

|||||||||||||||||

|

Earnings

Assets:

|

|||||||||||||||||||||||||

|

Loans,

Net of Unearned Interest(2)

|

$

|

(15,271

|

)

|

$

|

(365

|

) |

$

|

2,491

|

$

|

(17,397

|

)

|

$

|

(21,978

|

)

|

$

|

426

|

$

|

(2,012

|

)

|

$

|

(20,392

|

)

|

|||

|

Investment

Securities:

|

|||||||||||||||||||||||||

|

Taxable

|

(1,191

|

)

|

(11

|

)

|

(483

|

)

|

(697

|

)

|

(1,061

|

)

|

13

|

(400

|

)

|

(674

|

)

|

||||||||||

|

Tax-Exempt(2)

|

(787

|

)

|

(13

|

)

|

439

|

(1,213

|

)

|

448

|

12

|

636

|

(200

|

)

|

|||||||||||||

|

Funds

Sold

|

(3,027

|

)

|

(8

|

)

|

(2,368

|

)

|

(651

|

)

|

196

|

8

|

3,393

|

(3,205

|

)

|

||||||||||||

|

Total

|

(20,276

|

)

|

(397

|

)

|

79

|

(19,958

|

)

|

(22,395

|

) |

459

|

1,617

|

(24,471

|

)

|

||||||||||||

|

Interest

Bearing Liabilities:

|

|||||||||||||||||||||||||

|

NOW

Accounts

|

(6,415

|

)

|

(21

|

) |

(316

|

)

|

(6,078

|

)

|

(3,293

|

)

|

29

|

3,584

|

(6,906

|

)

|

|||||||||||

|

Money

Market Accounts

|

(3,954

|

)

|

(14

|

) |

(753

|

)

|

(3,187

|

)

|

(8,425

|

)

|

37

|

(786

|

)

|

(7,676

|

)

|

||||||||||

|

Savings

Accounts

|

(61

|

)

|

-

|

4

|

(65

|

)

|

(159

|

)

|

1

|

(8

|

)

|

(152

|

)

|

||||||||||||

|

Time

Deposits

|

(6,291

|

)

|

(40

|

) |

(155

|

)

|

(6,096

|

)

|

(5,505

|

)

|

55

|

(2,099

|

)

|

(3,461

|

)

|

||||||||||

|

Short-Term

Borrowings

|

(866

|

)

|

(3

|

) |

227

|

(1,090

|

)

|

(1,713

|

)

|

8

|

(185

|

)

|

(1,536

|

)

|

|||||||||||

|

Subordinated

Notes Payable

|

(5

|

)

|

(10

|

) |

-

|

5

|

5

|

10

|

-

|

(5

|

)

|

||||||||||||||

|

Long-Term

Borrowings

|

434

|

(5

|

)

|

555

|

(116

|

)

|

8

|

5

|

85

|

(82

|

)

|

||||||||||||||

|

Total

|

(17,158

|

)

|

(93

|

) |

(438

|

) |

(16,627

|

)

|

(19,082

|

)

|

145

|

591

|

|

(19,818

|

)

|

||||||||||

|

Changes

in Net Interest Income

|

$

|

(3,118

|

)

|

$

|

(304

|

) |

$

|

517

|

$

|

(3,331

|

)

|

$

|

(3,313

|

)

|

$

|

314

|

$

|

1,026

|

$

|

(4,653

|

)

|

||||

|

(1)

|

This table shows the change in

taxable equivalent net interest income for comparative periods based on

either changes in average volume or changes in average rates for earning

assets and interest bearing liabilities. Changes which are not solely due

to volume changes or solely due to rate changes have been attributed to

rate changes.

|

|

(2)

|

Interest income includes the

effects of taxable equivalent adjustments using a 35% tax rate to adjust

interest on tax-exempt loans and securities to a taxable equivalent

basis.

