UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| þ | Filed by the Registrant | o | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| þ | Preliminary Proxy Statement |

| o | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

Capital City Bank Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: | |

| (2) Aggregate number of securities to which transaction applies: | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: | |

| (4) Proposed maximum aggregate value of transaction: | |

| (5) Total fee paid: | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: | |

| (2) Form, Schedule or Registration Statement No.: | |

| (3) Filing Party: | |

| (4) Date Filed: | |

Notice of

2021 Annual Meeting of Shareowners

and Proxy Statement

| |

| 217 North Monroe Street | |

| Tallahassee, Florida 32301 |

LETTER TO SHAREOWNERS

217 North Monroe Street

Tallahassee, Florida 32301

March 11, 2021

Dear Fellow Shareowners:

Please

join us for our 2021 Annual Shareowners Meeting at 10 a.m., Eastern Time, on Tuesday, April 27, 2021, by

visiting: www.virtualshareholdermeeting.com/CCBG2021. I look forward to this opportunity to share highlights from 2020 and discuss near- and longer-term plans for Capital City. I will

also be calling for a vote on six important matters.

As a valued Capital City Bank supporter,

your vote is important and your Board of Directors encourages you to let your voice be heard. Proxy materials are attached for

your convenience and are accessible at www.proxyvote.com along with the 2020 Annual Report. We are distributing

Proxy Materials online rather than mailing printed copies as it allows us to expedite delivery to our shareowners through a lower-cost,

more environmentally responsible option. You will not receive printed copies unless you request them by following the instructions

contained in the Notice of Internet Availability of Proxy Materials.

Whether or not you are able to attend the virtual meeting, I encourage

you to vote as soon as possible. By voting your proxy, it ensures your representation at the meeting. We offer several methods

of voting for your convenience: by telephone, online at www.proxyvote.com or via mailed proxy card if you received

paper copies of your materials.

Thank you for your vote and for your continued support. I look forward

to you joining us in April.

Your banker,

William G. Smith, Jr.

Chairman, President,

and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREOWNERS

BUSINESS (1) Vote on Adoption of Amendment to Amended and Restated Articles of Incorporation to Declassify the Board and Provide for Annual Election of Directors; (2) Vote on 11 nominees for election to the Board of Directors; or, in the event Proposal No. 1 does not pass, vote on three Class III nominees for election to the Board of Directors; (3) Consider and vote on the adoption of the 2021 Director Stock Purchase Plan; (4) Consider and vote on the adoption of the 2021 Associate Stock Purchase Plan; (5) Consider and vote on the adoption of the 2021 Associate Incentive Plan; (6) Ask for ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year; and (7) Transact other business properly coming before the meeting or any postponement or adjournment of the meeting. RECORD DATE Shareowners owning Capital City Bank Group shares at the close of business on February 25, 2021, are entitled to notice of, attend, and vote at the virtual meeting. A list of these shareowners will be available for 10 days before the Annual Meeting between the hours of 9 a.m. and 5 p.m., Eastern Time, at our principal executive offices at 217 North Monroe Street, Tallahassee, Florida 32301. |

TIME 10:00 a.m., Eastern Time, April 27, 2021 WHERE You will be able to attend the meeting online, vote your shares electronically, and submit your questions during the meeting by visiting: www.virtualshareholdermeeting.com/CCBG2021. To be admitted to the virtual meeting, you must enter the control number found on your proxy card or Notice of Internet Availability of Proxy Materials. VOTING Even if you plan to attend the virtual meeting, please provide us your voting instructions in one of the following ways as soon as possible:

|

By Order of the Board of Directors

J. Kimbrough Davis Tallahassee,

Florida Important Notice Regarding the Availability of Proxy Materials for the Shareowners’ Meeting to be Held on April 27, 2021. The Proxy Statement and the Annual Report are available at: www.proxyvote.com. |

CONTENTS

We are providing these Proxy Materials in connection with the solicitation by the Board of Directors (the “Board”) of Capital City Bank Group, Inc., a Florida corporation (“Capital City”), of proxies to be voted at our 2021 Annual Meeting of Shareowners and at any adjournments or postponements of the Annual Meeting.

We will hold our 2021 Annual Meeting at 10:00 a.m., Eastern Time, Tuesday, April 27, 2021, virtually at: www.virtualshareholdermeeting.com/CCBG2021. We are making these Proxy Materials available to our shareowners on or about March 11, 2021.

At Capital City, and in this Proxy Statement, we refer to our employees as “associates.” Also in the Proxy Statement, we refer to Capital City as the “Company,” “we,” or “us” and to the 2021 Annual Meeting as the “Annual Meeting.”

Who can vote?

All shareowners of record at the close of business on the record date of February 25, 2021 are entitled to receive these Proxy Materials and to vote at the Annual Meeting. On that date, there were 16,840,267 shares of our common stock outstanding and entitled to vote.

How do I vote my shares virtually at the Annual Meeting?

Shares held in your name as the shareowner of record may be voted virtually at the Annual Meeting by following the instructions at www.virtualshareholdermeeting.com/CCBG2021. Shares for which you are the beneficial owner but not the shareowner of record may be voted virtually at the Annual Meeting only if you obtain a legal proxy from the broker, trustee, or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to virtually attend the Annual Meeting, we recommend that you vote by proxy as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. The vote you cast virtually will supersede any previous votes that you submitted, whether by Internet, phone, or mail.

How do I vote my shares in the 401(k) plan?

If you are an associate who participates in Capital City’s 401(k) Plan, you may instruct the Plan trustee on how to vote your shares in the Plan by mail, by telephone, or on the Internet as described above, except that, if you vote by mail, the card that you use will be a voting instruction card rather than a proxy card. If you own shares through the Plan and you do not vote, the Plan trustee will vote the shares in the same proportion as other Plan participants vote their Plan shares.

How can I vote my shares without attending the Annual Meeting virtually?

Whether you hold shares directly as a shareowner of record or beneficially, you may direct how your shares are voted without attending the Annual Meeting virtually. You may give voting instructions by the Internet or by telephone. If you requested and received a paper copy of a proxy card by mail, you may vote by mail. Instructions are on the Notice of Internet Availability of Proxy Materials or the proxy card.

Whether you provide voting instructions by the Internet or by telephone, or vote by mail, you are designating certain individuals to vote on your behalf as your legal Proxy. We have designated Bethany H. Corum and Dale A. Thompson each as a Proxy. The Proxies will vote all valid voting instructions and proxy cards that are delivered in response to this solicitation, and not later revoked, in accordance with the instructions given by you.

What is the deadline for voting my shares?

If you hold shares as the shareowner of record, then your vote by proxy must be received before 11:59 p.m., Eastern Time, on April 26, 2021 (the day before the Annual Meeting). If you are the beneficial owner of shares held through a broker, trustee, or other nominee, please follow the instructions provided by your broker, trustee, or other nominee.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 1

PROPOSAL NO. 1 – Approval of Amended and Restated Articles of Incorporation to Declassify the Board and Provide for Annual Election of Directors

Our Articles of Incorporation currently provide that the Board is divided into three classes, with each class being elected every three years. Our Board has unanimously adopted, and recommends that our shareowners approve, an amendment and restatement of our Articles of Incorporation that would immediately declassify the Board, so that all our directors will stand for election annually, beginning at this Annual Meeting. In addition, if the proposed Amended and Restated Articles of Incorporation are approved, the Board has approved certain conforming changes to our Bylaws to declassify the Board, which would automatically become effective upon approval of the shareowners and the effectiveness of the Amended and Restated Articles of Incorporation. The proposed Amended and Restated Articles of Incorporation are attached to this proxy statement as Appendix A. Additions of text contained in the appendices are indicated by underlining and deletions of text are indicated by strikeouts. The below summary of the proposed Amended and Restated Articles of Incorporation does not purport to be complete and is qualified in its entirety by reference to the full text of the proposed amendment attached hereto as Appendix A. If the proposed amendments are adopted and become effective, the Board has approved conforming amendments to our Bylaws that would automatically become effective.

