UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| ☒ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of

2025 Annual Meeting of Shareowners

and

Proxy Statement

| |

| 217 North Monroe Street | |

| Tallahassee, Florida 32301 |

LETTER TO SHAREOWNERS

217 North Monroe Street

Tallahassee, Florida 32301

March 13, 2025

Dear Fellow Shareowners:

Please join us for

our 2025 Annual Shareowners Meeting at 10:00 a.m., Eastern Time, on Tuesday, April 22, 2025, at the Florida State University Turnbull

Conference Center, 555 West Pensacola Street, Tallahassee, Florida 32306. I look forward to this opportunity to share highlights

from 2024 and discuss near- and longer-term plans for Capital City. I will also be calling for a vote on several important matters.

As a valued Capital City Bank supporter, your vote is important and your Board of Directors encourages you to let your voice be

heard. Proxy materials are attached for your convenience and are accessible at www.proxyvote.com along with the

2024 Annual Report. We are distributing Proxy Materials online rather than mailing printed copies as it allows us to expedite

delivery to our shareowners through a lower-cost, more environmentally responsible option. You will not receive printed copies

unless you request them by following the instructions contained in the Notice of Internet Availability of Proxy Materials.

Whether or not you attend the meeting in person, I encourage you to vote as soon as possible. Voting your proxy ensures your representation

at the meeting. We offer several methods of voting for your convenience: by telephone, online at www.proxyvote.com,

or by mailed proxy card if you received paper copies of your materials.

Thank you for your vote and for your continued support. I look forward to your joining us in April.

Your banker,

William G. Smith, Jr.

Chairman, President,

and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREOWNERS

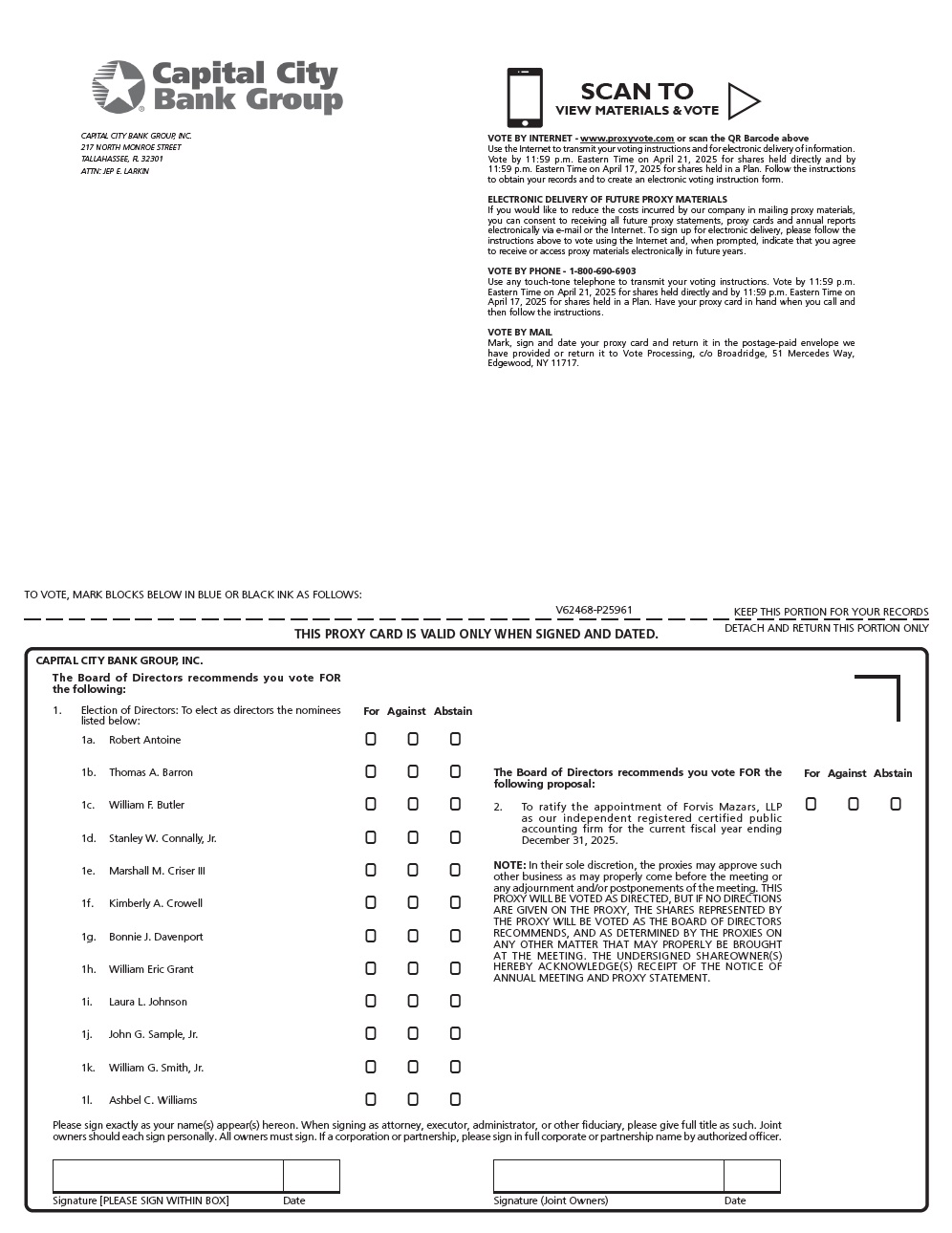

BUSINESS (1) Vote on 12 nominees for election to the Board of Directors; (2) Vote on ratification of the appointment of Forvis Mazars, LLP as our independent registered public accounting firm for the current fiscal year; and (3) Transact other business properly coming before the meeting or any postponement or adjournment of the meeting. RECORD DATE Shareowners owning Capital City Bank Group shares at the close of business on February 20, 2025, are entitled to notice of, attend, and vote at the meeting. A list of these shareowners will be available for 10 days before the Annual Meeting between the hours of 9 a.m. and 5 p.m., Eastern Time, at our principal executive offices at 217 North Monroe Street, Tallahassee, Florida 32301. |

TIME 10:00 a.m., Eastern Time, April 22, 2025 WHERE Florida State University Turnbull Conference Center 555 West Pensacola Street Tallahassee, Florida 32306 VOTING Even if you plan to attend the meeting in Tallahassee, Florida, please provide us your voting instructions in one of the following ways as soon as possible:

| ||

By Order of the Board of Directors

Jeptha E. Larkin Tallahassee, Florida Important Notice Regarding the Availability of Proxy Materials for the Shareowners’ Meeting to be Held on April 22, 2025. The Proxy Statement and the Annual Report are available at: www.proxyvote.com. |

|||

CONTENTS

PROXY STATEMENT

We are providing these Proxy Materials in connection with the solicitation by the Board of Directors (the “Board”) of Capital City Bank Group, Inc., a Florida corporation (“Capital City”), of proxies to be voted at our 2025 Annual Meeting of Shareowners and at any adjournments or postponements of the Annual Meeting.

We will hold our 2025 Annual Meeting at 10:00 a.m., Eastern Time, Tuesday, April 22, 2025, at the Florida State University Turnbull Conference Center, 555 West Pensacola Street, Tallahassee, Florida 32306. We are making these Proxy Materials available to our shareowners on or about March 13, 2025.

At Capital City, and in this Proxy Statement, we refer to our employees as “associates.” Also in the Proxy Statement, we refer to Capital City as the “Company,” “we,” “our,” or “us” and to the 2025 Annual Meeting as the “Annual Meeting.”

VOTING INFORMATION

Who can vote?

All shareowners of record at the close of business on the record date of February 20, 2025, are entitled to receive these Proxy Materials and to vote at the Annual Meeting. On that date, there were 17,046,077 shares of our common stock outstanding and entitled to vote.

How do I vote my shares in person at the Annual Meeting?

Shares held in your name as the shareowner of record may be voted in person at the Annual Meeting. Shares for which you are the beneficial owner but not the shareowner of record may be voted in person at the Annual Meeting only if you obtain a legal proxy from the broker, trustee, or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you vote by proxy as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. The vote you cast in person will supersede any previous votes that you submitted, whether by internet, phone, or mail.

How do I vote my shares in the 401(k) plan?

If you are an associate who participates in Capital City’s 401(k) Plan, you may instruct the Plan trustee on how to vote your shares in the Plan by mail, by telephone, or on the internet as described above, except that, if you vote by mail, the card that you use will be a voting instruction card rather than a proxy card. If you own shares through the Plan and you do not vote, the Plan trustee will vote the shares in the same proportion as other Plan participants vote their Plan shares.