|

|

(3)

|

Reflects difference in 365 day

year (2009 and 2007) versus 366 day year

(2008).

|

|

For

the Years Ended December 31,

|

||||||||||||

|

(Dollars

in Thousands)

|

2009

|

2008

|

2007

|

|||||||||

|

Noninterest

Income:

|

||||||||||||

|

Service

Charges on Deposit Accounts

|

$

|

28,142

|

$

|

27,742

|

$

|

26,130

|

||||||

|

Data

Processing Fees

|

3,628

|

3,435

|

3,133

|

|||||||||

|

Asset

Management Fees

|

3,925

|

4,235

|

4,700

|

|||||||||

|

Retail

Brokerage Fees

|

2,655

|

2,399

|

2,510

|

|||||||||

|

Gain/(Loss)

on Sale/Call of Investment Securities

|

10

|

125

|

14

|

|||||||||

|

Mortgage

Banking Revenues

|

2,699

|

1,623

|

2,596

|

|||||||||

|

Merchant

Fees(1)

|

2,359

|

5,548

|

7,257

|

|||||||||

|

Interchange

Fees(1)

|

4,432

|

4,165

|

3,757

|

|||||||||

|

Gain

on Sale of Portion of Merchant Services Portfolio

|

-

|

6,250

|

-

|

|||||||||

|

ATM/Debit

Card Fees(1)

|

3,515

|

2,988

|

2,692

|

|||||||||

|

Other

|

6,026

|

8,530

|

6,511

|

|||||||||

|

Total

Noninterest Income

|

$

|

57,391

|

$

|

67,040

|

$

|

59,300

|

||||||

|

For

the Years Ended December 31,

|

||||||||||||

|

(Dollars

in Thousands)

|

2009

|

2008

|

2007

|

|||||||||

|

Noninterest

Expense:

|

||||||||||||

|

Salaries

|

$

|

50,494

|

$

|

50,581

|

$

|

49,206

|

||||||

|

Associate

Benefits

|

14,573

|

11,250

|

11,073

|

|||||||||

|

Total

Compensation

|

65,067

|

61,831

|

60,279

|

|||||||||

|

Premises

|

9,798

|

9,729

|

9,347

|

|||||||||

|

Equipment

|

9,096

|

9,902

|

9,890

|

|||||||||

|

Total

Occupancy

|

18,894

|

19,631

|

19,237

|

|||||||||

|

Legal

Fees

|

3,975

|

2,240

|

1,739

|

|||||||||

|

Professional

Fees

|

4,501

|

4,083

|

3,855

|

|||||||||

|

Processing

Services

|

3,591

|

3,921

|

3,278

|

|||||||||

|

Advertising

|

3,285

|

3,609

|

3,742

|

|||||||||

|

Travel

and Entertainment

|

1,123

|

1,390

|

1,470

|

|||||||||

|

Printing

and Supplies

|

1,882

|

1,977

|

2,124

|

|||||||||

|

Telephone

|

2,227

|

2,522

|

2,373

|

|||||||||

|

Postage

|

1,711

|

1,743

|

1,565

|

|||||||||

|

FDIC

Insurance Fees

|

4,616

|

835

|

240

|

|||||||||

|

Intangible

Amortization

|

4,042

|

5,685

|

5,834

|

|||||||||

|

Interchange

Fees

|

1,929

|

4,577

|

6,118

|

|||||||||

|

Other

Real Estate Owned

|

6,843

|

1,120

|

159

|

|||||||||

|

Miscellaneous

|

8,429

|

6,308

|

9,979

|

|||||||||

|

Total

Other

|

48,154

|

40,010

|

42,476

|

|||||||||

|

Total

Noninterest Expense

|

$

|

132,115

|

$

|

121,472

|

$

|

121,992

|

||||||

|

2008

to

|

Percentage

|

Components

of

|

||||||||||||||||||

|

2009

|

Of

Total

|

Average Earning Assets

|

||||||||||||||||||

|

(Average

Balances – Dollars In Thousands)