The Board’s consideration of whether to remove the classified board provisions was undertaken as part of the efforts of the Board and the Corporate Governance and Nominating Committee to improve and enhance our corporate governance practices, to ensure that they are aligned with developments in our business, changes in regulations and exchange listing requirements, and the continuing evolution of best practices in corporate governance. The Board considered the advantages and disadvantages of maintaining the classified Board structure compared with providing for an annual election of directors. The Board recognized that the classified structure benefits shareowners by promoting continuity and stability in the management of our business and by encouraging directors to take a long-term perspective. Although the Board continues to believe that these are important benefits, the Board has considered the fact that that classified boards may be viewed as having the effect of reducing the accountability of directors to shareowners, as shareowners are unable to evaluate and elect all directors on an annual basis. The Board also recognized the growing sentiment among shareowners and the investment community in favor of annual elections, and that many institutional investors believe that the election of directors is the primary means for shareowners to influence corporate governance policies and to hold management accountable for implementing those policies. As a result, proxy advisory firms, such as Institutional Shareholder Services (ISS), typically recommend voting against classified boards. After carefully weighing these and other factors (including that the number of public companies with classified boards continues to decline), the Board has determined that it is in the best interests of the Company and our shareowners to declassify the Board and recommends that shareowners approve the proposed Amended and Restated Articles of Incorporation to effectuate the declassification.

If the proposed Amended and Restated Articles of Incorporation are approved by the shareowners, we intend to file the amendment with the Secretary of State of the State of Florida during the annual meeting, prior to the vote on the election of directors, so that the declassified board structure will become effective immediately. Accordingly, in such event, each of our current directors, regardless of his or her current class, will stand for election at this annual meeting for a one-year term until the 2022 Annual Meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. Any vacancies on the Board that occur prior to the 2022 Annual Meeting will be filled by the Board to serve a term ending at the 2022 Annual Meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. The changes to our Articles of Incorporation will become effective upon the filing of Articles of Amendment with the Secretary of State of the State of Florida. In addition, if the proposed amendment is approved, the Board has approved certain conforming changes to our Bylaws to declassify the Board, which would become automatically effective upon the effectiveness of the Amended and Restated Articles of Incorporation.

If this proposal is not approved, then our Board will remain classified, and three of our four Class III directors will stand for election at this Annual Meeting to serve a three-year term. In future elections of directors, directors will continue to be elected to serve three-year terms, subject to their earlier death, resignation or removal. Please see Proposal No. 2 for additional information regarding the election of directors at this annual meeting.

2 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Article X of our Articles of Incorporation currently provide that “the affirmative vote of (a) the holders of at least two-thirds (66 2/3%) of the voting power of all of the then outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class; or (b) a majority of “Disinterested Directors”, as defined in Florida Statutes Section 607.0901(1)(h) as in effect on the date hereof, and the holders of at least a majority of the voting power of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, [are] required to amend or repeal any of Articles V, VI, VII, VIII, IX and X.” Our Disinterested Directors unanimously approved the adoption of the Amended and Restated Articles of Incorporation contemplated by this Proposal No. 1, satisfying the majority requirement set forth in Article X of our Articles of Incorporation. Based on this majority, in order for Proposal No. 1 to be approved, at least a majority of the outstanding shares must cast a vote “For” the proposal. Abstentions and broker non-votes, if any, will have the same effect as “Against” votes.

| The

Board of Directors unanimously recommends a vote “FOR” approval of the Amended and Restated Articles of Incorporation to declassify the Board and provide for annual election of directors |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 3

PROPOSAL NO. 2 – ELECTION OF DIRECTORS

The Board of Directors has approved, and recommends that shareholders approve, a proposed amendment to our Articles, as described in Proposal No. 1, to eliminate the classes of directors, effective immediately, and to require each director to stand for election annually for a one-year term, beginning at this annual meeting.

All of our current directors (except one of our Class III Directors that is retiring) have been nominated by the Board to stand for election at this annual meeting. If our shareholders approve the proposed amendment to declassify the Board and Proposal No. 1 passes, our director nominees at this annual meeting will be 11 of our incumbent directors, and each will stand for election for a one-year term of office, expiring at the 2022 Annual Meeting, until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. Frederick Carroll III will be retiring as of the date of the Annual meeting. While we currently have 12 directors, after this annual meeting, the number of director seats on the Board will be fixed at 11.

If, however, Proposal No. 1 does not pass, our Board will remain divided into three classes, designated Class I, Class II, and Class III, and three of our 12 current directors, our Class III directors other than Mr. Carroll, will stand for election at this annual meeting. If elected, each of the Class III director nominees would serve until the 2024 Annual Meeting, until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal.

Each of the nominees is currently serving as a member of the Board. The proxies will vote, unless instructed otherwise, each valid voting instruction and proxy card for the election of the following nominees as directors. If a nominee is unable to serve, the shares represented by all valid proxies that have not been revoked will be voted for the election of a substitute as the Board may recommend, or the Board may by resolution reduce the size of the Board to eliminate the resulting vacancy. At this time, the Board knows of no reason why any nominee might be unable to serve.

If the 11 director nominees, in the event that Proposal No. 1 is passed, or the three director nominees, in the event that Proposal No. 1 is not passed, are elected, the Board will not have any vacancies. Brokers do not have discretion to vote on this proposal without your instructions. If you do not instruct your broker how to vote on this proposal, your broker will deliver a broker non-vote on this proposal.

The following paragraphs provide information as of the date of this Proxy Statement about each nominee up for re-election in the categories of: age, positions held, principal occupation and business experience for the past five years, and names of other publicly-held companies for which he or she serves as a director or has served as a director during the past five years. While the following paragraphs note certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole, we also believe that all of our nominees have a reputation for integrity, honesty, and adherence to high ethical standards. They each have demonstrated strong leadership skills, business acumen and an ability to exercise sound judgment, as well as a commitment of service to our shareowners.

4 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

if Proposal No. 1 is approved, THE FOLLOWING 11 DIRECTORS HAVE BEEN NOMINATED for a One-Year Term Expiring at the 2022 Annual Meeting

(If Proposal No. 1 is not approved by the shareowners at the Annual Meeting, the first three directors listed below (three of our current Class III directors) have been nominated to serve for a three-year term expiring in 2024)

Independent director Age: 64 Director since: 2019 Board committees: Compensation and Corporate Governance and Nominating Other current public company boards: None |

ROBERT ANTOINE Until his retirement from Deloitte & Touche LLP in 2019, Mr. Antoine was a partner in the firm’s Banking and Securities practice for more than 21 years, advising clients on a broad range of issues affecting corporate governance, risk management, internal controls, information security and regulatory compliance. Prior to Deloitte & Touche, Mr. Antoine held a number of executive positions in internal audit and financial management. He is a Certified Internal Auditor and a Certified Public Accountant in Florida. Mr. Antoine earned his Accounting degree from the University of West Florida in Pensacola, FL, and holds a master of Business Administration from Western New England College in Springfield, MA. Mr. Antoine is a member of the National Association of Corporate Directors, the American and Florida Institutes of Certified Public Accountants. Mr. Antoine is also a charter member of the Jacksonville Chapter of the National Association of Black Accountants. We believe Mr. Antoine’s qualifications to sit on our Board include his extensive regulatory experience and strong accounting and financial background. |