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as a shareowner of record or beneficially, you may direct how your shares are voted without attending the Annual Meeting. You may give voting instructions by the internet or by telephone. If you requested and received a paper copy of a proxy card by mail, you may vote by mail. Instructions are on the Notice of Internet Availability of Proxy Materials or the proxy card.

Whether you provide voting instructions by the internet or by telephone, or vote by mail, you are designating certain individuals to vote on your behalf as your legal Proxy. We have designated Bethany H. Corum and Lee Nichols each as a Proxy. The Proxies will vote all valid voting instructions and proxy cards that are delivered in response to this solicitation, and not later revoked, in accordance with the instructions given by you.

What is the deadline for voting my shares?

If you hold shares as the shareowner of record, then your vote by proxy must be received before 11:59 p.m., Eastern Time, on April 21, 2025, the day before the Annual Meeting. If you are the beneficial owner of shares held through a broker, trustee, or other nominee, please follow the instructions provided by your broker, trustee, or other nominee.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 1

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

The Board has nominated all 12 of our current directors to stand for election at the Annual Meeting. Each nominee will stand for election to hold office for a term expiring at the next annual meeting of shareowners following the director’s election and until such director’s successor is duly elected and qualified, subject to the director’s prior death, resignation, retirement, disqualification or removal.

Each nominee is currently serving as a member of the Board. The proxies will vote, unless instructed otherwise, each valid voting instruction and proxy card for the election of the following nominees as directors. If a nominee is unable to serve, the shares represented by all valid proxies that have not been revoked will be voted for the election of a substitute as the Board may recommend, or the Board may by resolution reduce the size of the Board to eliminate the resulting vacancy. At this time, the Board knows of no reason why any nominee might be unable to serve.

If the 12 director nominees are elected, the Board will not have any vacancies. Brokers do not have discretion to vote on this proposal without your instructions. If you do not instruct your broker how to vote on this proposal, your broker will deliver a broker non-vote on this proposal.

The following paragraphs provide information as of the date of this Proxy Statement about each nominee up for re-election in the categories of: age, positions held, principal occupation and business experience for the past five years, and names of other publicly-held companies for which the nominee serves as a director or has served as a director during the past five years. While the following paragraphs note certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole, we also believe that all of our nominees have a reputation for integrity, honesty, and adherence to high ethical standards. They each have demonstrated strong leadership skills, business acumen and an ability to exercise sound judgment, as well as a commitment of service to our shareowners.

2 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

THE FOLLOWING 12 DIRECTORS HAVE BEEN NOMINATED for ELECTION:

Chairman, President, and Chief Executive Officer Age: 71 Director since: 1982 Other current public company boards: Southern Company |

WILLIAM G. SMITH, JR. Mr. Smith currently serves as our chairman, president, and chief executive officer. He was elected chairman in 2003 and has been president and chief executive officer since 1995. Mr. Smith also serves as chairman of Capital City Bank, a position he has held since 1995. In addition, Mr. Smith has served as a director of Southern Company since 2006. We believe Mr. Smith’s qualifications to sit on our Board include his four decades of banking experience, including more than 25 years as our president and chief executive officer. |

|

|

Independent director Age: 68 Director since: 2019 Board committees: Audit and Corporate Governance and Nominating Other current public company boards: None |

ROBERT ANTOINE Mr. Antoine was appointed to our Board in 2019 after retiring as a senior partner in the Deloitte & Touche Banking & Capital Markets Practice. During his two decades plus career with Deloitte, he advised a number of U.S. and foreign institutions on a broad array of regulatory issues, mergers and acquisitions, and corporate governance, in addition to supporting many large financial statement audits for the firm in various industries. He also served some of the largest agencies of the federal government as part of his work in the Federal Practice. Prior to Deloitte, Mr. Antoine held a number of executive positions in risk and financial management in the financial services industry. Mr. Antoine is a certified public accountant and a certified internal auditor. He is a member of the American and Florida Institutes of Certified Public Accountants. He is also a founding member of the Jacksonville Chapter of the National Association of Black Accountants. We believe Mr. Antoine’s qualifications to sit on our Board include his extensive regulatory experience and strong accounting and financial background. |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 3

President - Capital City Bank Age: 72 Director since: 1982 Other current public company boards: None |

THOMAS A. BARRON Mr. Barron is our treasurer and was appointed president of Capital City Bank in 1995. We believe Mr. Barron’s qualifications to sit on our Board include his more than four decades of banking experience, including more than 25 years as the president of Capital City Bank. |

Independent director Age: 65 Director since: 2021 Board committees: Audit and Compensation Other current public company boards: None |

WILLIAM F. BUTLER Mr. Butler is an accomplished real estate project and portfolio manager with over 40 years of experience partnering with high net worth private, corporate and institutional clients throughout the United States on projects ranging from commercial portfolios to mixed-use facilities and residential developments. As founder and principal of Real Estate InSync (REI), Mr. Butler works closely with clients to assess needs, clarify goals, design comprehensive development solutions and manage programs to strategically reposition assets, brand properties, and maximize real estate portfolios valued up to $100 million. Mr. Butler’s previous experience includes serving as a senior vice president with The St. Joe Land Company, where he designed and implemented business models for five new product lines involving 250,000 rural acres across a six-county region in North Florida. We believe Mr. Butler’s qualifications to sit on our Board include his extensive executive leadership and management experience. |

Independent director (Lead) Age: 55 Director since: 2017 Board committees: Audit Other current public company boards: None |

STANLEY W. CONNALLY, JR. Mr. Connally has been employed by Southern Company since 1989, currently serving as executive vice president of operations and chief operating officer for Southern Company. From 2012, until the end of 2018, Mr. Connally served as chairman, president, and chief executive officer of Gulf Power Company, a subsidiary of Southern Company. He formerly served on the boards of the Florida Chamber of Commerce, Florida Council of 100, Enterprise Florida, National Association of Manufacturers, Aerospace Alliance, and Electric Power Research Institute. We believe Mr. Connally’s qualifications to sit on our Board include his executive leadership and management experience and his operational and financial expertise gained from almost three decades of increasing responsibility at a Fortune 500 company. |

4 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Independent director Age: 66 Director since: 2018 Board committees: Audit and Compensation (Chair)

Other current public company boards: None |

MARSHALL M. CRISER III Mr. Criser is the president of Piedmont University in Georgia. He previously served as the chancellor of the State University System of Florida. Prior to that, he worked for AT&T and its predecessor, BellSouth, where he served as its president. Mr. Criser is a member of the Florida Council of 100, where he is a former chairman. Mr. Criser’s community service includes terms as the vice chairman of the University of Florida’s Board of Trustees, chairman of the Florida Chamber of Commerce, and chairman of Florida TaxWatch. A Florida native, Mr. Criser graduated from the University of Florida with a bachelor’s degree in business administration in 1980, and later completed an Advanced Management Programme at INSEAD in Fontainebleau, France. We believe Mr. Criser’s qualifications to sit on our Board include his extensive executive leadership and management experience. |

Independent director Age: 43 Director since: 2021 Board committees: Audit and Compensation Other current public company boards: None |

KIMBERLY A. CROWELL Ms. Crowell is the CEO and co-founder or Kalo Companies, which owns and operates over 70 Jersey Mike’s Subs and Slim Chickens restaurant franchises in Florida, Georgia and Alabama, with a number of restaurants currently in development. Prior to entering the franchise industry, she practiced corporate law in Charlotte, North Carolina, specializing in Commercial Real Estate and Development. Since that time, she has continued to use her legal knowledge and expertise to advise other franchisees and business-owners on a variety of business-related legal matters by serving on the Board of the International Franchise Association. Ms. Crowell graduated from the University of Virginia with a Bachelor of Science degree in Commerce. In 2006, she received her law degree from the University of North Carolina at Chapel Hill. We believe Ms. Crowell’s qualifications to sit on our Board include her extensive executive leadership and management experience. |

Independent director Age: 45 Director since: 2021 Board committees: Corporate Governance and Nominating Other current public company boards: None |