|

Change

|

Change

|

2009

|

2008

|

2007

|

|||||||||||||||

|

Loans:

|

||||||||||||||||||||

|

Commercial,

Financial, and Agricultural

|

2,988

|

5.0

|

%

|

9.1

|

%

|

8.8

|

%

|

9.5

|

%

|

|||||||||||

|

Real

Estate – Construction

|

(7,797

|

)

|

(14.0

|

)%

|

6.4

|

%

|

6.6

|

%

|

7.3

|

%

|

||||||||||

|

Real

Estate – Commercial

|

59,353

|

105.0

|

%

|

31.5

|

%

|

28.0

|

%

|

29.2

|

%

|

|||||||||||

|

Real

Estate – Residential

|

(7,421

|

)

|

(13.0

|

)%

|

31.6

|

%

|

31.1

|

%

|

31.5

|

%

|

||||||||||

|

Consumer

|

(3,550

|

)

|

(6.0

|

)%

|

11.2

|

%

|

11.1

|

%

|

11.2

|

%

|

||||||||||

|

Total

Loans

|

43,573

|

77.0

|

%

|

89.8

|

%

|

85.6

|

%

|

88.7

|

%

|

|||||||||||

|

Investment

Securities:

|

||||||||||||||||||||

|

Taxable

|

(9,501

|

)

|

(17.0

|

)%

|

3.8

|

%

|

4.2

|

%

|

4.8

|

%

|

||||||||||

|

Tax-Exempt

|

8,673

|

16.0

|

%

|

4.9

|

%

|

4.3

|

%

|

3.8

|

%

|

|||||||||||

|

Total

Securities

|

(828

|

)

|

(1.0

|

)%

|

8.7

|

%

|

8.5

|

%

|

8.6

|

%

|

||||||||||

|

Funds

Sold

|

(99,162

|

)

|

(176.0

|

)%

|

1.5

|

%

|

5.9

|

%

|

2.7

|

%

|

||||||||||

|

Total

Earning Assets

|

$

|

(56,417

|

)

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||||||||

|

As

of December 31,

|

||||||||||||||||||||

|

(Dollars

in Thousands)

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

Commercial,

Financial and Agricultural

|

$

|

189,061

|

$

|

206,230

|

$

|

208,864

|

$

|

229,327

|

$

|

218,434

|

||||||||||

|

Real

Estate - Construction

|

111,249

|

141,973

|

142,248

|

179,072

|

160,914

|

|||||||||||||||

|

Real

Estate - Commercial

|

716,791

|

656,959

|

634,920

|

643,885

|

718,741

|

|||||||||||||||

|

Real

Estate - Residential

|

416,469

|

484,238

|

488,372

|

536,138

|

558,000

|

|||||||||||||||

|

Real

Estate – Home Equity

|

246,722

|

218,500

|

192,428

|

173,597

|

165,336

|

|||||||||||||||

|

Consumer

|

235,648

|

249,897

|

249,018

|

237,702

|

246,069

|

|||||||||||||||

|

Total

Loans, Net of Unearned Interest

|

$

|

1,915,940

|

$

|

1,957,797

|

$

|

1,915,850

|

$

|

1,999,721

|

$

|

2,067,494

|

||||||||||

|

Maturity

Periods

|

||||||||||||||||

|

(Dollars

in Thousands)

|

One

Year

or

Less

|

Over

One

Through

Five

Years

|

Over

Five

Years

|

Total

|

||||||||||||

|

Commercial,

Financial and Agricultural

|

$

|

90,321

|

$

|

81,995

|

$

|

16,745

|

$

|

189,061

|

||||||||

|

Real

Estate – Construction

|

97,860

|

10,581

|

2,808

|

111,249

|

||||||||||||

|

Real

Estate – Commercial Mortgage

|

159,873

|

130,602

|

426,316

|

716,791

|

||||||||||||

|

Real

Estate – Residential

|

79,179

|

45,919

|

291,371

|

416,469

|

||||||||||||

|

Real

Estate – Home Equity

|

618

|

7,328

|

238,776

|

246,722

|

||||||||||||

|

Consumer(1)