Independent director Age: 62 Director since: 2018 Board committees: Audit and Corporate Governance and Nominating Other current public company boards: None |

MARSHALL M. CRISER III Mr. Criser has served as the chancellor of the State University System of Florida since 2014. Prior to this post, he worked for AT&T and its predecessor, BellSouth, since 1980, where he most recently served as its President. Mr. Criser is a member of the Boards of Directors of the Florida Chamber of Commerce and Enterprise Florida, Inc. and a past member of the Scripps Research Institute Board of Trustees in California and the Florida Council of 100, where he is a former chairman. Mr. Criser’s community service includes terms as the vice chairman of the University of Florida’s Board of Trustees, chairman of the Florida Chamber of Commerce, and chairman of Florida TaxWatch. A Florida native, Mr. Criser graduated from the University of Florida with a bachelor’s degree in business administration in 1980, and later completed an Advanced Management Programme at INSEAD in Fontainebleau, France. We believe Mr. Criser’s qualifications to sit on our Board include his extensive executive leadership and management experience. |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 5

Independent director Age: 58 Director since: 2017 Board committees: Audit and Compensation Other current public company boards: None |

LAURA L. JOHNSON For over two decades, Ms. Johnson has been the founding artist and Chief Executive Officer of Coton Colors, a leading lifestyle brand in the giftware and home décor industries headquartered in Tallahassee, Florida. We believe Ms. Johnson’s qualifications to sit on our Board include her executive leadership and management experience and her operational and financial expertise gained from the successful operation of her own businesses.

|

Current CLASS II DIRECTORS | |

President-Capital City Bank Age: 68 Director since: 1982 Other current public company boards: None |

THOMAS A. BARRON Mr. Barron is our Treasurer and was appointed President of Capital City Bank in 1995. We believe Mr. Barron’s qualifications to sit on our Board include his more than four decades of banking experience, including more than 25 years as the President of Capital City Bank. |

Independent director Age: 51 Director since: 2017 Board committees: Audit and Corporate Governance and Nominating (Chair) Other current public company boards: None |

STANLEY W. CONNALLY, JR. Mr. Connally has been employed by Southern Company since 1989, currently serving as executive vice president of operations for Southern Company Services, Inc. From 2012, until the end of 2018, Mr. Connally served as Chairman, President, and Chief Executive Officer of Gulf Power Company, a subsidiary of Southern Company. Mr. Connally serves on the board of the Electric Power Research Institute and formerly served on the boards of the Florida Chamber of Commerce, Florida Council of 100, Enterprise Florida and Aerospace Alliance. We believe Mr. Connally’s qualifications to sit on our Board include his executive leadership and management experience and his operational and financial expertise gained from almost three decades of increasing responsibility at a Fortune 500 company. |

6 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Independent director (Lead) Age: 65 Director since: 2003 Board committees: Compensation Other current public company boards: None |

J. EVERITT DREW Since 2007, Mr. Drew has been President of SouthGroup Equities, Inc., a private real estate investment and development company. From 2000 to 2007, Mr. Drew was President of St. Joe Land Company where his duties included overseeing the sale and development efforts of several thousand acres of St. Joe property in northwest Florida and southwest Georgia. We believe Mr. Drew’s qualifications to sit on our Board include his experience as President of St. Joe Land Company, which at the time was the largest landowner in Florida, as well as his operational and financial expertise gained from the successful operation of his own business. |

Independent director Age: 45 Director since: 2017 Board committees: Audit and Compensation Other current public company boards: None |

ERIC GRANT Mr. Grant has been employed by Municipal Code Corporation, the nation’s largest provider of municipal solutions, including printing and hosting municipal codes online, since 2007. Mr. Grant served as Vice President of the Supplement Department of Municipal Code Corporation until 2012. Since 2012, Mr. Grant has served as President. Prior to receiving his Juris Doctorate from the University of Virginia, Mr. Grant attended the United States Naval Academy and Georgetown University’s School of Foreign Service while serving as a member of the United States Marine Corps. In addition to being stationed in Virginia, Kentucky, California and abroad, Grant and his unit, the 15th Marine Expeditionary Unit, were deployed during Operation Enduring Freedom in 2001. Mr. Grant also serves on the boards of the Community Foundation of North Florida and the United Way of the Big Bend. We believe Mr. Grant’s qualifications to sit on our Board include his executive leadership and management experience. |

CURRENT CLASS I DIRECTORS | |

Independent director Age: 69 Director since: 2013 Board committees: Audit and Compensation (Chair) Other current public company boards: None |

ALLAN G. BENSE Mr. Bense is currently Chairman, President and CEO of Bense Enterprises, Inc., which is affiliated with companies that have interests in road building, general construction, mechanical contracting, insurance, healthcare, golf courses, pavement marking and farming since the early 1980s. Mr. Bense received his M.B.A. from Florida State University. He served as Speaker of the Florida House of Representatives from 2004 to 2006. Mr. Bense has also served as the chairman of the Florida State University Board of Trustees, Chairman of the Board of the James Madison Institute, and Chairman of the Florida Chamber of Commerce and the Bay Economic Alliance. Mr. Bense also previously served as a director for the Gulf Power Company. We believe Mr. Bense’s qualifications to sit on our Board include his executive leadership and management experience and his operational and financial expertise gained from the successful operation of his own businesses. |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 7

Independent director Age: 71 Director since: 1994 Board committees: Compensation and Corporate Governance and Nominating Other current public company boards: None |

CADER B. COX, III From 1976 to 2006, Mr. Cox served as President, and from 2006 until 2013, he served as CEO of Riverview Plantation, Inc., a resort and agricultural company located in Georgia. He currently serves as Chairman and Secretary of Riverview Plantation, Inc. and an officer and a director of Plantation Precooler, Inc., a large fresh vegetable operation. He is extensively involved in the community, including serving as a board member for The University of Georgia Research Foundation Board, trustee of AgriTrust, and he serves on the Board and Executive Committee of the Georgia Agribuisness Council. We believe Mr. Cox’s qualifications to sit on our Board include his operational and financial expertise gained from the successful operation of his own businesses, as well as his executive leadership and management experience. |

Independent director Age: 64 Director since: 2016 Board committees: Audit (Chair) Other current public company boards: 1st Franklin Financial Corp. |

JOHN G. SAMPLE, JR. Mr. Sample previously served, until his retirement in July 2017, as Senior Vice President and Chief Financial Officer of Atlantic American Corporation, an Atlanta, Georgia-based holding company that operates through its subsidiaries in specialty markets within the life, health and property and casualty insurance industries, from July 2002 until July 2017 and Corporate Secretary from May 2010 until July 2017. Prior to joining Atlantic American Corporation in July 2002, he had been a partner of Arthur Andersen LLP since 1990. Mr. Sample has also served as a director and chairman of the audit committee of the board of directors of 1st Franklin Financial Corporation, a consumer finance company that originates and services direct cash loans, real estate loans and sales finance contracts through 314 branch offices located throughout the southeastern United States, since 2004. We believe Mr. Sample’s qualifications to sit on our Board include his executive leadership and management experience, his extensive accounting and financial background, and his experience in the financial services industry. |

Chairman Age: 67 Director since: 1982 Other current public company boards: Southern Company |