BONNIE J. DAVENPORT Ms. Davenport is a registered architect and general contractor. Since 2011, she has been the president and founding principal of BKJ, Inc. Architecture. She has worked on many successful projects across the State of Florida that have built her reputation as a leader in our local community. She is a member of many organizations and serves on several local boards. She believes that working with every client is an opportunity to build a unique partnership. She strives to use her knowledge and experience to become an integral member of the project team. Ms. Davenport graduated Summa Cum Laude from the University of Florida with a Master of Architecture, Bachelors of Design, and a minor in business administration and landscape architecture. We believe Ms. Davenport’s qualifications to sit on our Board include her extensive executive leadership and management experience. |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 5

Independent director Age: 49 Director since: 2017 Board committees: Audit and Corporate Governance and Nominating Other current public company boards: None |

WILLIAM ERIC GRANT Mr. Grant currently serves as a vice president for CivicPlus, one of the nation’s largest providers of software and services to local governments across the nation. Prior to its acquisition by CivicPlus, Mr. Grant was president and CEO of Municipal Code Corporation. Mr. Grant served as a vice president at Municipal Code Corporation from 2007 until 2012, when he was promoted to president. In 2019, Mr. Grant was promoted to CEO. Prior to receiving his Juris Doctorate from the University of Virginia, Mr. Grant attended the United States Naval Academy and Georgetown University’s School of Foreign Service. While serving as a member of the United States Marine Corps, Mr. Grant was stationed in Virginia, Kentucky, California, and abroad. Mr. Grant and his unit, the 15th Marine Expeditionary Unit, were deployed during Operation Enduring Freedom in 2001. We believe Mr. Grant’s qualifications to sit on our Board include his executive leadership and management experience. |

Independent director Age: 62 Director since: 2017 Board committees: Compensation and Corporate Governance and Nominating (Chair) Other current public company boards: None |

LAURA L. JOHNSON Ms. Johnson is the founder and CEO of Coton Colors Company, a multi-channel designer and manufacturer of home décor and gift products with a national and international presence. She has over 30 years of experience leading a high-growth business, building a strong brand identity, and driving strategic expansion across retail, eCommerce, and wholesale markets. Under her leadership, Coton Colors has been recognized as a four-time Inc. 5000 honoree for rapid growth and innovation. She has been actively involved in leadership and mentorship through Vistage Florida and the Female Founder Collective. She is also a dedicated partner of St. Jude Children’s Research Hospital, designing exclusive products to support fundraising and awareness initiatives. We believe Ms. Johnson’s qualifications to sit on our Board include her executive leadership and management experience and her operational and financial expertise gained from the successful operation of her own business.

|

6 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Independent director Age: 68 Director since: 2016 Board committees: Audit (Chair) Other current public company boards: 1st Franklin Financial Corp. |

JOHN G. SAMPLE, JR. Until retiring in 2017, Mr. Sample served, as senior vice president and chief financial officer from 2002 to 2017 for Atlantic American Corporation, an Atlanta, Georgia-based holding company that operates through its subsidiaries in specialty markets within the life, health, and property and casualty insurance industries. He also served as corporate secretary from 2010 until 2017. Prior to joining Atlantic American Corporation, he had been a partner of Arthur Andersen LLP since 1990. Since 2004, Mr. Sample has also served as a director and chairman of the Audit Committee of the Board of Directors of 1st Franklin Financial Corporation, a consumer finance company that originates and services direct cash loans, real estate loans and sales finance contracts through over 300 branch offices located throughout the southern United States. We believe Mr. Sample’s qualifications to sit on our Board include his executive leadership and management experience, his extensive accounting and financial background, and his experience in the financial services industry. |

Independent director Age: 70 Director since: 2021 Board committees: Corporate Governance and Nominating Other current public company boards: None |

ASHBEL C. WILLIAMS Mr. Williams is vice chair at J.P. Morgan Asset Management. With assets under management of approximately $3.3 trillion, the firm is a global leader in investment management. He served as executive director and chief investment officer for the Florida State Board of Administration, prior to his retirement in 2021. There, he was responsible for managing approximately $250 billion in assets, including those of the Florida Retirement System, the fifth largest public pension fund in the United States. He serves on the board of the Economic Club of Florida and chairs the Florida State University Foundation Investment Committee. He is a member of the Council on Foreign Relations, a founding trustee of the National Institute for Public Finance, and a member of the AIF Global Investor Board. He serves on the investment committees of the IEEE, the Episcopal Diocese of Florida, and the investment advisory board of the Public Employee Retirement System of Idaho. He received his bachelor’s degree in management and a Master of Business Administration from Florida State University and completed post-graduate programs at University of Pennsylvania’s Wharton School and Harvard University’s John F. Kennedy School of Government. We believe Mr. Williams’s qualifications to sit on our Board include his extensive executive leadership and management experience. |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 7

EXECUTIVE OFFICERS

Our officers are appointed annually by the Board at the first meeting of the Board held after the shareowners’ annual meeting. Each officer shall hold office until a successor has been duly appointed and qualified, or until an earlier resignation, removal from office, or death. Thomas A. Barron and William G. Smith, Jr. serve as directors and executive officers, and Jeptha E. Larkin is an executive officer.

Executive Vice President

and Chief |

JEPTHA E. LARKIN Mr. Larkin, 61, was appointed executive vice president and chief financial officer, effective January 1, 2023. He joined Capital City in 1986. After serving in various credit roles early in his career, he led the Capital City Bank Group Internal Audit Division from 1992 to 2002. He was subsequently appointed Capital City Bank controller, where he served until assuming his current roles. As the principal financial and accounting officer of the Company, he oversees all functions involving accounting and financial reporting, profitability analysis, financial planning, and treasury. Mr. Larkin is a certified public accountant licensed in Florida and Georgia and, in addition to his role as chief financial officer, he serves the Company in a number of leadership roles including, chairing the Asset/Liability and Market Risk Oversight Committees and serving as a member of the Strategic Planning Committee. He assists managers in the evaluation and financial analysis of business line initiatives and acquisitions, and oversees the integration of accounting and financial reporting for the Company’s merger and acquisition activity. Mr. Larkin holds a Bachelor of Science degree in Economics and a Master of Business Administration in Finance from the Florida State University. He is also a graduate of the Stonier School of Banking. |

| The Board of Directors unanimously recommends a vote “FOR” the nominees |

8 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

CORPORATE GOVERNANCE at capital city

GOVERNING PRINCIPLES

We are committed to creating and maintaining a business atmosphere with the highest ethical standards and integrity. We believe our Directors should possess the highest personal and professional ethics, integrity and values, and represent the best interests of the Company to create shareowner value. An unwavering adherence to high ethical standards is the foundation on which our business and reputation thrive and is integral to sustaining a successful, high-caliber company.

ENVIRONMENTAL, SOCIAL, AND CORPORATE GOVERNANCE

Environmental

We recognize the value of environmental stewardship and seek opportunities to reduce our carbon footprint and incorporate energy efficiency products into business operations.

In 2022 through 2024, we made commitments for a $7 million investment in SOLCAP 2022-1, LLC, a $7 million investment in SOLCAP 2023-1, LLC, and a $9.1 million investment in SOLCAP 2024-1, LLC. Each of these funds were formed to make solar tax equity investments in renewable solar energy projects and provided us with tax credits and other tax benefits. These projects will produce approximately 31,778,716 kw hours of clean power each year. The clean power produced is equivalent to removing approximately 21,350 metric tons of greenhouse gas emissions. We plan to continue to review these kinds of investment opportunities as they arise.

We work to ensure lending activities do not encourage business activities that could cause irreparable damage to our reputation or the environment. In general, we evaluate each credit or transaction on its individual merits, with larger deals receiving more attention and deeper analysis, including a review of environmental matters related to certain real estate loans, which is overseen by our Credit Risk Oversight Committee.

To prepare for any climate-related occurrences, our business continuity plan addresses how to maintain business operations in response to a disastrous event. We offer disaster assistance to our associates, including accommodation and shelter reimbursement in case of evacuations or sustained power outages.

Sustainable Investing. Capital City Wealth offers sustainable investing (SI) strategies that seek to grow capital by employing a globally focused and sustainable investment approach. The SI investing portfolios take a broader approach to evaluating risk and do so over a long-term horizon by evaluating a company’s environmental, social, and governance risks, in addition to traditional financial risks.

Social

“Be Committed to Community” is one of our core values and integral to our culture. We believe that this commitment not only builds better communities but also helps us attract and retain associates. We encourage our associates to volunteer their hours with service organizations and philanthropic groups in the communities we serve.

