This presentation includes forward-looking statements, including statements about future results. !ese statements are subject to uncertainties and risks, including, but not limited to legislative or regulatory changes, including the Dodd-Frank Act; the strength of the U.S. economy and the local economies where the Company conducts operations; the accuracy of the Company's "nancial statement estimates and assumptions, including the estimate for the Company's loan loss provision; the frequency and magnitude of foreclosure of the Company's loans; continued depression of the market value of the Company that could result in an impairment of goodwill; restrictions on our operations, including the inability to pay dividends without our regulators' consent; the e#ects of the health and soundness of other "nancial institutions, including the FDIC's need to increase Deposit Insurance Fund assessments; our ability to declare and pay dividends; the e#ects of the Company's lack of a diversi"ed loan portfolio, including the risks of geographic and industry concentrations; harsh weather conditions and man-made disasters; $uctuations in in$ation, interest rates, or monetary policies; changes in the stock market and other capital and real estate markets; customer acceptance of third-party products and services; increased competition and its e#ect on pricing; technological changes; the e#ects of security breaches and computer viruses that may a#ect the Company's computer systems; changes in consumer spending and savings habits; the Company's growth and pro"tability; changes in accounting; the Company's ability to integrate acquisitions; and the Company's ability to manage the risks involved in the foregoing. !ese factors, as well as additional factors can be found in the Company's Annual Report on Form 10-K for the "scal year ended December 31, 2016, as updated in the Company's Quarterly Reports on Form 10-Q, and the Company's other "lings with the SEC, which are available at the SEC's internet site (http://www.sec.gov). Forward-looking statements in this presentation speak only as of the date of these materials, and the Company assumes no obligation to update forward-looking statements or the reasons why actual results could di#er.

board of directors John Humphress Wadsworth, Humphress Hollar, PA, CPAs William G. Smith, Jr., Chairman Rick Carroll Laura Johnson Capital City Bank Group, Inc. Carroll Company, CPAs Coton Colors, Inc. Stanley Connally, Jr. Everitt Drew, Lead Director Lina Knox Gulf Power Company SouthGroup Equities, Inc. Community Volunteer Cader Cox, III Tom Barron Dr. Henry Lewis III Riverview Plantation, Inc. Capital City Bank Tuskegee Homes, LLC Eric Grant Allan Bense John Sample Municipal Code Corporation Bense Enterprises, Inc. Atlantic American Corporation

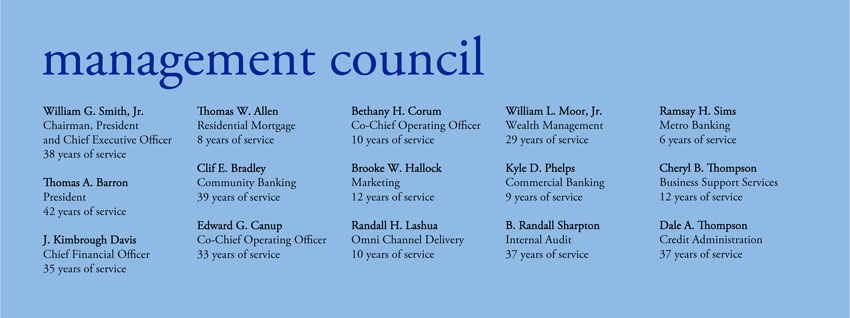

management council William G. Smith, Jr. !omas W. Allen Bethany H. Corum William L. Moor, Jr. Ramsay H. Sims Chairman, President Residential Mortgage Co-Chief Operating O%cer Wealth Management Metro Banking and Chief Executive O%cer 8 years of service 10 years of service 29 years of service 6 years of service 38 years of service Clif E. Bradley Brooke W. Hallock Kyle D. Phelps Cheryl B. !ompson !omas A. Barron Community Banking Marketing Commercial Banking Business Support Services President 39 years of service 12 years of service 9 years of service 12 years of service 42 years of service Edward G. Canup Randall H. Lashua B. Randall Sharpton Dale A. !ompson J. Kimbrough Davis Co-Chief Operating O%cer Omni Channel Delivery Internal Audit Credit Administration Chief Financial O%cer 33 years of service 10 years of service 37 years of service 37 years of service 35 years of service sales and service leaders