WILLIAM G. SMITH, JR. Mr. Smith currently serves as our Chairman, President, and Chief Executive Officer. He was elected Chairman in 2003 and has been President and Chief Executive Officer since 1995. Mr. Smith also serves as Chairman of Capital City Bank, a position he has held since 1995. In addition, Mr. Smith has served as a director of Southern Company since 2006. We believe Mr. Smith’s qualifications to sit on our Board include his four decades of banking experience, including more than 25 years as our President and Chief Executive Officer. |

8 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

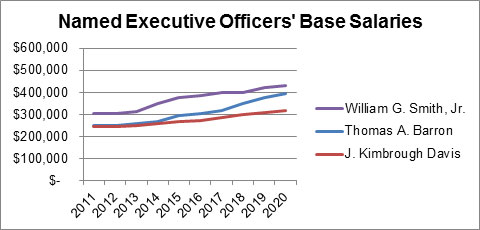

EXECUTIVE OFFICERS Executive officers are elected annually by the Board at its meeting following the annual meeting of shareowners to serve for a one-year term and until their successors are elected and qualified. Thomas A. Barron and William G. Smith, Jr. serve as directors and executive officers and J. Kimbrough Davis is an executive officer. | |

|

J. KIMBROUGH DAVIS Mr. Davis, 67, was appointed our Executive Vice President and Chief Financial Officer in 1997. He served as Senior Vice President and Chief Financial Officer from 1991 to 1997. In 1998, he was appointed Executive Vice President and Chief Financial Officer of Capital City Bank. |

| The

Board of Directors unanimously recommends a vote “FOR” the nominees |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 9

CORPORATE GOVERNANCE at capital city

GOVERNING PRINCIPLES

We are committed to maintaining a business atmosphere where only the highest ethical standards and integrity prevail. An unwavering adherence to high ethical standards provides a strong foundation on which our business and reputation can thrive, and is integral to creating and sustaining a successful, high-caliber company.

ENVIRONMENTAL, SOCIAL, AND CORPORATE GOVERNANCE

Environmental

Conservation and Energy Efficiency. We are committed to conservation and energy efficiency efforts. As of December 31, 2020, these efforts included:

| · | Programming all HVAC systems company-wide to operate during business hours only |

| · | Converting one-third of our buildings to LED exterior lighting, with a disciplined and measured approach to converting all buildings by 2025 |

| · | Installing occupancy sensors throughout our footprint to reduce energy consumption |

| · | Converting 100% of exterior signage to LED lighting |

We utilize paperless document storage, retaining in paper form only the documents required by law or regulation to be kept in hard copy form. We also have encouraged our clients to opt for electronic notices and statements, reducing paper consumption and transportation-related emissions.

Our plans for 2021 include purchasing an electric vehicle for courier routes and matching 100% of our electricity use with Renewable Energy Certificates.

Sustainable Investing. For wealth management clients, Capital City Investments and Capital City Trust Company can provide Sustainable Investing – ESG (SI) strategies that seek to grow capital by employing a globally focused and sustainable investment approach. The SI portfolios use a broad array of sustainable approaches that consider environmental, social, and governance factors for the purpose of generating a long-term competitive return and positive societal impact. By seeking exposure to socially and economically innovative companies, these portfolios pursue the potential economic benefits resulting from future transformational change. With these portfolio strategies, the sustainable investing portfolios take a broader approach to evaluating risk and do so over a long-term horizon by evaluating a company’s environmental, social, and governance risks, in addition to traditional financial risks.

Social

Community relations and philanthropy. We ask each of our associates to contribute at least 10 hours per year in community service. As a result, our associates serve many charitable organizations and support community endeavors throughout our footprint. In 2020, our approximately 750 associates volunteered approximately 13,000 hours in the communities we serve. United Way organizations throughout our market area received over $120,000 in contributions from our associates and our company. Through our foundation, we distributed over $170,000 in grants to philanthropic organizations in the communities we serve.

Access, affordability, and financial inclusion. In 2020, our foundation made grants totaling approximately $120,000 to Community Reinvestment Act eligible organizations in our market area. Additionally, we contributed $10,000 to the Equal Justice Initiative in support of ending racial inequality.

Working with Capital City Home Loans, we are committed to providing educational outreach regarding home ownership and equal access to funding.

10 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

We are a long-time supporter of Habitat for Humanity, with our associates providing volunteer hours on home builds. In late 2020, we partnered with Habitat for Humanity, Warrick Dunn Charities, and Capital City Home Loans to build and furnish a home in early 2021.

During tax season, we provide locations for community residents to access Volunteer Income Tax Assistance (VITA) services. VITA is a nationwide IRS program that offers free tax preparation assistance to people who generally make $54,000 or less, persons with disabilities, the elderly, and limited English speaking taxpayers who need assistance in preparing their own tax returns.

Small Business Lending. We are focused on supporting small businesses throughout our communities. The global pandemic exposed the challenges of small business and Capital City Bank was proud to participate in the Paycheck Protection Program (PPP), originating 2,224 loans totaling more than $193 million in the first round. In early 2021, we chose to participate in the second round of PPP. As of February 19, 2021, we had originated 738 loans totaling $52 million. During the pandemic, our company financially supported locally-owned restaurants to provide meals and gift cards for our associates.

Human Capital

For the last nine years, Florida Trend has honored us by listing Capital City Bank as a Best Place to Work, and American Bankers Magazine has recognized us for the last eight years as a Best Bank to Work For. Additionally, Georgia Trend recognized CCB in 2016 and 2017 as a Best Place to Work. Tenure statistics support these accolades and further demonstrate that associates enjoy working for CCB.

In an effort to support our associates during the COVID-19 pandemic, among other things, we offered the following benefits:

| · | Compensation of an extra $1.00 an hour for every hour worked (for a period of 12 weeks for all non-exempt associates) |

| · | Meals on Tuesdays and Thursdays for every associate working in an office |

| · | Self-quarantine pay of up to 10 days |

| · | Extra paid time off for all associates |

| · | Free access to mental health tools, such as online apps |

We emphasize compliance with all state and federal laws throughout our operations. However, we often exceed the requirements for our associates by providing more generous protection and benefits than mandated. In addition, we focus on providing training to our associates for a better work environment. For example, each year our legal counsel typically provides employment law training to our senior level associates.

We actively seeks to hire minorities, veterans and disabled individuals and have a robust internal response for associates that request an accommodation. We have remained focused on diversity at the Board of Directors level, and in 2020, minority representation increased for the companies in our holding company structure. Also, our vendor supply chain is comprised of approximately 28% female and/or minority owned businesses.

In 2020, we increased our focus and attention on Diversity, Equity & Inclusion (DEI). Our efforts are focused on transparency of diversity data at the associate, Board and vendor levels and setting targets to improve our minority representation. Additionally, we have convened a group of minority associates to help identify and eliminate any systemic racism and to have open conversations about the culture at Capital City Bank. Through this work, we intend to identify any challenges, focus on priorities and make progress.