We recorded 9,542 community service hours in 2024, and 10,526 and 9,508 hours in 2023 and 2022, respectively. Additionally, the CCBG Foundation donated approximately $0.3 million in 2024 and 2023 and approximately $0.2 million in 2022 to various non-profit organizations in the communities we serve.

Since 2015, we have annually supported the United Way of the Big Bend in analyzing financial information for its annual grant review process. Many of these grants are provided to low-moderate income communities in North Florida’s Big Bend area.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 9

Financial literacy is a priority. In 2024, the CCBG Foundation made grants totaling $167,000 to Community Reinvestment Act of 1977 (“CRA”) eligible organizations in our market area. We provide educational outreach regarding home ownership and financial access for minorities. During 2020 to 2023, we partnered with Habitat for Humanity and Warrick Dunn Charities to build and furnish four homes, with our associates providing volunteer hours. We continue to originate loans under the Habitat for Humanity loan program and community development loans under various affordable housing, community service, and revitalization projects.

During tax season, we provide locations for community residents to access Volunteer Income Tax Assistance (VITA) services. VITA is a nationwide IRS program that offers free tax preparation assistance to people who generally make $60,000 or less, persons with disabilities, the elderly, and limited English-speaking taxpayers who need assistance in preparing their own tax returns.

Human Capital

Our culture distinguishes us from our competitors and is the driving force behind our continued success. Our leadership is committed to a culture that values people alongside results.

Our brand promise (“More than your bank. Your banker.”) and purpose (“We empower our clients’ financial wellness and help them build secure futures”), together with our core values statement (“Do the Right Thing, Build Relationships & Loyalty, Embrace Individuality & Value Others, Promote Career Growth, Be Committed to Community, and Represent the Star (our bank) Proudly”), are the foundation on which our culture is built.

The bank has grown significantly since its beginnings in 1895. Our commitment to fostering a culture that values our associates across our entire footprint remains unwavering. We have a chief culture officer and a chief inclusion officer whose priority is to ensure our culture is upheld and associates exemplify our values.

At December 31, 2024, we had approximately 969 associates, approximately 940 full-time associates and approximately 29 part-time associates. At December 31, 2024, approximately 68% of our workforce was female, 32% was male, and approximately 21% was ethnic minorities. None of our associates are represented by a labor union or covered by a collective bargaining agreement.

Our commitment to people and being an employer with integrity and heart has earned us numerous accolades including: one of the “Best Companies to Work for in Florida” by Florida Trend for 13 consecutive years, a “Best Bank to Work For” by American Banker for 12 consecutive years and being named by Forbes in 2023 and 2024 as one of “America’s Best-in-State Banks, a selection made from direct consumer feedback and online reviews.

The average tenure of our associates is approximately 9.4 years, and the average tenure of our management team is 23.9 years. Tenure statistics support these accolades and further demonstrate that associates enjoy working for Capital City Bank.

Health and Safety. Our business success is fundamentally connected to our associates’ well-being. We make available to our associates a voluntary wellness program, StarFit, that provides associates with resources and good-health opportunities through exercise, diet, and preventive care.

Compensation and Benefits Program. To attract and retain experienced associates we offer competitive compensation and benefits.

Our compensation program is designed to attract and reward talented individuals who possess the skills necessary to support our business objectives, assist in the achievement of our strategic goals, and create long-term value for our shareowners. We provide our associates with compensation packages that include base salary and annual incentive bonuses, and certain associates can receive equity awards tied to the Company’s performance.

Experience has taught us that a compensation program with both short- and long-term awards provides fair and competitive compensation and aligns associate and shareowner interests by incentivizing business and individual performance. This dual approach also encourages long-term company performance and integrates compensation with our business plans.

10 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

In addition to cash and equity compensation, we offer associates benefits including life and health (medical, dental & vision) insurance, paid time off, an associate stock purchase plan, and a 401(k) plan. Associates hired prior to 2020 are eligible to participate in a pension plan.

A core value is providing associates the ability to “grow a career.” To that end, we support and encourage associates to pursue personal and professional development through higher education. We offer an educational Tuition Assistance Plan to help eligible associates continue or begin post-high school education, develop skills, increase knowledge, and aid in career development.

Governance

Our corporate governance framework fosters an engaged, independent board with diverse perspectives who are committed to creating long-term value for our shareowners. In so doing, the Company recognizes the interests of its shareowners will be advanced by responsibly taking into account the concerns of the Company’s other constituencies, including clients, associates, the communities in which the Company conducts its business, the public at large, and the governmental entities that regulate the Company’s business.

Specifically, the Board of Directors

| · | oversees the Company’s affairs, striving to protect the interests of our shareowners. |

| · | exercises sound and independent business judgment regarding significant, strategic, and operational issues. |

| · | advises senior management and adopts governance principles consistent with Capital City Bank’s mission, vision, and values. |

| · | focuses on corporate risk management, board structure, and managing the Company for the long-term. |

Corporate Governance and Nominating Committee Report

During 2024, the Corporate Governance and Nominating Committee focused its efforts on:

| · | Management succession planning, specifically for the position of chief executive officer; |

| · | Thoroughly reviewing all governing documents including Capital City Bank Group’s Bylaws; all committee charters and the Company’s Corporate Governance Guidelines; Director Code of Conduct, Associate Code of Conduct with the Officer Addendum, and Code of Ethics for the Chief Executive Officer and Senior Financial Officers. |

| · | Board refreshment, including completing a thorough review of board and committee onboarding processes; |

| · | Thoroughly reviewing director skills required/needed to ensure alignment with the Company’s strategic initiatives; |

| · | Reviewing risk management practices, including scheduling time with senior executive officers to discuss cybersecurity practices, posture, and response, as well as insurance coverages in place to help protect the Company and its shareowners in the event a cyberattack occurs; and |

| · | Reviewing continuing education opportunities for directors and monitoring compliance with our policy that requires directors complete at least one outside training event or four virtual seminars every twenty-four month cycle. |

2024 Corporate Governance and Nominating Committee:

Laura L. Johnson (Chair)

Robert Antoine

Bonnie J. Davenport

William Eric Grant

Ashbel C. Williams

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 11

BOARD’S RESPONSIBILITIES AND DUTIES

Succession Planning

The Board plans for succession to the position of chief executive officer as well as certain other senior management positions. William G. Smith, Jr., our chairman, president, and CEO, assists the Board by providing an annual assessment of senior managers and their potential to succeed him, as well as an assessment of associates considered potential successors to certain other senior management positions. Additionally, an outside consulting firm annually provides the Board an independent assessment of select associate candidate qualifications.

The Corporate Governance and Nominating Committee and the independent directors annually review these assessments in an executive session. In addition, the Board interacts with members of senior management who are potential successors to our executive management.

Board Refreshment

The Corporate Governance Guidelines support board refreshment through mandatory resignation if the director does not receive a majority vote of support from our shareowners; mandatory tender of a resignation upon a change in our director’s principal employment; and a strict prohibition on serving on too many boards. The guidelines do not require term limits nor a mandatory retirement age. We believe that directors should not be subject to term limits nor a retirement age because they would likely cause the board to lose directors who have strong experience, institutional knowledge, and insight into the Company’s strategies, operations and risks. Our Board regularly reviews its own composition and skills, and plans for an orderly director transition and refreshment process in response to potential retirements, resignations, or gaps by identifying potential candidates. Recognizing the importance of balancing experience with fresh perspectives, the Board has added one director in 2016, three in 2017, one in 2018, one in 2019 and four in 2021.

Risk Management

Risk management is a key component of our corporate strategy. Specific risks are assessed at our committee levels, and the Board oversees our risk management process, discussing and reviewing with management major policies that address risk assessment and risk management. The Board is regularly informed through committee reports about our risks. Our Enterprise Risk Oversight Committee reports to the Board at least twice per year. This Committee assists the Board in establishing and monitoring the Company’s key risks and meets at least quarterly. Further, our Disclosure Committee oversees the Company’s disclosure control framework and reports its activities and findings to the Audit Committee on a regular basis.

Board and Committee Evaluations

The Corporate Governance and Nominating Committee uses a variety of methods to annually evaluate the Board and its Committees. In 2024, the Committee engaged an outside firm, Bank Director, to evaluate board and committee performance. Directors submitted completed questionnaires directly to Bank Director, which summarized the results without attribution. The Corporate Governance and Nominating Committee discussed the results, followed by the full Board.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to implement the Nasdaq corporate governance listing standards and various other corporate governance matters.