Janette Burkes Danny Etheridge Julie DeLorme Clif Bradley Bank Direct Financial Advisor Marketing Community Banking

star summit career camp

4.6% loan growth 12 consecutive quarters

$136 million $235 million

Georgia Florida

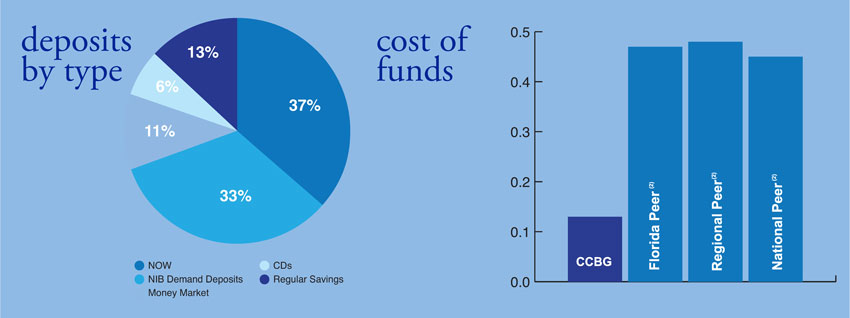

0.5 deposits 13% cost of by type funds 0.4 6% 37% 11% 0.3 0.2 33% 0.1 NOW CDs NIB Demand Deposits Regular Savings 0.0 Money Market

non-performing assets $10.4 million $9.2 million

to you 435,000 shares repurchased

how our clients bank with us 300,000 25,000 teller calls chats 175,000 1.3m client ATM

2016 goals $1.56B $52.1M performing loans classi"ed assets ..43% 85.34% return on assets e%ciency ratio

Announcing 2017 Company Goals Loan Income ROA E!ciency 74.283 ..62 81.47 Classified Assets 39.546

1Q17 = $.16 per share

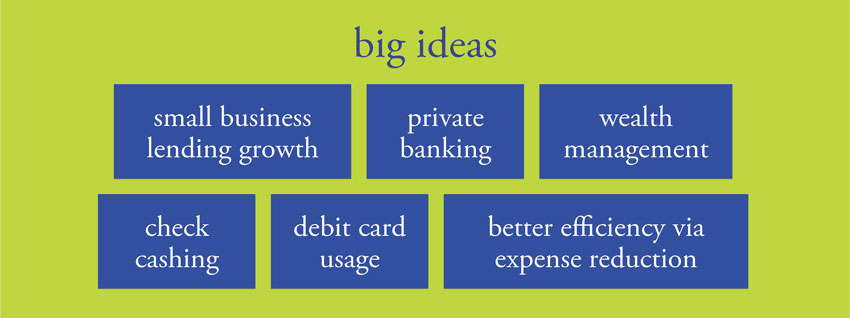

big ideas small business private wealth lending growth banking management check debit card better e%ciency via cashing usage expense reduction

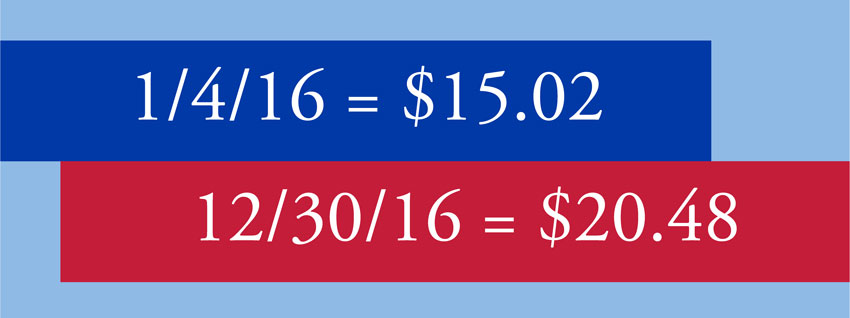

1/4/16 = $15.02 12/30/16 = $20.48

Small business commercial will play here