Governance

Our Board of Directors oversees the affairs of the company, striving to protect the interests of our shareowners. Our directors focus on exercising sound and independent business judgment regarding significant, strategic and operational issues. The Board also advises senior management and adopts governance principles consistent with Capital City Bank’s mission and vision. Our Board is specifically focused on corporate risk management, Board structure (including declassifying our Board of Directors in 2021 and having a named Lead Director), and managing the company for the long-term.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 11

Corporate Governance and Nominating Committee Report

During 2020, the Corporate Governance and Nominating Committee focused its efforts on:

| § | Reviewing the Company’s Business Continuity Planning (BCP) efforts; convening a sub-committee to work with key risk leaders in the company; |

| § | Management succession planning, specifically for the positions of Chief Executive Officer, President, and Chief Financial Officer; |

| § | Completing a thorough review of all governing documents including Capital City Bank Group’s Articles of Incorporation & Bylaws; Capital City Bank’s Articles of Incorporation & Bylaws; all committee charters and the CCBG Corporate Governance Guidelines; |

| § | Analyzing the advisability of declassifying Capital City Bank Group’s Board of Directors; |

| § | Reviewing risk management practices, including scheduling time with senior executive officers to discuss cybersecurity practices, posture, and response, as well as insurance coverages in place to help protect the Company and its shareowners in the event a cyberattack occurs; and |

| § | Reviewing continuing director educational opportunities and implementing a policy requiring all Directors complete at least one outside training event prior to standing for re-election. |

2020 Corporate Governance and Nominating Committee:

Stanley W. Connally, Jr. (Chair)

Robert Antoine

Cader B. Cox, III

Marshall Criser III

BOARD’S RESPONSIBILITIES AND DUTIES

Succession Planning

The Board plans for succession to the position of Chief Executive Officer as well as certain other senior management positions. To assist the Board, William G. Smith, Jr., our Chairman, President, and CEO, annually provides the Board with an assessment of senior managers and of their potential to succeed him. He also provides the Board with an assessment of persons considered potential successors to certain other senior management positions. The Corporate Governance and Nominating Committee and our independent directors in an executive session annually review this updated assessment. In addition, the Board interacts with members of senior management who are potential successors to our executive management.

Board Refreshment

Our Corporate Governance Guidelines reflect our belief that directors should not be subject to term limits because it would likely cause us to lose directors who have developed insight into our strategies and operations and risks. Nevertheless, we have several policies in place to support board refreshment such as a mandatory retirement age, mandatory resignation if the director does not receive a majority vote of support from our shareowners, mandatory tender of a resignation upon a change in our director’s principal employment, and a strict prohibition on serving on too many boards. Nevertheless, our Board regularly reviews its own composition, and considers and plans for an orderly transition and refreshment process, which includes planning for potential retirements and identifying potential candidates for service as new directors. As part of this process, since 2016, the Board has added six new independent directors, Ms. Johnson and Messrs. Antoine, Connally, Criser, Grant, and Sample, who the Board believes have the relevant experience and expertise to complement that of our other directors and to further contribute to the Board’s ongoing guidance of our company.

Risk Management

Risk management is an important component of our corporate strategy. While we assess specific risks at our committee levels, the Board, as a whole, oversees our risk management process, and discusses and reviews with management major policies with respect to risk assessment and risk management. The Board is regularly informed through committee reports about our risks. In addition, we have an Enterprise Risk Oversight Committee, which reports to the Board at least twice per year. The Enterprise Risk Oversight Committee serves to assist the Board in establishing and monitoring our key risks, and meets at least on a quarterly basis.

12 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Board and Committee Evaluations

The Corporate Governance and Nominating Committee uses a variety of methods to annually evaluate the Board as a whole and its committees. In 2020, the Corporate Governance and Nominating Committee engaged an outside firm, Bank Director, to evaluate board and committee performance. Directors submitted completed questionnaires directly to Bank Director, which summarized the results without attribution. The full Board discussed the summary of the Board evaluation and each committee discussed the summary of its own evaluation.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to implement the Nasdaq corporate governance listing standards and various other corporate governance matters.

Codes of Conduct and Ethics

The Board has adopted Codes of Conduct applicable to all directors, officers, and associates, and a Code of Ethics applicable to our Chief Executive Officer and our financial and accounting officers, all of which are available, without charge, upon written request to:

Capital City Bank Group, Inc. c/o Corporate Secretary 217 North Monroe Street Tallahassee, Florida 32301 | |

These codes are designed to comply with Nasdaq and SEC requirements. We will disclose any amendments to, or waivers from, the Code of Ethics on our website (www.ccbg.com) within four business days of such determination.

Board structure and process

Independent Directors

Our common stock is listed on the Nasdaq Global Select Market. Nasdaq requires that a majority of our directors be “independent,” as defined by Nasdaq’s rules. Generally, a director does not qualify as an independent director if the director or a member of a director’s immediate family has had in the past three years certain relationships or affiliations with us, our outside auditors, or other companies that do business with us. Our Board has adopted categorical independence standards that include all objective standards of independence set forth in the Nasdaq rules. The categorical independence standards are posted to the Corporate Governance section of our website, www.ccbg.com. Based on these standards, our Board has affirmatively determined that the following current directors, constituting a majority of our directors, are independent: Robert Antoine, Allan G. Bense, Frederick Carroll III, Stanley W. Connally, Jr., Cader B. Cox, III, Marshall M. Criser III, J. Everitt Drew, Eric Grant, Laura L. Johnson, and John G. Sample, Jr.

Board Leadership

The Board does not have a policy with respect to separation of the positions of Chairman and CEO or with respect to whether the Chairman should be a member of management or an independent director, and believes that these are matters that should be discussed and determined by the Board from time to time. When the Chairman of the Board is a member of management or is otherwise not independent, the independent directors elect a lead director, which we discuss below. Currently, William G. Smith, Jr. serves as our Chairman and CEO. Given the fact that Mr. Smith is tasked with the responsibility of implementing our corporate strategy, we believe he is best suited for leading discussions regarding performance relative to our corporate strategy, and these discussions represent a significant portion of our Board meetings.

Lead Director

The independent directors of our Board of Directors annually elect an independent director to serve in a lead capacity. Although elected annually, the lead director is generally expected to serve for more than one year. Mr. Drew currently serves as our lead director. Effective April 27, 2021, Mr. Connally will assume the role of lead director. The lead director’s duties, which are listed in a Board approved charter, include:

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 13

| § | presiding at all meetings of the Board at which the Chairman is not present; |

| § | calling meetings of the independent directors; |

| § | coordinating with the Chairman the planning of meeting agenda items; and |

| § | serving as an independent point of contact for shareowners wishing to communicate with the Board other than through the Chairman. |

We have posted the Lead Director Charter on our website, www.ccbg.com.

Independent Director Meetings In Executive Sessions

Our independent directors have established a policy to meet separately without any Company associates present in regularly scheduled executive sessions at least twice annually, and at such other times as may be deemed appropriate by our independent directors. Any independent director may call an executive session of independent directors at any time. In 2020, the independent directors met in an executive session four times.

Director Nominating Process

The Corporate Governance and Nominating Committee annually reviews and makes recommendations to the full Board regarding the composition and size of the Board so that the Board consists of members with the proper expertise, skills, attributes, and personal and professional backgrounds needed by the Board, consistent with applicable Nasdaq and regulatory requirements.

The Corporate Governance and Nominating Committee believes that all directors, including nominees, should possess the highest personal and professional ethics, integrity, and values, and be committed to representing the long-term interests of our shareowners. The Corporate Governance and Nominating Committee will consider criteria including the nominee’s current or recent experience as a senior executive officer, whether the nominee is independent, as that term is defined by the Nasdaq listing standards, the business experience currently desired on the Board, geography, the nominee’s banking industry experience, and the nominee’s general ability to enhance the overall composition of the Board. The Corporate Governance and Nominating Committee does not have a formal policy on diversity; however, the Board and the Corporate Governance and Nominating Committee believe that it is essential that the Board members represent diverse viewpoints and considers this issue during the annual board and committee evaluation process.