Codes of Conduct and Ethics

The Board has adopted Codes of Conduct applicable to all directors, officers, and associates, and a Code of Ethics applicable to our chief executive officer and our financial and accounting officers, all of which are available, without charge, on our website (www.ccbg.com) or upon written request to:

Capital City Bank Group, Inc.

c/o Corporate Secretary

217 North Monroe Street

Tallahassee, Florida 32301

These codes are designed to comply with Nasdaq and Security Exchange Commission requirements. We will disclose any amendments to, or waivers from, the Code of Ethics on our website within four business days of such determination.

12 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Board structure and process

Independent Directors

Our common stock is listed on the Nasdaq Global Select Market. Nasdaq requires that a majority of our directors be “independent,” as defined by Nasdaq’s rules. Generally, a director does not qualify as an independent director if the director or a member of a director’s immediate family has had in the past three years certain relationships or affiliations with us, our outside auditors, or other companies that do business with us. Under current Nasdaq rules, our Board must undertake both a subjective and an objective determination of the independence of the directors. For purposes of the objective determination, our Board utilizes the objective standards of independence set forth in the Nasdaq rules. Our Board has affirmatively determined that the following current directors, constituting a majority of our directors, are independent: Robert Antoine, William F. Butler, Stanley W. Connally, Jr., Marshall M. Criser III, Kimberly A. Crowell, Bonnie J. Davenport, William Eric Grant, Laura L. Johnson, John G. Sample, Jr., and Ashbel C. Williams. The Board, in making its independence determinations, considered the following relationships between the Company and the directors, and determined that none of the relationships for the directors and director nominees set forth below constituted a material relationship between the director or director nominee and the Company: (1) the Company or its subsidiaries provided non-preferential, ordinary course financial products and services to certain of our directors and director nominees, some of their immediate family members, and entities affiliated with some of them or their immediate family members; and (2) Ms. Davenport is the founding principal, president, and majority owner of BKJ, Inc. Architecture (“BKJ”), a company that has provided architectural services to, and received fees from, the Company over the last several years.

Board Leadership

The Board does not have a policy with respect to separation of the positions of chairman and CEO or with respect to whether the chairman should be a member of management or an independent director, and believes that these are matters that should be discussed and determined by the Board from time to time. When the chairman of the board is a member of management or is otherwise not independent, the independent directors elect a lead independent director, which we discuss below. Currently, William G. Smith, Jr. serves as our chairman and CEO. Given the fact that Mr. Smith is tasked with the responsibility of implementing our corporate strategy, we believe he is best suited for leading discussions regarding performance relative to our corporate strategy, and these discussions represent a significant portion of our Board meetings.

Lead Independent Director

The independent directors of our Board of Directors annually elect an independent director to serve in a lead capacity. Although elected annually, the lead independent director is generally expected to serve for more than one year. Mr. Connally currently serves as our lead independent director. The lead independent director’s duties, which are listed in a Board approved charter, include:

| · | presiding at all meetings of the Board at which the chairman is not present; |

| · | calling meetings of the independent directors; |

| · | coordinating with the chairman the planning of meeting agenda items; and |

| · | serving as an independent point of contact for shareowners wishing to communicate with the Board other than through the chairman. |

We have posted the Lead Independent Director Charter on our website, www.ccbg.com.

Independent Director Meetings In Executive Sessions

Our independent directors regularly meet without any Company associates present in executive sessions. Any independent director may call an executive session of independent directors at any time. In 2024, the independent directors met in an executive session five times.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 13

Director Nominating Process

The Corporate Governance and Nominating Committee annually reviews and makes recommendations to the full Board regarding the composition and size of the Board so that the Board consists of members with the proper experience, skills, attributes, and personal and professional backgrounds needed by the Board, consistent with applicable Nasdaq and regulatory requirements.

The Corporate Governance and Nominating Committee believes that all directors, including nominees, should possess the highest personal and professional ethics, integrity, and values, and be committed to representing the long-term interests of our shareowners. The Corporate Governance and Nominating Committee will consider criteria including the nominee’s current or recent experience as a senior executive officer, whether the nominee is independent, as that term is defined by the Nasdaq listing standards, the business experience currently desired on the Board, geography, the nominee’s banking industry experience, and the nominee’s general ability to enhance the overall composition of the Board. The Corporate Governance and Nominating Committee does not have a formal policy on diversity; however, the Board and the Corporate Governance and Nominating Committee believe that it is essential that the Board members represent diverse viewpoints and considers this issue during the annual board and committee evaluation process.

Our Corporate Governance and Nominating Committee identifies nominees for directors primarily based upon suggestions from shareowners, current directors, and executives. Shareowners who wish to suggest candidates may submit the name and qualifications of the candidate to the Corporate Governance and Nominating Committee c/o Capital City Bank Group, Inc., 217 North Monroe Street, Tallahassee, Florida 32301. Candidates for director recommended by shareowners are afforded the same consideration as all other candidates. The Chair of the Corporate Governance and Nominating Committee and at least one other member of the Corporate Governance and Nominating Committee interviews director candidates. The full Board formally nominates candidates for director to be included in the slate of directors presented for shareowner vote based upon the recommendations of the Corporate Governance and Nominating Committee following this process.

Voting Standard

Our Bylaws provide that in

an uncontested election, if a nominee for director does not receive at least a majority of the votes cast at any meeting for the

nominee’s election at which a quorum is present, then the director must promptly tender the director’s resignation

to the Board. The Corporate Governance and Nominating Committee would then recommend to the Board whether to accept or reject

the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation and publicly

disclose its decision and the rationale behind the decision within 90 days from the date of the certification of the election

results. If a director’s resignation is not accepted by the Board, then such director will continue to serve the remainder

of the director’s term. If a nominee’s resignation is accepted by the Board, then the Board, in its sole discretion,

may fill any remaining vacancy or decrease the size of the Board. To be eligible to be a nominee for election or reelection as

our director, a person must deliver to our Corporate Secretary a written agreement that such person will abide by these requirements.

14 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Board Diversity

The demographic information presented in the matrix below is based on voluntary self-identification by each director. Additional biographical information of our directors nominated for reelection and executive officers is set forth above.

| Board Diversity Matrix (As of March 1, 2025) | ||||

| Total Number of Directors | 12 | |||

| Female | Male | Non-Binary | Did

Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 3 | 9 | 0 | 0 |

| Part II: Demographic Background | ||||

| African American or Black | 1 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 8 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 | |||

| Did Not Disclose Demographic Background | 0 | |||

Director Service on Other Boards

To ensure that our directors can provide sufficient time and attention to the Company, our directors may not serve on more than three other boards of directors of public companies. Our CEO may not serve on more than two other boards of directors of public companies.

Change in Director Occupation

A director whose principal occupation or business association changes substantially during the director’s tenure must tender a resignation for consideration by the Corporate Governance and Nominating Committee. The Committee will recommend to the Board the action, if any, to be taken with respect to the resignation.

DIRECTOR ATTENDANCE

Our Board met nine times in 2024. Each of our directors attended at least 95.6% of the aggregate number of meetings of the Board and Committees on which they served. We expect all directors to attend our Annual Meeting. Each of our directors, who was a director at the time of our Annual Meeting in 2024, attended the 2024 Annual Meeting.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 15

SHAREOWNER COMMUNICATIONS

Our Corporate Governance Guidelines provide for a process by which shareowners may communicate with the Board, a Board committee, the independent directors as a group, or individual directors. Shareowners who wish to communicate with the aforementioned constituencies may do so by sending written communications to the address below:

Capital City Bank Group, Inc.

c/o Corporate Secretary

217 North Monroe Street

Tallahassee, Florida 32301

Communications will be compiled by our Corporate Secretary and submitted to the Board, a committee of the Board, or the appropriate group of directors or individual directors, as appropriate, at the next regular meeting of the Board. The Board has requested that the Corporate Secretary submit to the Board all communications received, excluding those items that are not related to board duties and responsibilities, such as: mass mailings, job inquiries, resumes, advertisements, solicitations, and surveys.