|

23,967

|

168,062

|

43,619

|

235,648

|

||||||||||||

|

Total

|

$

|

451,818

|

$

|

444,487

|

$

|

1,019,635

|

$

|

1,915,940

|

||||||||

|

Loans

with Fixed Rates

|

$

|

158,165

|

$

|

337,403

|

$

|

166,920

|

$

|

662,488

|

||||||||

|

Loans

with Floating or Adjustable Rates

|

293,653

|

107,084

|

852,715

|

1,253,452

|

||||||||||||

|

Total

|

$

|

451,818

|

$

|

444,487

|

$

|

1,019,635

|

$

|

1,915,940

|

||||||||

|

(1)

|

Demand loans and overdrafts are

reported in the category of one year or

less.

|

|

For

the Years Ended December 31,

|

|||||||||||||||||||

|

(Dollars

in Thousands)

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||

|

Balance

at Beginning of Year

|

$

|

37,004

|

$

|

18,066

|

$

|

17,217

|

$

|

17,410

|

$

|

16,037

|

|||||||||

|

Acquired

Reserves

|

-

|

-

|

-

|

-

|

1,385

|

||||||||||||||

|

Reclassification

of Unfunded Reserve to Other Liability

|

392

|

-

|

-

|

-

|

-

|

||||||||||||||

|

Charge-Offs:

|

|||||||||||||||||||

|

Commercial,

Financial and Agricultural

|

2,590

|

1,649

|

1,462

|

841

|

1,287

|

||||||||||||||

|

Real

Estate - Construction

|

8,031

|

2,581

|

166

|

-

|

-

|

||||||||||||||

|

Real

Estate - Commercial

|

4,417

|

1,499

|

709

|

346

|

255

|

||||||||||||||

|

Real

Estate - Residential

|

13,491

|

3,787

|

407

|

260

|

311

|

||||||||||||||

|

Real

Estate - Home Equity

|

1,632

|

267

|

1,022

|

20

|

10

|

||||||||||||||

|

Consumer

|

5,912

|

6,192

|

3,451

|

2,516

|

2,380

|

||||||||||||||

|

Total

Charge-Offs

|

36,073

|

15,975

|

7,217

|

3,983

|

4,243

|

||||||||||||||

|

Recoveries:

|

|||||||||||||||||||

|

Commercial,

Financial and Agricultural

|

567

|

331

|

174

|

246

|

180

|

||||||||||||||

|

Real

Estate - Construction

|

540

|

4

|

-

|

-

|

-

|

||||||||||||||

|

Real

Estate - Commercial

|

53

|

15

|

14

|

17

|

3

|

||||||||||||||

|

Real

Estate - Residential

|

525

|

161

|

34

|

11

|

37

|

||||||||||||||

|

Real

Estate - Home Equity

|

5

|

1

|

2

|

-

|

-

|

||||||||||||||

|

Consumer

|

1,753

|

1,905

|

1,679

|

1,557

|

1,504

|

||||||||||||||

|

Total

Recoveries

|

3,443

|

2,417

|

1,903

|

1,831

|

1,724

|

||||||||||||||

|

Net

Charge-Offs

|

32,630

|

13,558

|

5,314

|

2,152

|

2,519

|

||||||||||||||

|

Provision

for Loan Losses

|

40,017

|

32,496

|

6,163

|

1,959

|

2,507

|

||||||||||||||

|

Balance

at End of Year

|

$

|

43,999

|

$

|

37,004

|

$

|

18,066

|

$

|

17,217

|

$

|

17,410

|

|||||||||

|

Ratio

of Net Charge-Offs to Average Loans Outstanding

|

1.66

|

%

|

.71

|

%

|

.27

|

%

|

.11

|

%

|

.13

|

%

|

|||||||||

|

Allowance

for Loan Losses as a Percent of Loans at End of Year

|

2.30

|

%

|

1.89

|

%

|

.94

|

%

|

.86

|

%

|

.84

|

%

|

|||||||||

|

Allowance

for Loan Losses as a Multiple of Net Charge-Offs

|

1.35

|

x

|

2.73

|

x

|

3.40

|

x

|

8.00

|

x

|

6.91

|

x

|

|||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

(Dollars

in Thousands)

|

Allowance

Amount

|

Percent

of

Loans

in

Each

Category

To

Total

Loans

|

Allowance

Amount

|

Percent

of

Loans

in

Each

Category

To

Total

Loans

|

Allowance

Amount

|

Percent

of

Loans

in

Each

Category

To

Total

Loans

|

Allowance

Amount

|

Percent

of

Loans

in

Each

Category

To

Total

Loans

|

Allowance

Amount

|

Percent

of

Loans

in

Each

Category

To

Total

Loans

|

||||||||||

|

Commercial,

Financial and Agricultural

|

$

|

2,409

|

9.9

|

%

|

$

|

2,401

|

10.5

|

%

|

$

|

3,106

|

10.9

|

%

|

$

|

3,900

|

11.5

|

%

|

$

|

3,663

|

10.6

|

%

|

|

Real

Estate:

|

||||||||||||||||||||

|

Construction

|

12,117

|

5.8

|

8,973

|

7.3

|

3,117

|

7.4

|

745

|

9.0

|

762

|

7.8

|

||||||||||

|

Commercial

|

8,751

|

37.4

|

6,022

|

33.6

|

4,372

|

33.1

|

5,996

|

32.2

|

6,352

|

34.7

|

||||||||||

|

Residential

|

14,159

|

21.7

|

12,489

|

24.7

|

3,733

|

35.6

|

1,050

|

35.5

|

1,019

|

35.0

|

||||||||||

|

Home

Equity

|

2,201

|

12.9

|

1,091

|

11.2

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||

|

Consumer

|

3,457

|

12.3

|

5,055

|

12.8

|

2,790

|

13.0

|

3,081

|

11.8

|

3,105

|

11.9

|

||||||||||

|

Not

Allocated

|

905

|

-

|

973

|

-

|

948

|

-

|

2,445

|

-

|

2,509

|

-

|

||||||||||

|

Total

|

$

|

43,999

|

100.0

|

%

|

$

|

37,004

|

100.0

|

%

|

$

|

18,066

|

100.0

|

%

|

$

|

17,217

|

100.0

|

%

|

$

|

17,410

|

100.0

|

%

|

|

As

of December 31,

|

|||||||||||||||||||

|

(Dollars

in Thousands)

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||

|

Nonaccruing

Loans

|

$

|

86,274

|

$

|

96,876

|

$

|

25,119

|

$

|

8,042

|

$

|

5,258

|

|||||||||

|

Troubled

Debt Restructurings

|

21,644

|

1,744

|

-

|

-

|

-

|

||||||||||||||

|

Total

Nonperforming Loans

|

107,918

|

98,620

|

25,119

|

8,042

|

5,258

|

||||||||||||||

|

Other

Real Estate Owned

|

36,134

|

9,222

|

3,043

|

689

|

292

|

||||||||||||||

|

Total

Nonperforming Assets

|

$

|

144,052

|

$

|

107,842

|

$

|

28,162

|

$

|

8,731

|

$

|

5,550

|

|||||||||

|

Past

Due 90 Days or More (still accruing interest)

|

$

|

-

|

$

|

88

|

$

|

416

|

$

|

135

|

$

|

309

|

|||||||||

|

Nonperforming