Our Corporate Governance and Nominating Committee identifies nominees for directors primarily based upon suggestions from shareowners, current directors, and executives. The Chair of the Corporate Governance and Nominating Committee and at least one other member of the Corporate Governance and Nominating Committee interviews director candidates. The full Board formally nominates candidates for director to be included in the slate of directors presented for shareowner vote based upon the recommendations of the Corporate Governance and Nominating Committee following this process.

Voting Standard

Our Bylaws provide that in an uncontested election, if a nominee for director does not receive at least a majority of the votes cast at any meeting for his or her election at which a quorum is present, then the director must promptly tender his or her resignation to the Board. The Corporate Governance and Nominating Committee would then recommend to the Board whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation and publicly disclose its decision and the rationale behind the decision within 90 days from the date of the certification of the election results. If a director’s resignation is not accepted by the Board, then such director will continue to serve the remainder of the director’s term. If a nominee’s resignation is accepted by the Board, then the Board, in its sole discretion, may fill any remaining vacancy or decrease the size of the Board. To be eligible to be a nominee for election or reelection as our director, a person must deliver to our Corporate Secretary a written agreement that such person will abide by these requirements.

Mandatory Retirement Policy

Our Corporate Governance Guidelines provide for mandatory director retirement at age 72.

14 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Director Service on Other Boards

To ensure that our directors can provide sufficient time and attention to the Company, our directors may not serve on more than three other boards of directors of public companies in addition to our Board. Our CEO may not serve on more than two other boards of directors of public companies in addition to our Board.

Change in Director Occupation

A director whose principal occupation or business association changes substantially during the director’s tenure must tender a resignation for consideration by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee will recommend to the Board the action, if any, to be taken with respect to the resignation.

DIRECTOR ATTENDANCE

Our Board met nine times in 2020. Each of our directors attended at least 85.7 percent of the aggregate number of meetings of the Board and Committees on which they served. We expect all directors to attend our Annual Meeting. Each of our directors, who was a director at the time of our Annual Meeting in 2020, attended the 2020 Annual Meeting that was held in a virtual format due to the ongoing pandemic.

SHAREOWNER COMMUNICATIONS

Our Corporate Governance Guidelines provide for a process by which shareowners may communicate with the Board, a Board committee, the independent directors as a group, or individual directors. Shareowners who wish to communicate with the Board, a Board committee, or any other directors or individual directors may do so by sending written communications to the address below:

Capital City Bank Group, Inc. c/o Corporate Secretary 217 North Monroe Street Tallahassee, Florida 32301 | |

Communications will be compiled by our Corporate Secretary and submitted to the Board, a committee of the Board, or the appropriate group of directors or individual directors, as appropriate, at the next regular meeting of the Board. The Board has requested that the Corporate Secretary submit to the Board all communications received, excluding those items that are not related to board duties and responsibilities, such as: mass mailings, job inquiries, resumes, advertisements, solicitations, and surveys.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 15

| Audit Committee | Compensation Committee | Corporate

Governance and Nominating Committee |

The Committee assists

the Board in § the integrity of our financial reporting process, system of internal controls, and the independence and performance of our internal auditors; § our compliance with Section 112 of the Federal Deposit Insurance Corporation Improvement Act of 1991; § the hiring, qualifications, independence, and performance of our independent auditors, for which the Committee bears primary responsibility; and § our policies and practices with respect to risk assessment and risk management. Our Board has determined that each member of the Committee, other than Ms. Johnson, is an “audit committee financial expert” as defined under applicable SEC rules. |

The Committee assists

the Board in § our compensation and benefits policies and programs generally; § the performance evaluation of designated senior managers, including our named executive officers; § the compensation of our designated senior managers, including our named executive officers; § assessing the relationship between incentive compensation arrangements and risk management policies and practices; § stock ownership guidelines for directors and executive officers; and § Board compensation. |

The Committee assists

the Board in § Director qualification standards and nominations; § appointing directors to committees; § Board, committee, and director performance; § managerial succession; § our policies and practices relating to corporate governance; and § shareowner proposals. |

Current committee members John G. Sample (Chair) Allan Bense Frederick Carroll III Stanley W. Connally, Jr. Marshall Criser William Eric Grant Laura Johnson |

Current committee members Robert Antoine Allan G. Bense (Chair) Cader B. Cox, III Frederick Carroll III J. Everitt Drew William Eric Grant Laura S. Johnson |

Current committee members Stanley W. Connally, Jr. (Chair) Robert Antoine Cader B. Cox, III Marshall Criser

|

Meetings in 2020 13 |

Meetings in 2020 5 |

Meetings in 2020 3 |

| Committee report on page 53 | Committee report on page 23 | Committee report on page 12 |

| Each member of each committee is independent under the rules of Nasdaq. The Board has adopted written charters for each of its standing committees. The charter for each committee may be viewed on the Corporate Governance section of our website at www.ccbg.com. | ||

16 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Compensation elements

We currently have ten independent directors who qualify for compensation for Board service. In 2020, the Compensation Committee engaged Blanchard Consulting to measure Capital City’s board compensation against the same peer group used to measure executive management compensation. Additionally, the Compensation Committee amended our Compensation Philosophy to include targeting total annual fees, including retainer, equity compensation, board meeting fees, committee chairmen fees, committee meeting fees, and Lead Director fees for our directors to be between the 50th and 75th percentile of our selected peer group unless an exception is stated by the Compensation Committee due to Company performance or market demand. As a result of the review, the Compensation Committee lowered per meeting fees to $500 and increased cash and equity retainers to $30,000 respectively. While the Compensation Committee deems attendance by directors to be mandatory at all meetings, having a variable compensation structure better aligns compensation with the volume of business conducted by each committee. The elements of director compensation are as follows:

2020 Cash Compensation

| Cash Payment | Fees Earned in Cash ($) |

| Annual Retainer | $30,000 |

| Member of Board Committee | $500 per meeting attended |

| Audit Committee Chair – Annual Retainer | $8,000 |

| Compensation Committee Chair – Annual Retainer | $8,000 |

| Corporate Governance and Nominating Committee Chair – Annual Retainer | $5,000 |

| Lead Outside Director – Annual Retainer | $8,000 |

| Board Meeting Fees | $500 per board meeting and annual strategic meeting attended |

Equity Compensation

Stock Grant. Each independent director earns restricted shares of our common stock valued at $30,000. The restricted shares are granted at the February Compensation Committee meeting and vest on December 31st of the same calendar year, provided that these shares will be forfeited if we incur a net loss for the year in which the grants were made. The restricted stock is issued under the terms of the current 2011 Associate Incentive Plan.

Director Stock Purchase Plan. Directors are also permitted to purchase shares of common stock at a 10% discount from fair market value under the current 2011 Director Stock Purchase Plan. During 2020, 16,119 shares were purchased. As of December 31, 2020, there were 2,459 shares of common stock available for issuance to directors under this plan. Purchases under this plan were not permitted to exceed the annual retainer and meeting fees received. Our shareowners adopted the Director Stock Purchase Plan at our 2011 Annual Meeting.