16 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

BOARD COMMITTEE MEMBERSHIP

| Audit Committee | Compensation Committee | Corporate

Governance and Nominating Committee |

The Committee assists the Board in its oversight of: · the integrity of our financial reporting process, system of internal controls, and the independence and performance of our internal auditors; · our compliance with Section 112 of the Federal Deposit Insurance Corporation Improvement Act of 1991; · the hiring, qualifications, independence, and performance of our independent auditors, for which the Committee bears primary responsibility; and · our policies and practices with respect to risk assessment and risk management. Our Board has determined that each member of the Committee is an “audit committee financial expert” as defined under applicable SEC rules. |

The Committee assists the Board in its oversight of: · our compensation and benefits policies and programs generally; · the performance evaluation of designated senior managers, including our named executive officers; · the compensation of our designated senior managers, including our named executive officers; · assessing the relationship between incentive compensation arrangements and risk management policies and practices; · stock ownership guidelines for directors and executive officers; and · Board compensation. |

The Committee assists the Board in its oversight of: · director qualification standards and nominations; · appointing directors to committees; · Board, committee, and director performance; · managerial succession; · director orientation and continuing education · our policies and practices relating to corporate governance; and · shareowner proposals. |

Current committee members John G. Sample, Jr. (Chair) Robert Antoine William F. Butler Stanley W. Connally, Jr. Marshall M. Criser III Kimberly A. Crowell William Eric Grant

|

Current committee members Marshall M. Criser III (Chair) William F. Butler Kimberly A. Crowell Laura L. Johnson

|

Current committee members Laura L. Johnson (Chair) Robert Antoine Bonnie J. Davenport William Eric Grant Ashbel C. Williams |

Meetings in 2024 16 |

Meetings in 2024 4 |

Meetings in 2024 4 |

| Committee report on page 44 | Committee report on page 24 | Committee report on page 11 |

| Each committee member is independent under the rules of Nasdaq. The Board has adopted written charters for each of its standing committees. Each committee’s charter may be viewed on our website at www.ccbg.com. | ||

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 17

DIRECTOR COMPENSATION

Compensation elements

We currently have 10 independent directors who qualify for compensation for Board service. In 2023, the Compensation Committee engaged Blanchard Consulting to measure Capital City’s board compensation against the same peer group used to measure executive management compensation. Additionally, Compensation Philosophy includes targeting total annual fees, including retainer, equity compensation, board meeting fees, committee chairmen fees, committee meeting fees, and Lead Independent Director fees for our directors to be between the 50th and 75th percentile of our selected peer group unless an exception is stated by the Compensation Committee due to Company performance or market demand. While the Compensation Committee deems attendance by directors to be mandatory at all meetings, having a variable compensation structure better aligns compensation with the volume of business conducted by each committee. The elements of director compensation are as follows:

2024 Cash Compensation

| Cash Payment | Fees Earned in Cash ($) |

| Annual Retainer | $30,000 |

| Member of Board Committee | $500 per meeting attended |

| Audit Committee Chair – Annual Retainer | $12,000 |

| Compensation Committee Chair – Annual Retainer | $8,000 |

| Corporate Governance and Nominating Committee Chair – Annual Retainer | $8,000 |

| Lead Outside Director – Annual Retainer | $15,000 |

| Board Meeting Fees | $500 per board meeting and annual strategic meeting attended |

Equity Compensation

Stock Grant. Each independent director earns restricted shares of our common stock valued at $30,000. The restricted shares are granted at the February Compensation Committee meeting and vest on December 31st of the same calendar year, provided that these shares will be forfeited if we incur a net loss for the year in which the grants were made. The restricted stock is issued under the terms of our 2021 Associate Incentive Plan.

Director Stock Purchase Plan. Directors are also permitted to purchase shares of common stock at a 10% discount from fair market value under our 2021 Director Stock Purchase Plan. During 2024, 14,969 shares were purchased. As of December 31, 2024, there were 237,602 shares of common stock available for issuance to directors under this plan. Purchases under this plan were not permitted to exceed the annual retainer and meeting fees received. Our shareowners adopted the Director Stock Purchase Plan at our 2021 Annual Meeting.

Perquisites and Other Personal Benefits

We provide directors with perquisites and other personal benefits that we believe are reasonable, competitive and consistent with our overall director compensation program. The value of the perquisites for each director in the aggregate is less than $10,000.

18 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Director Compensation Table

The following table sets forth a summary of the compensation we paid in 2024 to our directors (other than directors who are also executive officers):

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | All Other Compensation ($) | Total ($) | ||||||||||||

| Robert Antoine | 44,500 | 30,012 | — | 74,512 | ||||||||||||

| William F. Butler | 45,000 | 30,012 | — | 75,012 | ||||||||||||

| Stanley W. Connally, Jr. | 57,000 | 30,012 | — | 87,012 | ||||||||||||

| Marshall M. Criser III | 52,000 | 30,012 | — | 82,012 | ||||||||||||

| Kimberly A. Crowell | 43,500 | 30,012 | — | 73,512 | ||||||||||||

| Bonnie J. Davenport | 36,500 | 30,012 | — | 66,512 | ||||||||||||

| William Eric Grant | 42,500 | 30,012 | — | 72,512 | ||||||||||||

| Laura L. Johnson | 47,000 | 30,012 | — | 77,012 | ||||||||||||

| John G. Sample, Jr. (2) | 56,500 | 30,012 | — | 86,512 | ||||||||||||

| Ashbel C. Williams | 36,000 | 30,012 | — | 66,012 | ||||||||||||

| (1) | In 2024, we granted each independent director 1,087 shares of our common stock under our 2021 Associate Incentive Plan. The fair value of each share at the time of the grant was $27.61. The column represents the fair value of the award as calculated in accordance with U.S. generally accepted accounting principles. |

| (2) | Mr. Sample serves as the chairman and our representative on the board of directors of Red Hills REIT, Inc., a wholly-owned subsidiary of Southern Live Oak Investments, Inc., which is a wholly-owned subsidiary of Capital City Bank. In 2024, he was paid $2,000 (his annual retainer) and an additional $1,000 ($500 per board meeting) for this service. |

Stock Ownership Expectations

We maintain stock ownership guidelines for all independent directors. Under our current guidelines, each independent director is expected to own our common stock equal in value to 10 times their annual director retainer fees (including annual cash and equity grants). Directors have 10 years from the date they are first appointed or elected to our Board to meet the stock ownership requirement. The Compensation Committee has determined that as of December 31, 2024, all directors have met our share ownership expectations or are on track to meet these expectations within the stated time period of 10 years from date of appointment or election.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 19

TRANSACTIONS WITH RELATED PERSONS

PROCEDURES FOR REVIEW, APPROVAL, OR RATIFICATION OF RELATED PERSON TRANSACTIONS

We recognize that related person transactions may raise questions among our shareowners as to whether the transactions are consistent with our best interests and our shareowners’ best interests. We generally do not enter into or ratify a related person transaction unless our Board, acting through the Audit Committee or otherwise, determines that the related person transaction is in, or is not inconsistent with, our best interests and our shareowners’ best interests. We have adopted a written Related Person Transaction Policy.

Under our procedures, each director, executive officer, and nominee for director submits to our designated compliance officer certain information to assist us in monitoring the presence of related party transactions. On an ongoing basis, and to the best of their knowledge, directors and executive officers are expected to notify our designated compliance officer of any updates to that information. We use our best efforts to have our Audit Committee pre-approve all related person transactions. In the event a related person transaction was not pre-approved by the Audit Committee, the transaction is immediately submitted for the Audit Committee’s review for ratification or attempted rescission.

In addition to the policy described above, we circulate a questionnaire each quarter to our directors and executive officers, in which respondents are required to disclose, to the best of their knowledge, all related person transactions that occurred in the previous quarter.

TRANSACTIONS WITH RELATED PERSONS

Some of our directors and officers and their affiliates, are clients of, and have, in the ordinary course of business and banking, transacted with, Capital City Bank. These transactions include loans, commitments, lines of credit, and letters of credit, any of which may, from time to time, exceed $120,000. All loans included in these transactions were made on substantially the same terms, including interest rates and collateral requirements, as those prevailing at the time for comparable transactions with other persons who were not affiliates of Capital City Bank and, in the opinion of management, did not involve more than the normal risk of collectability or presented other unfavorable features. The Capital City Bank Board of Directors approved each of these transactions.

For the year ended December 31, 2024, we have not identified any transactions or series of similar transactions (other than the ordinary course of business transactions discussed above) for which we are a party in which the amount involved exceeded or will exceed $120,000 and in which any current director, executive officer, or holder of more than 5% of our capital stock had or will have a direct or indirect material interest other than as follows:

The Company leases land from a partnership (Smith Interests General Partnership L.L.P.) in which William G. Smith, Jr. has an interest. The Company made lease payments totaling $0.1 million in 2024 and $0.2 million in 2023. In December 2023 the lease payments adjusted to $0.1 million annually due to a reduction in the size of the parcel leased by the Company. The payments under the lease agreement provide for annual lease payments of approximately $0.1 million annually through December 2033, and thereafter, increase by 5% every 10 years until 2053 at which time the rent amount will adjust based on reappraisal of the parcel rental value. The Company then has four successive options to extend the lease for five years each with rental increases of 5% at each extension. Further, in accordance with this lease agreement, the Company made a $0.5 million payment in May 2024 to the lessor as reimbursement for a portion of the costs related to the development of subject property to support the construction of a new banking office by the Company.

William G. Smith, III, the son of our Chairman, President and Chief Executive Officer, William G. Smith, Jr., is employed as Chief Lending Officer at Capital City Bank. In 2024, William G. Smith, III’s total compensation (consisting of annual base salary, annual bonus, and stock-based compensation) was determined in accordance with the Company’s standard employment and compensation practices applicable to associates with similar responsibilities and positions.

20 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

COMPENSATION DISCUSSION AND ANALYSIS

Executive Overview

Capital City’s Performance Highlights

We believe Capital City has performed well and has positioned itself to take advantage of new opportunities. Consider that:

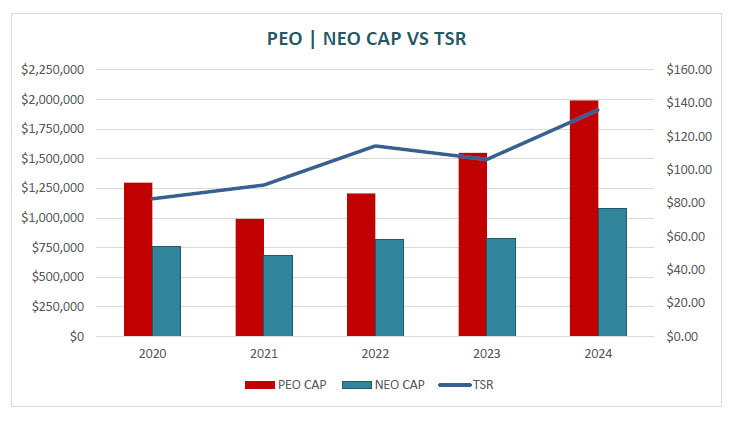

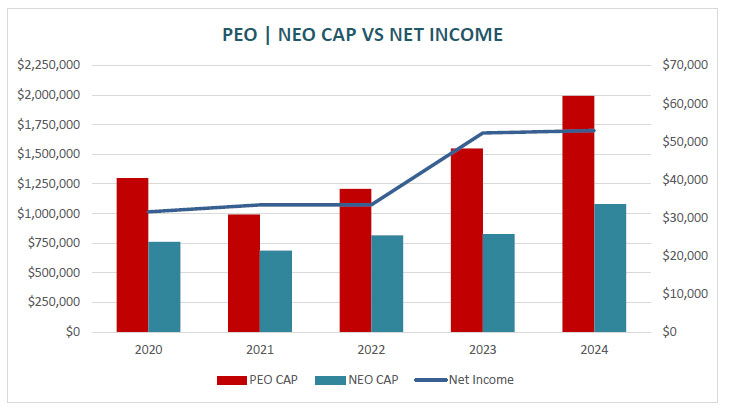

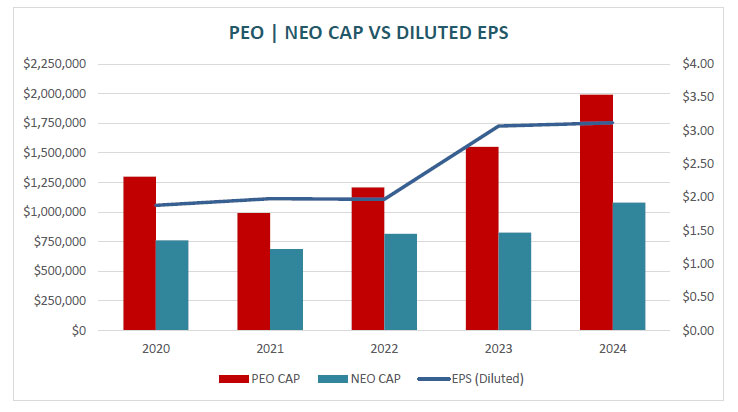

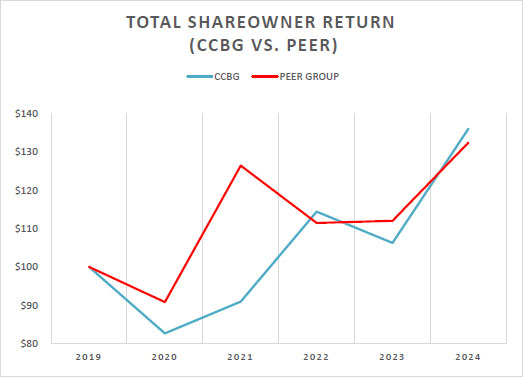

| · | 2024 was a record year of earnings which totaled $53 million, a 1.3% increase over 2023. Since 2019, our EPS has grown at an average annual growth rate of 13%; |

| · | 2024 year end loan balances declined $82 million, or 3.0%, from 2023 as loan demand slowed due to the higher rate environment, and have grown by $816 million, or 44.4%, since the end of 2019; |

| · | Average deposit balances declined $72 million, or 2.0%, in 2024, during a challenging environment, and have grown at an average annual growth rate of 7.6% for the past 5 years driven by core deposit growth and government stimulus programs; |

| · | Our total cost of deposits in 2024 was 89 basis points, which contributed greatly to our performance and outperformed many of our peer banks; |

| · | Credit quality remained strong in 2024 as net loan losses were 21 basis points of average loans. From 2020 to 2024, our average annual loan losses were 13 basis points of average loans. Classified assets totaled $20.3 million at December 31, 2024 and our nonperforming assets to total assets ratio was 15 basis points. Our allowance for credit losses as a percentage of loans was 110 basis points; |

| · | We have not taken on excessive interest rate risk or relaxed our credit standards, and believe our balance sheet continues to be well positioned for the current economic and interest rate environment; |

| · | Our tangible book value per share increased $3.20, or 15.6%, in 2024, and has increased $9.27 per share, or an average annual growth rate of 11.0% since 2019; |

| · | We increased our cash dividends in 2024 by $0.12 per share, or 15.8%, over 2023; and |

| · | We believe we have sufficient capital and liquidity to pursue and implement our long-term strategic initiatives. |

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 21

We are Focused on Being Careful with How We Spend our Shareowners’ Money

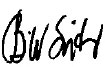

We have an experienced and hardworking management team. In fact, members of our executive management team have more than 31 years of experience in the banking industry on average. We have been able to retain our management team by strongly linking pay to performance. Compare how our CEO’s base salary matches up to the median base salary of the CEOs of our 2024 peer group, which is listed on page 31:

Mr. Smith’s relatively low base salary does not reflect his performance level, but rather it reflects our conservative compensation philosophy. Superior compensation should be earned through superior performance. Because Capital City’s performance was adversely affected during last decade’s recession, we significantly limited the raises our named executive officers received during that time frame. On the other hand, as Capital City has thrived, we have recognized our executives’ performance through base salary increases.

We Strive to Maximize Shareowner Return

At Capital City, we strive to foster a culture of accountability to our shareowners and work to maximize shareowner return each day. In fact, this is why we refer to our shareholders as “shareowners” – we understand that we work for the benefit of Capital City’s owners. We also believe that a good way to align the interests of our associates with the interests of our shareowners is to encourage our associates to become shareowners. We are proud to offer our associates the ability to purchase shares of Capital City through our 2021 Associate Stock Purchase Plan and through the Capital City 401(k) Plan. We also pay our directors, executive officers and senior management team partially in shares of Capital City stock and maintain robust share ownership requirements for many of these individuals.

22 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

Pay for Performance is Integral to the Capital City Culture

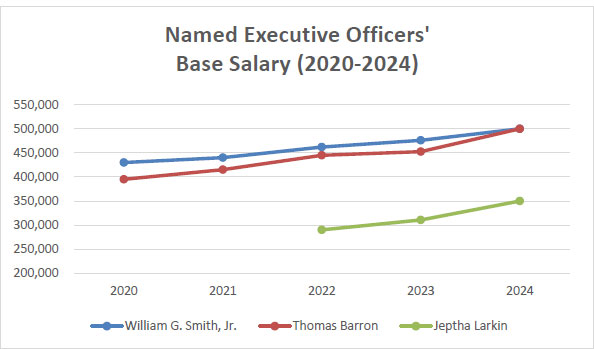

Our focus on maximizing shareowner return and the strong ownership culture among our associates makes it much easier to implement a strong pay-for-performance compensation plan for your management team. Your executive officers do not expect to get paid well when Capital City’s results do not meet our expectations. On the other hand, when Capital City achieves its board approved performance goals, your management team should be rewarded. In 2024, a substantial majority of Mr. Smith’s eligible compensation was “at risk.”