Perquisites and Other Personal Benefits

We provide directors with perquisites and other personal benefits that we believe are reasonable, competitive and consistent with our overall director compensation program. The value of the perquisites for each director in the aggregate is less than $10,000.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 17

Director Compensation Table

The following table sets forth a summary of the compensation we paid to our directors, other than directors who are also executive officers, in 2020:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | All Other Compensation ($) | Total ($) | ||||||||||||

| Robert Antoine | 48,000 | 29,993 | 0 | 77,993 | ||||||||||||

| Allan G. Bense | 49,500 | 29,993 | 0 | 79,493 | ||||||||||||

| Frederick Carroll III | 43,500 | 29,993 | 0 | 73,493 | ||||||||||||

| Stanley W. Connally, Jr. | 47,000 | 29,993 | 0 | 76,993 | ||||||||||||

| Cader B. Cox, III | 38,000 | 29,993 | 0 | 67,993 | ||||||||||||

| Marshall M. Criser III | 42,000 | 29,993 | 0 | 71,993 | ||||||||||||

| J. Everitt Drew | 45,000 | 29,993 | 0 | 74,993 | ||||||||||||

| Eric Grant | 43,000 | 29,993 | 0 | 72,993 | ||||||||||||

| Laura L. Johnson | 43,500 | 29,993 | 0 | 73,493 | ||||||||||||

| John G. Sample, Jr. | 49,000 | 29,993 | 0 | 78,993 | ||||||||||||

| (1) | In 2020, we granted each independent director 1,082 shares of our common stock under our 2011 Associate Incentive Plan. The fair value of each share at the time of the grant was $27.72. The column represents the fair value of the award as calculated in accordance with U.S. generally accepted accounting principles. |

Stock Ownership Expectations

We maintain stock ownership guidelines for all independent directors. Under our current guidelines, each independent director is expected to own our common stock equal in value to 10 times their annual director retainer fees (including annual cash and equity grants). Directors have 10 years from the date they are first appointed or elected to our Board to meet the stock ownership requirement. The Compensation Committee has determined that as of December 31, 2020, all directors have met our share ownership expectations or are on track to meet these expectations within the stated time period of 10 years from date of appointment or election.

18 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

TRANSACTIONS WITH RELATED PERSONS

PROCEDURES FOR REVIEW, APPROVAL, OR RATIFICATION OF RELATED PERSON TRANSACTIONS

We recognize that related person transactions may raise questions among our shareowners as to whether the transactions are consistent with our best interests and our shareowners’ best interests. We generally do not enter into or ratify a related person transaction unless our Board, acting through the Audit Committee or otherwise, determines that the related person transaction is in, or is not inconsistent with, our best interests and our shareowners’ best interests. We have adopted a written Related Person Transaction Policy.

Under our procedures, each director, executive officer, and nominee for director submits to our designated compliance officer certain information to assist us in monitoring the presence of related party transactions. On an ongoing basis, and to the best of their knowledge, directors and executive officers are expected to notify our designated compliance officer of any updates to that information. We use our best efforts to have our Audit Committee pre-approve all related person transactions. In the event a related person transaction was not pre-approved by the Audit Committee, the transaction is immediately submitted for the Audit Committee’s review for ratification or attempted rescission.

In addition to the policy described above, we circulate a questionnaire each quarter to our directors and executive officers, in which each respondent is required to disclose, to the best of their knowledge, all related person transactions that occurred in the previous quarter.

TRANSACTIONS WITH RELATED PERSONS

Some of our directors and officers and their affiliates, are clients of, and have, in the ordinary course of business and banking, transacted with, Capital City Bank. These transactions include loans, commitments, lines of credit, and letters of credit, any of which may, from time to time, exceed $120,000. All loans included in these transactions were made on substantially the same terms, including interest rates and collateral requirements, as those prevailing at the time for comparable transactions with other persons who were not affiliates of Capital City Bank and, in the opinion of management, did not involve more than the normal risk of collectability or presented other unfavorable features. Our Board of Directors approved each of these transactions.

For the year ended December 31, 2020, we have not identified any transactions or series of similar transactions (other than the ordinary course of business transactions discussed above) for which we are a party in which the amount involved exceeded or will exceed $120,000 and in which any current director, executive officer, or holder of more than 5% of our capital stock had or will have a direct or indirect material interest other than as follows:

Capital City Bank’s Apalachee Parkway Office is located on land leased from the Smith Interests General Partnership L.L.P. (“SIGP”) in which William G. Smith, Jr., Chairman of the Board, President, and Chief Executive Officer is a partner. William G. Smith, Jr. owns approximately 30.77% of SIGP interests personally. A trust, under which William G. Smith, Jr. is one of two beneficiaries, owns approximately 2.57% of SIGP interests. Under a lease agreement expiring in 2024, Capital City Bank makes monthly lease payments to SIGP. Lease payments are adjusted periodically for inflation. Actual lease payments made by Capital City Bank to SIGP in 2020 amounted to approximately $198,000. The approximate dollar value of Mr. Smith’s interest in the transaction, without regard to profit and loss, was approximately $64,000. We believe the terms of this lease are comparable to the terms we would have received if we had leased the property from a third party.

William G. Smith, III, the son of our Chairman, President and Chief Executive Officer, William G. Smith, Jr., is employed as President, Leon County. In 2020, William G. Smith, III’s total compensation (consisting of annual base salary, annual bonus, and stock-based compensation) was determined in accordance with the Company’s standard employment and compensation practices applicable to associates with similar responsibilities and positions.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 19

COMPENSATION DISCUSSION AND ANALYSIS

Executive Overview

Capital City’s Performance Highlights

We believe Capital City has performed well and has positioned itself to take advantage of new opportunities. Consider that:

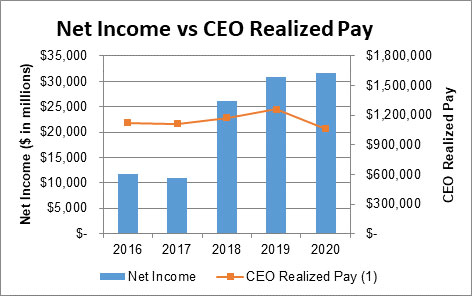

| § | Although 2020 was a very challenging year, our EPS grew 3% and since 2013 our EPS have grown at a compound annual growth rate of 27%. |

| § | Since the end of 2013 we have grown our loan portfolio (including SBA PPP loans) by $606 million, or 43%, with growth of 4% and 9% in 2019 and 2020, respectively; |

| § | We posted a further 15% reduction in classified assets during 2020. As of December 31, 2020, our classified assets totaled $18.4 million and classified assets to total assets ratio was .49%. We believe our strategy for the disposition of repossessed assets has worked and provided the best possible outcome for our shareowners by selling the repossessed assets at generally higher prices than we believe we could have sold the assets if we opted to immediately liquidate the assets; |

| § | During 2020, to address potential losses stemming from the pandemic, we increased our Allowance for Credit Losses to $23.8 million, a $9.9 million, or 71.3% increase over the balance at December 31, 2019. At December 31, 2020, the Allowance for Loan Losses as a percent of period-end loans (excluding SBA PPP loans which are 100% government guaranteed) was 1.30% compared to .75% at December 31, 2019. |

| § | On March 1, 2020, we acquired a 51% interest in Capital City Home Loans, which significantly increased the size of our mortgage banking operation and contributed $0.52 per share to our earnings in 2020. |

| § | Beginning in April 2020, we originated $190 million in SBA PPP loans to serve our communities and support our clients |

| § | Period-end deposits grew $572 million (21.6%), which is the largest single year increase in the history of the bank |

| § | We have not taken on excessive interest rate risk or relaxed our credit standards, and believe our balance sheet is well positioned for an improving economy; |

| § | We increased our quarterly cash dividends in the fourth quarter of 2020 to $0.15 per share, an increase of 7.1% over the third quarter of 2020; and |

| § | We believe we have sufficient capital and liquidity to pursue and implement our long-term strategic initiatives. |

We are Focused on Being Careful with How We Spend our Shareowners’ Money

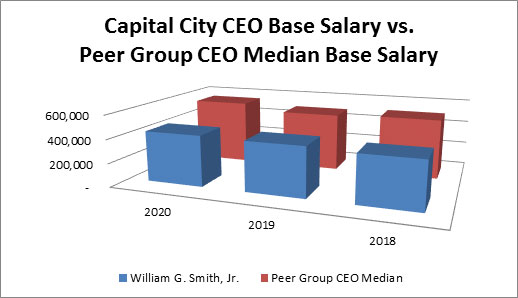

We have an experienced and hardworking management team. In fact, members of our executive management team have more than 42 years of experience in the banking industry on average. We have been able to retain our management team by strongly linking pay to performance. Compare how our CEO’s base salary matches up to the median base salary of the CEOs of our 2020 peer group, which is listed on page 31:

20 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Mr. Smith’s relatively low base salary does not reflect his performance level, but rather it reflects our conservative compensation philosophy. Superior compensation should be earned through superior performance. Because Capital City’s performance was adversely affected during last decade’s recession, we significantly limited the raises our named executive officers received during that time frame. On the other hand, as Capital City has thrived, we have recognized our executives’ performance through base salary increases.