(1) Eligible Incentive Pay assumes performance goals met at the 100% level.

Compensation Best Practices

We are proud of the strong corporate governance practices we have implemented. Below we have summarized some of the important policies we have implemented to ensure that we provide compensation to align the interests of our executive officers with the interests of our shareowners. More importantly, we have summarized the compensation practices that we do not have because we believe that these particular practices are not in the best interests of our shareowners.

| What We Do | What We Don’t Do | ||

| ✓ | Pay for performance | x | Employment contracts |

| ✓ | Balanced mix of fixed and variable pay | x | Stock option grants |

| ✓ | Meaningful stock ownership requirements | x | Separate change in control agreements |

| ✓ | Use an independent compensation adviser | x | Excise tax gross-ups upon change in control |

| ✓ | Allocate a significant portion of pay in stock | x | Guaranteed bonuses |

| ✓ | Independent compensation committee | x | Excessive perquisites |

| ✓ | Mitigate undue risk in compensation programs | x | Income tax “gross-up bonuses” Award shares for the “passage of time” |

| ✓ | Broad clawback policy for incentive compensation | ||

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 23

COMPENSATION COMMITTEE REPORT

Our Compensation Committee met four times in 2024, including three executive sessions with only the Compensation Committee members present. Mr. Criser, the chair of our Committee, sets the meeting dates and agenda for the committee. In the past year, the Committee:

| · | Held an executive session to discuss the 2024 performance of Mr. Smith. In accordance with our charter, Mr. Criser distributed an evaluation to all outside directors, and then collected and compiled the results of the evaluations. He presented the summarized and aggregated results for review by our Committee; |

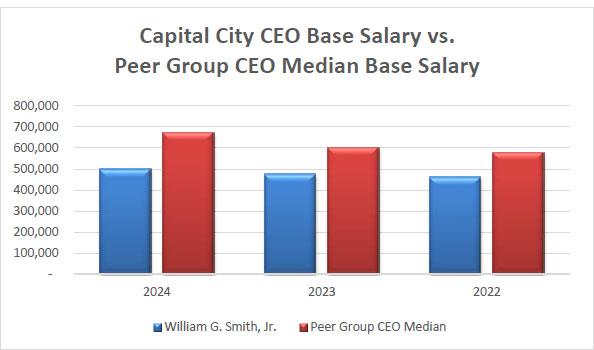

| · | Reviewed and approved Mr. Smith’s 2024 base salary of $500,000, and targeted short-term incentive compensation of $600,975; Mr. Barron’s 2024 base salary of $500,000, and targeted short-term incentive compensation of $522,600 and Mr. Larkin’s 2024 base salary of $350,000 and targeted short-term incentive compensation of $182,900; |

| · | Reviewed and approved 2024 Long-Term Incentive Plans for Mr. Smith targeted at $250,000 and Mr. Barron targeted at $100,000; |

| · | Reviewed total compensation for eight executive and senior managers, including a review of incentive plans and relative risk to the Company; |

| · | Reviewed executive perquisites and found them to be reasonable; |

| · | Reviewed stock ownership positions for all senior managers and directors; |

| · | Discussed and approved calculation and amount of clawback of 2022 Executive Management compensation based on 2022 restated financial statements; |

| · | Reviewed our director compensation and recommended changes for 2024 as disclosed on page 18; and |

| · | Discussed strategic compensation issues. |

We have also reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K included in this Proxy Statement. Based on that review and discussion, we have recommended to the Board of Directors of the Company that the Compensation Discussion and Analysis be included in this Proxy Statement.

2024 Compensation Committee

Marshall M. Criser III (Chair)

William F. Butler

Kimberly A. Crowell

Laura L. Johnson

Compensation and Benefits Strategy

Our compensation strategy provides broad guidance on senior management compensation and more specifically on the compensation of the named executive officers. Our compensation objectives are to provide compensation programs that:

| · | Align compensation with shareowner value; |

| · | Provide a direct and transparent link between our performance and pay for our CEO and senior management; |

| · | Make wise use of our equity resources to ensure compatibility between senior management and shareowner interests; |

| · | Align the interests of our executive officers with those of our shareowners through performance-based incentive plans; and |

| · | Award total compensation that is both reasonable and effective in attracting, motivating and retaining key associates. |

24 Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement

We believe that accomplishing corporate goals is essential for our continued success and sustained financial performance. Therefore, we believe that executive officer compensation should be largely at-risk and performance based. Specific targets and weightings used for establishing short-term and long-term performance goals are subject to change at the beginning of each measurement period, and are influenced by the Board’s desire to emphasize performance in certain areas. Each year, the Compensation Committee reviews and approves all executive officer performance-based goals.

The compensation and benefits programs for our executives are designed with the goal of providing compensation that is fair, reasonable and competitive. These programs are intended to help us recruit and retain qualified executives, and provide rewards that are linked to performance while also aligning the interests of executives with those of our shareowners.

Compensation Philosophy

The Compensation Committee, with Board approval, has adopted the following compensation philosophy and set the following compensation objectives:

| · | Target base salaries for our senior executives at the 50th percentile of our selected peer group unless an exception is approved by our Compensation Committee due to performance, experience, or market demand; |

| · | Position direct compensation (salary, cash and equity compensation) of our senior executives at the 75th percentile of our selected peer group of banks dependent upon performance, to attract top talent and to recognize exceptional performance by management; |

| · | Target variable (pay for performance) compensation to at least 30% of total compensation mix; |

| · | Continue, over time, the alignment of senior management’s interests with those of our shareowners (the percentage of equity compensation should increase relative to total incentive compensation); and |

| · | Target total annual fees, including retainer, equity compensation, board meeting fees, committee chairman fees, committee meeting fees, and Lead Independent Director fees, to be between the 50th and 75th percentile of our selected peer group unless an exemption is approved by our Compensation Committee due to company performance or market demand. |

We discuss the composition of our peer group and our benchmarking practices in further detail below.

Executive Compensation Policy Decisions

The Compensation Committee has adopted a number of policies to further the goals of our executive compensation program, particularly with respect to strengthening the alignment of our executives’ interests with our shareowners’ long-term interests. Further, the Compensation Committee believes the policies set forth below are effective based on the stability of our management team and our ability to attract talent from outside the Company.

Stock Ownership Expectations

We maintain stock ownership expectations for all senior managers, including our executive officers. Under our current guidelines, all senior managers are expected to own shares of our common stock equal in value to at least one and a half times their annual base salary; Mr. Barron, Mr. Larkin, and Bethany H. Corum are expected to own shares of our common stock equal in value to at least two times their annual base salary; and Mr. Smith is expected to own shares of our common stock equal in value to at least three times his annual base salary. Compliance is expected within six years of becoming a senior manager or executive officer.

The Compensation Committee has determined that, as of December 31, 2024, Mr. Smith and Mr. Barron have met our share ownership expectations and Mr. Larkin and all other senior managers covered by this program are making significant strides in meeting the ownership expectations.

Capital City Bank Group, Inc. | Notice of Annual Meeting and Proxy Statement 25

Stock Options; Timing of Certain Equity Awards

We ceased granting stock options in 2007, and there are currently no stock options outstanding. In the year ended December 31, 2024, we did not grant any stock options, stock appreciation rights, or similar awards. We do not currently plan to grant any such awards in the future.

Prohibition on Repricing Stock Options

By the terms of our 2021 Associate Incentive Plan, which is the only plan we may use to grant stock options, repricing stock options is prohibited without shareowner approval.

Insider Trading Policy

| · | prohibits trading in our securities, as well as securities of the companies in which we do business, by persons covered by the policy when in possession of material non-public information; |

| · | provides for “black-out periods” during which certain individuals are prohibited from transacting in our securities, as well as pre-clearance procedures for certain individuals, including all executive officers and directors, before engaging in certain transactions; |

| · | as described in more detail below, prohibits persons covered by the policy from engaging in certain transactions designed to offset decreases in the market value of our securities; and |