We Strive to Maximize Shareowner Return

At Capital City, we strive to foster a culture of accountability to our shareowners and work to maximize shareowner return each day. In fact, this is why we refer to our shareholders as “shareowners” – we understand that we work for the benefit of Capital City’s owners. We also believe that a good way to align the interests of our associates with the interests of our shareowners is to encourage our associates to become shareowners. We are proud to offer our associates the ability to purchase shares of Capital City through our 2011 Associate Stock Purchase Plan and through the Capital City 401(k) Plan. We also pay our directors, executive officers and senior management team partially in shares of Capital City stock and maintain robust share ownership requirements for many of these individuals.

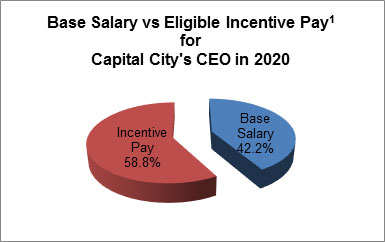

Pay for Performance is Integral to the Capital City Culture

Our focus on maximizing shareowner return and the strong ownership culture among our associates makes it much easier to implement a strong pay-for-performance compensation plan for your management team. Your executive officers do not expect to get paid well when Capital City’s results do not meet our expectations. On the other hand, when Capital City achieves its board approved performance goals as it did over the past three years, your management team should be rewarded. In 2020 a substantial majority of Mr. Smith’s eligible compensation was “at risk.”

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 21

| (1) | Eligible Incentive Pay assumes performance goals met at the 100% level. |

Capital City has been operating in a difficult environment over the past decade. We continue to experience low interest rates, which have reduced our net interest margin significantly. While we can’t control general economic factors, we believe that we can ensure that our management team’s compensation is in line with Capital City’s performance.

| (1) | CEO Realized Pay is based on the total compensation we reported in the Summary Compensation Table in that year’s proxy statement excluding the change in pension value amount because we believe it does not necessarily reflect the actual value received or to be received by the CEO, but rather it reflects an actuarial amount. |

Compensation Best Practices

We are proud of the strong corporate governance practices we have implemented. Below we have summarized some of the important policies we have implemented to ensure that we provide compensation to align the interests of our executive officers with the interests of our shareowners. More importantly, we have summarized the compensation practices that we do not have because we believe that these particular practices are not in the best interests of our shareowners.

22 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

| What We Do | What We Don’t Do | ||

| P | Pay for performance | O | Employment contracts |

| P | Balanced mix of fixed and variable pay | O | Stock option grants |

| P | Meaningful stock ownership requirements | O | Separate change in control agreements |

| P | Use an independent compensation adviser | O | Excise tax gross-ups upon change in control |

| P | Allocate a significant portion of pay in stock | O | Guaranteed bonuses |

| P | Independent compensation committee | O | Excessive perquisites |

| P | Mitigate undue risk in compensation programs | O | Income tax “gross-up bonuses” |

| P | Broad clawback policy for incentive compensation | Award shares for the “passage of time” | |

COMPENSATION COMMITTEE REPORT

We, as a Compensation Committee, met five times in 2020, including two executive sessions with only the Compensation Committee members present. Mr. Bense, the chairman of our Committee, sets the meeting dates and agenda for the committee. In the past year, we:

| § | Held an executive session to discuss the 2019 performance of Mr. Smith. In accordance with our charter, Mr. Bense distributed an evaluation to all outside directors, and then collected and compiled the results of the evaluations. He presented the summarized and aggregated results for review by our Committee; |

| § | Approved Mr. Smith’s 2020 base salary of $430,000, and targeted short-term incentive compensation of $350,000; |

| § | Approved Mr. Smith’s 2020 Long-Term Incentive Plan targeted at $250,000 and approved similar plans for Messrs. Barron and Davis each targeted at $100,000; |

| § | Reviewed and approved Mr. Barron’s 2020 base salary of $395,000, and targeted short-term incentive compensation of $239,000 and Mr. Davis’s 2020 base salary of $318,000 and target incentive compensation of $150,000; |

| § | Reviewed total compensation for 14 senior managers, including a review of incentive plans and relative risk to the Company; |

| § | Reviewed executive perquisites and found them to be reasonable; |

| § | Reviewed stock ownership positions for all senior managers and directors; |

| § | Reviewed our director compensation and recommended no changes for 2021 as disclosed on page 17; and |

| § | Discussed strategic compensation issues. |

We have also reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K included in this Proxy Statement. Based on that review and discussion, we have recommended to the Board of Directors of the Company that the Compensation Discussion and Analysis be included in this Proxy Statement.

2020 Compensation Committee

Robert Antoine

Allan G. Bense (Chair)

Cader B. Cox III

Frederick Carroll III

J. Everitt Drew

William Eric Grant

Laura S. Johnson

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 23

Compensation and Benefits Strategy

Our compensation strategy provides broad guidance on senior management compensation and more specifically on the compensation of the named executive officers. Our compensation objectives are to provide compensation programs that:

| § | Align compensation with shareowner value; |

| § | Provide a direct and transparent link between our performance and pay for our CEO and senior management; |

| § | Make wise use of our equity resources to ensure compatibility between senior management and shareowner interests; |

| § | Align the interests of our executive officers with those of our shareowners through performance-based incentive plans; and |

| § | Award total compensation that is both reasonable and effective in attracting, motivating and retaining key associates. |

We believe that accomplishing corporate goals is essential for our continued success and sustained financial performance. Therefore, we believe that executive officer compensation should be largely at-risk and performance based. Specific targets and weightings used for establishing short-term and long-term performance goals are subject to change at the beginning of each measurement period, and are influenced by the Board’s desire to emphasize performance in certain areas. Each year, the Compensation Committee reviews and approves all executive officer performance-based goals.

The compensation and benefits programs for our executives are designed with the goal of providing compensation that is fair, reasonable and competitive. These programs are intended to help us recruit and retain qualified executives, and provide rewards that are linked to performance while also aligning the interests of executives with those of our shareowners.

Compensation Philosophy

The Compensation Committee, with Board approval, has adopted the following compensation philosophy and set the following compensation objectives:

| § | Target base salaries for our senior executives at the 50th percentile of our selected peer group unless an exception is approved by our Compensation Committee due to performance, experience, or market demand; |

| § | Position direct compensation (salary, cash and equity compensation) of our senior executives at the 75th percentile of our selected peer group of banks dependent upon performance, to attract top talent and to recognize exceptional performance by management; |

| § | Target variable (pay for performance) compensation to at least 30% of total compensation mix; |